[ad_1]

The non-fungible token market that was the speak of the city in late 2021 and early 2022 has skilled a stunning downfall, leaving nearly all of NFTs shielding greater than 70% of their worth. A current examine has discovered that many NFT investments are actually nugatory. On this article, we will discover the present state and way forward for NFTs.

The non-fungible token started pumping someday in 2021 and quickly spiked to greater than $2.8 billion in month-to-month buying and selling gross sales quantity as of August 2021. The NFT market continued to pump, reaching an all-time gross sales quantity of $4.8 billion someday in late 2021 and early 2022.

Sadly, the non-fungible token market has suffered a brutal comedown lately. The crypto and NFT market started tanking final yr and has since continued, leaving most NFTs shedding greater than 80% of their worth.

Knowledge compiled by CryptSlam.io, an on-chain knowledge aggregator, reveals that the worldwide NFT market has recorded a buying and selling gross sales quantity of round $80 million prior to now seven days, representing simply 3% of its peak gross sales quantity in August 2021.

What Went Mistaken?

Of their current report, DappGambl, an on-chain analytic agency, has shared some elements that may have attributed to the sudden fall within the NFT market. To ship extra correct knowledge, the workforce compiled an evaluation of over 73,257 NFTs, assessed their market well being, decided the elements contributing to profitable tasks, and gained insights into the NFT ecosystem’s potential future.

Knowledge evaluation has discovered that 69,795 out of the 73,257 NFT collections have seen their market cap dropping to just about zero Ether. This stunning statistic signifies that 95% of individuals holding NFT collections presently maintain nugatory investments. The agency has estimated that 95% of over 23 million individuals who invested in NFTs are actually nugatory.

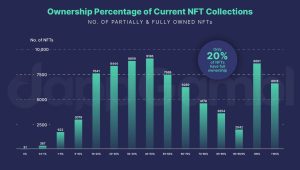

First, the analysis workforce has discovered an insufficient provide of NFTs available in the market as one of many important contributors to the current market downturn. The evaluation has discovered that out Of the entire NFT collections, solely 21% had been completely spoken for. Which means 79% of all NFT collections have remained unsold.

This surplus of NFT provide over demand has made consumers and potential traders extra discerning, rigorously evaluating the fashion, uniqueness, and potential worth of NFTs earlier than making a purchase order. Because of this, NFT tasks that lack clear use instances, compelling narratives, or real inventive worth have discovered it more and more troublesome to draw some consideration and gross sales.

The interconnection between the setting and NFTs is one other important issue pushing the non-fungible token market downward. It’s value noting that the minting strategy of NFTs includes certifying a digital asset as distinctive by making a transaction on the blockchain. Simply as some other operation within the digital realm does, every minting consumes power. Though the quantity of power consumed by minting NFTs is small, it may need prompted the market to undergo a nasty fame.

Primarily based on DappGambl’s examine, there are greater than 195,699 NFTs with no obvious homeowners or market share. The power required to mint these NFTs is akin to 27,789,258 kWh, producing roughly 16,243 metric tons of carbon dioxide. In that context, NFT creators ought to guarantee significant and real contributions to the NFT ecosystem.

The State Of NFTs Proper Now

Earlier than summarizing, the agency has determined to have a look at the highest 8,850 NFT collections, in response to CoinMarketCap.com. The analysis workforce has discovered that greater than 1,600 NFTs are almost useless. An 18% of the highest NFT collections have a flooring worth of zero, indicating that a good portion of even probably the most distinguished collections are struggling to keep up demand.

Moreover, 41% of the highest NFTs are modestly priced between $5 and $100, which alerts a scarcity of perceived worth amongst these digital property. Fortuitously, lower than 1% of those NFTs boast a price ticket of over $6,000, shedding gentle on the rarity of high-value property even inside the cream of the crop.

After taking a light-weight slumber prior to now a number of months, the non-fungible token market seems to be crawling again to life. Prior to now 24 hours, the worldwide NFT market has recorded a buying and selling gross sales quantity of $11.3 million, representing a 6.59% spike from the day before today. The NFT market showcases the robust potential of reverting the bearish sentiments. The NFT market would possibly quickly retest one other hype.

Supply: CryptoSlam.io, NFT buying and selling gross sales previous 24 hours

Associated NFT Information:

Ends Quickly – Wall Road Memes

Early Entry Presale Stay Now

Established Group of Shares & Crypto Merchants

Featured on Cointelegraph, CoinMarketCap, Yahoo Finance

Rated Greatest Crypto to Purchase Now In Meme Coin Sector

Staff Behind OpenSea NFT Assortment – Wall St Bulls

Tier One Change Listings September 27

Tweets Replied to by Elon Musk

[ad_2]

Source link