[ad_1]

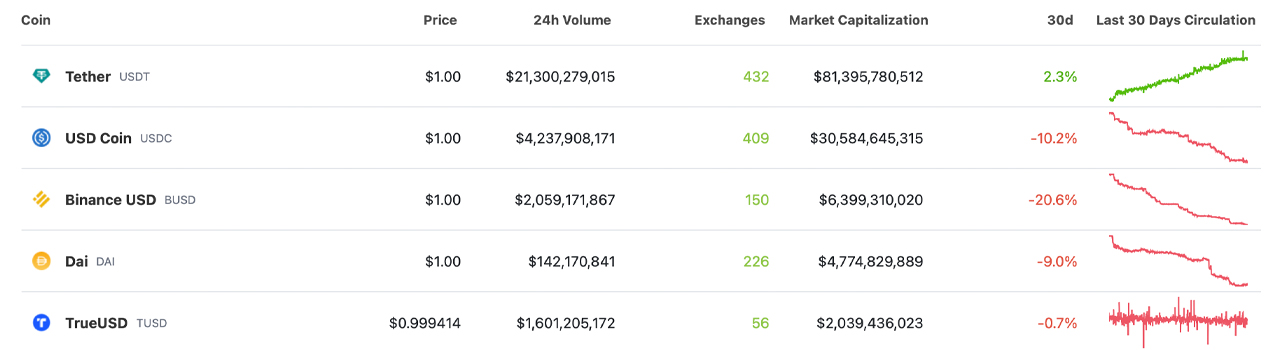

Whereas a number of high digital belongings have decreased in worth in opposition to the U.S. greenback over the previous month, the stablecoin financial system has misplaced $2.4 billion in worth since March 31, 2023. 4 of the highest 5 stablecoins skilled internet redemptions during the last 30 days, aside from tether, which grew by 2.3% throughout that point.

4 of the Prime 5 Stablecoins Expertise Web Redemptions within the Previous 30 Days

On March 31, 2023, the highest stablecoins by market capitalization represented $133.63 billion in worth, and now the valuation is all the way down to $131.21 billion. A complete of $2.4 billion price of stablecoins has been withdrawn from the stablecoin financial system since then. Knowledge reveals that over the previous 30 days, USDC, BUSD, DAI, and TUSD have all seen redemptions. Usd coin’s (USDC) circulating provide dropped 10.2% in comparison with final month, and binance usd (BUSD) fell by 20.6%. Of the highest 5 largest stablecoins, each USDC and BUSD skilled essentially the most redemptions.

Additional, DAI’s circulating provide slipped 9% decrease in 30 days and TUSD’s provide decreased by 0.7%. Tether (USDT), nevertheless, grew 2.3% since final month, reaching a market capitalization price $81.39 billion. Tether’s market valuation accounts for 61.65% of all the stablecoin financial system’s $131.21 billion worth. Whereas tether’s provide grew by 2.3%, pax greenback (USDP) rose by 33.9% since final month.

USDP now has a market valuation of roughly $1,037,832,268. Each frax greenback and Tron’s USDD skilled losses through the previous 30 days; frax greenback (FRAX) shed 3.8% whereas USDD misplaced 1% of its circulating provide. Gemini’s dollar-pegged token GUSD noticed its provide enhance by 18.1% to $465.22 million. Liquity usd (LUSD) recorded a 2.4% rise, and magic web cash (MIM) elevated by 5.9% final month. The whole stablecoin financial system represents 11.02% of the crypto financial system’s $1.19 trillion internet worth.

What does the current decline within the stablecoin financial system imply to you? Share your ideas about this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any harm or loss brought about or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link