[ad_1]

In a stunning twist, Bitcoin (BTC), the undisputed king of cryptocurrencies, has plunged to ranges not seen for the reason that early days of 2023.

The battle-hardened Bitcoin bulls have suffered one other crushing defeat, leaving buyers on edge, anxiously pondering whether or not the dreaded sub $20,000 abyss will hang-out them once more.

With relentless uncertainty gripping the market, the burning query lingers: Has Bitcoin actually hit all-time low, or is BTC in for a fair darker descent?

Bitcoin Path Aligned With 1930 Inventory Market Crash

Based on Mike McGlone, Bloomberg’s Senior Macro Strategist, Bitcoin’s present trajectory bears an uncanny resemblance to the US inventory market crash of 1930.

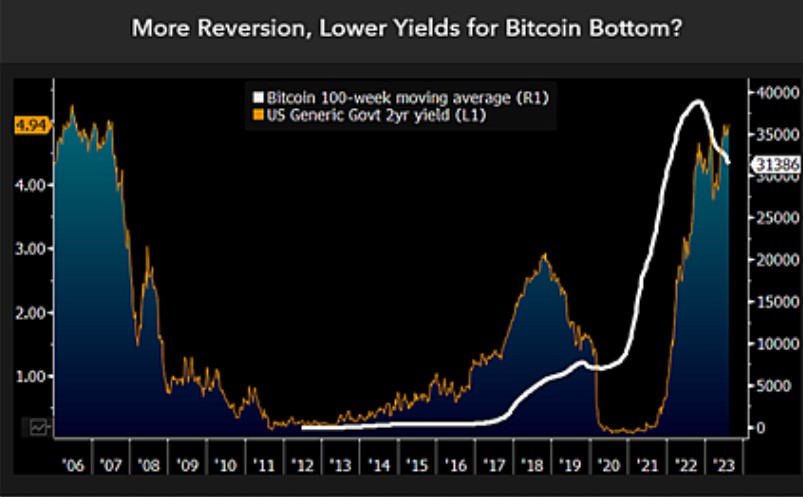

In his evaluation, McGlone highlights the clear rollover sample and downward development evident in Bitcoin’s 100-week shifting common (MA) graphic.

The implications of this sample, mixed with the elemental precept of “not going towards” the Federal Reserve (Fed) and the potential for reversion of one among historical past’s best-performing property, warrant critical consideration.

Including to the potential headwinds for Bitcoin, US Treasury two-year notes yield practically 5%, marking a historic excessive within the crypto realm.

Bitcoin, born within the aftermath of the 2008 monetary disaster and through a interval of extremely low-interest charges, could now be dealing with an prolonged interval of retracement.

Based on Mcglone, in an period of near-zero and detrimental rates of interest, the attract of a digital equal to gold might be fascinating. Nonetheless, the panorama is shifting because the world’s most secure securities supply roughly 10% complete return over two years. This shift could strain the costs of riskier property, together with Bitcoin.

The importance of the US Treasury two-year notice’s approximate 5% yield has historic parallels. It harkens again to earlier than the monetary disaster and the beginning of Bitcoin. This correlation suggests potential headwinds for many danger property.

McGlone’s evaluation, specializing in the 100-week shifting averages, reinforces the prevailing downward biases noticed in Bitcoin, significantly when in comparison with the steepest Treasury yield competitors witnessed in virtually 20 years.

Analyst Warns Of Potential Sub-$20,000 Ranges

Bitcoin’s current worth trajectory has left many buyers unsure about its future, with some analysts drawing parallels to historic worth crashes. Materials Indicators co-founder Keith Alan has shared insights on the present market circumstances.

Because the starting of the bear market, Alan has been intently monitoring Bitcoin’s worth actions and sharing a chart that implies the potential for retesting sub-$20,000 ranges.

Whereas acknowledging the potential of short-term scalping alternatives, Alan advises warning and restricted publicity to protect capital for what he believes may very well be a generational shopping for alternative. Notably, Alan emphasizes that he doesn’t consider the underside has been reached for Bitcoin.

The chart highlights numerous downrange ranges, showcasing Alan’s perception within the potential for additional draw back motion.

As depicted in Alan’s chart, the Bitcoin market faces a essential juncture the place the energy of assist at $25,000 is essential for the bullish case within the close to time period. Failure to carry this stage may result in a revisit of the December 2017 bull market peak at $19,800.

Including to issues for Bitcoin, there’s the potential of persevering with the draw back momentum, probably reaching a four-year low across the June 2019 bull market high of $13,800. This state of affairs would catch many bulls off guard, particularly contemplating the prevailing perception all through 2023 that the crypto winter was ending.

The momentum has shifted for probably the most outstanding cryptocurrency available in the market, and the bulls should defend their remaining assist ranges to avert an prolonged decline all through the rest of the 12 months.

BTC has briefly reclaimed the $26,000 threshold; nonetheless, it stays down by over 7% up to now 24 hours.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link