[ad_1]

Knowledge reveals there was a big spike in curiosity round stablecoins just lately, an indication that traders of Bitcoin and different property could also be trying to exit.

Stablecoins Have Noticed A Sharp Rise In Social Quantity Not too long ago

In keeping with knowledge from the on-chain analytics agency Santiment, there was a serious uptick within the social quantity of the stablecoins just lately. The “social quantity” refers to an indicator that measures the entire variety of social media textual content paperwork which are speaking a couple of sure subject or time period.

The social media textual content paperwork right here have been collected by Santiment and embody quite a lot of sources like Reddit, Twitter, Telegram, and different web boards.

One thing to notice in regards to the metric is that it solely tells us in regards to the distinctive variety of such posts which are mentioning the given time period not less than as soon as. Which means even when a thread consists of a number of mentions of the subject, its contribution in the direction of the social quantity will nonetheless stay just one unit.

The social quantity can present perception into the diploma of consideration any explicit coin is getting on social media platforms. Every time this indicator’s worth goes up, it signifies that the final curiosity within the asset amongst traders is rising at present.

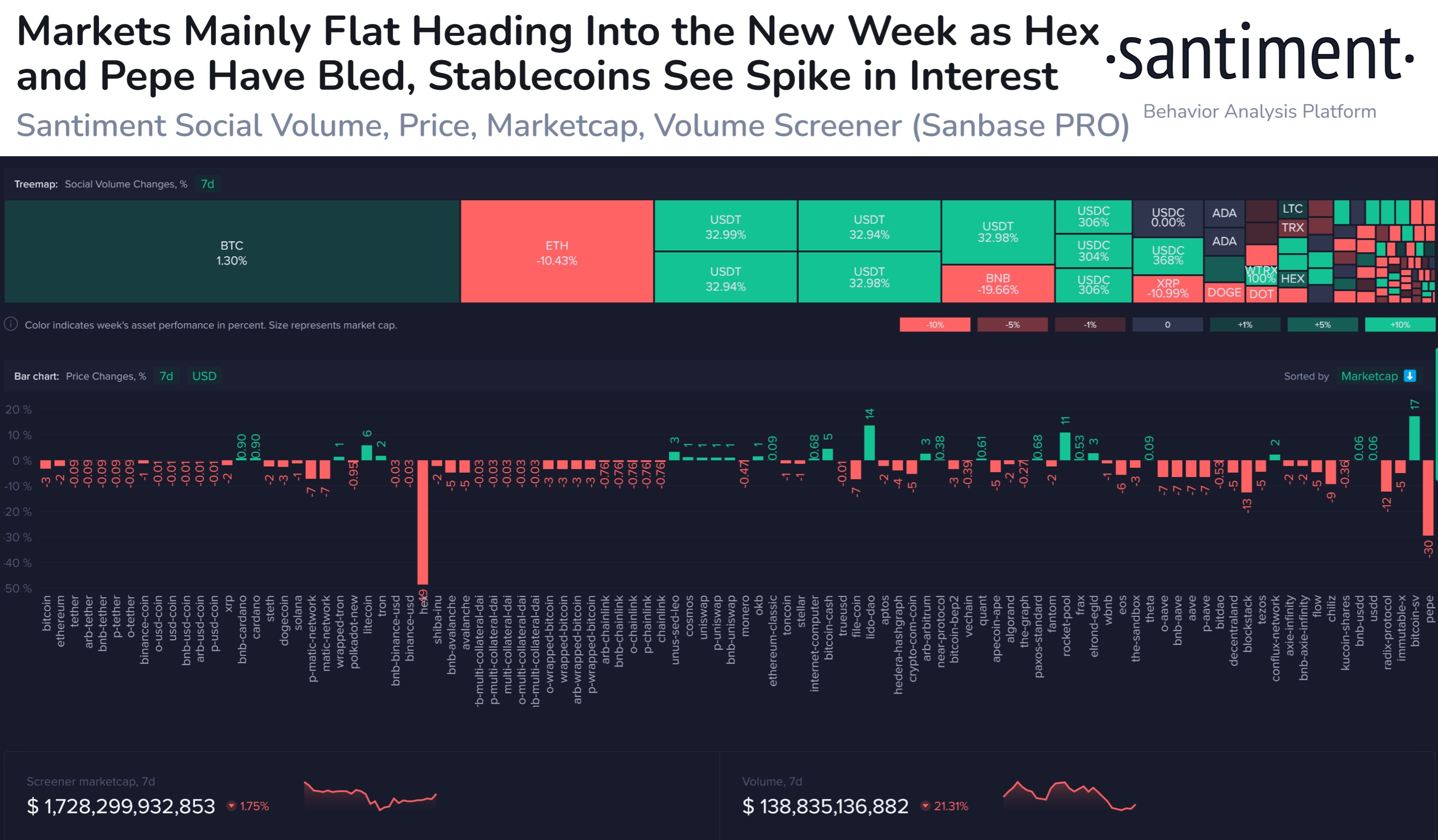

Now, here’s a chart that reveals the 7-day change within the social quantity for the varied property within the cryptocurrency sector (together with the stablecoins):

How the metric’s worth has modified for the totally different cash out there in the course of the previous week | Supply: Santiment on Twitter

As displayed within the above graph, the social quantity of quite a lot of the risky property has registered a unfavorable 7-day change, implying that there’s a lesser quantity of dialogue occurring associated to them proper now as in comparison with per week in the past.

Among the property like Bitcoin have seen a optimistic 7-day change within the metric, however the enhance has solely been minuscule for them, implying that their social quantity is comparatively unchanged.

Apparently, whereas the risky property might have seen lowering or sideways-moving social volumes, the stablecoins have seen a totally totally different development with the metric; their social volumes have sharply surged prior to now week.

USD Coin (USDC), which is the stablecoin second solely to Tether (USDT) when it comes to market cap, has seen a rare rise of greater than 300% when it comes to this metric. This implies that discussions across the coin have elevated by greater than 300% in the course of the previous week.

Tether itself has noticed a optimistic 7-day change within the social quantity of greater than 30%, which, whereas a lot lesser than USDC’s, remains to be fairly vital nonetheless.

Typically, traders use stables at any time when they need to escape the volatility related to the opposite cash within the sector. So, for the reason that curiosity round these tokens has surged just lately whereas the risky cryptocurrencies have been seeing a crimson interval, it might seem that holders might as soon as once more be in search of the security of this secure type of digital property.

BTC Value

On the time of writing, Bitcoin is buying and selling round $27,300, down 2% within the final week.

Seems to be like BTC has seen some restoration | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Santiment.web

[ad_2]

Source link