[ad_1]

Terra Luna has seen the profitable approval of neighborhood proposals 11658 and 11660, authorizing the retrieval and subsequent incineration of a complete of 800 million USTC. The prevailing sentiment throughout the neighborhood leans in the direction of directing these USTC tokens in the direction of the burn deal with versus reintegrating them into the neighborhood pool.

Conversely, a noteworthy shift has been detected in LUNC’s staking ratio throughout the previous day, the place a earlier upward trajectory has now given strategy to a decline. This alteration within the staking ratio generally signifies decreased assurance amongst stakers relating to a selected asset.

Right here’s what’s happening throughout the struggling Terra neighborhood:

Latest Neighborhood Selections Form Terra Luna Future

In a big flip of occasions, Proposal 11658 titled “Return of Neighborhood funds not used,” offered by Vegas, a former member of the ex-Terra Rebels developer group, has achieved approval with an affirmative vote share of 70.27%.

And it appears that evidently as soon as once more.somebody is combating towards us… So the 200 milion ustc that RH have “missed” used.. is without doubt one of the causes that I used to be so vocal to not ship all the remainder of the funds to the CP. Now appears that’s already moviments asking the signers to not do,the 11658…

— Vegas (@VegasMorph) August 8, 2023

Vegas has advocated for the reintegration of 800 million USTC on-chain funds again into the Terra Luna Basic neighborhood pool. This proposition stems from the statement that the Ozone Protocol undertaking is presently deviating from the proposed growth plan.

In a parallel growth, Proposal 11660, labeled “Burn 100% of Funds Ought to Prop: 11658 Go,” has garnered substantial help, amassing a “Sure” vote share of 82.55%. This counter-proposal asserts {that a} substantial section of the neighborhood is advocating for the incineration of the 800 million tokens.

Consequently, even when Proposal 11658 is ratified, the counter-proposal is poised to take priority as a consequence of its larger vote rely.

Complete crypto market cap reaches $1.12 trillion right now. Chart: TradingView.com

Awaiting the neighborhood’s consideration is one other proposal, suggesting the burning of 80% of the funds whereas allocating the remaining 20% to the neighborhood pool designated for builders. Notably, this proposal has encountered restricted favor, with solely 46% of the neighborhood displaying settlement.

The aftermath of those current updates has naturally sparked curiosity relating to their influence on the value dynamics of LUNC. How are these choices influencing the valuation of the token?

Staking Confidence Wanes As LUNC Faces Worth Challenges

Bringing the latest developments to the forefront, there was a notable lower within the share of LUNC staked throughout the previous 24 hours. This shift signifies that holders and customers are opting to un-stake their holdings, signifying a diminished stage of belief and confidence within the token’s efficiency.

The implications of this development elevate questions in regards to the present sentiment surrounding LUNC.

A recent evaluation of LUNC’s value dynamics reveals that the token’s staking ratio now stands at 14.92%. This share signifies the portion of LUNC holdings which have been dedicated to staking, underscoring the extent of engagement and dedication from the neighborhood.

Supply: Coingecko

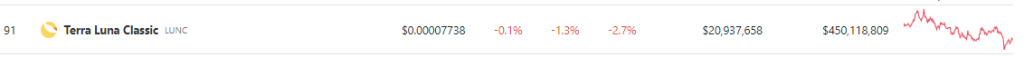

In the meantime, as noticed on CoinGecko, LUNC is presently valued at $0.000077. Over the previous 24 hours, the token’s value has skilled a discount of 1.3%, whereas its worth has declined by 2.7% over the previous seven days.

These figures make clear the challenges LUNC presently faces throughout the market and the potential influence on investor sentiment.

(This website’s content material shouldn’t be construed as funding recommendation. Investing includes danger. Whenever you make investments, your capital is topic to danger).

Featured picture from Analytics Perception

[ad_2]

Source link