[ad_1]

Throughout a comparatively secure second quarter, Bitcoin and Ethereum have expanded their shares to over 70% of the full cryptocurrency market capitalization for the primary time since April 2021

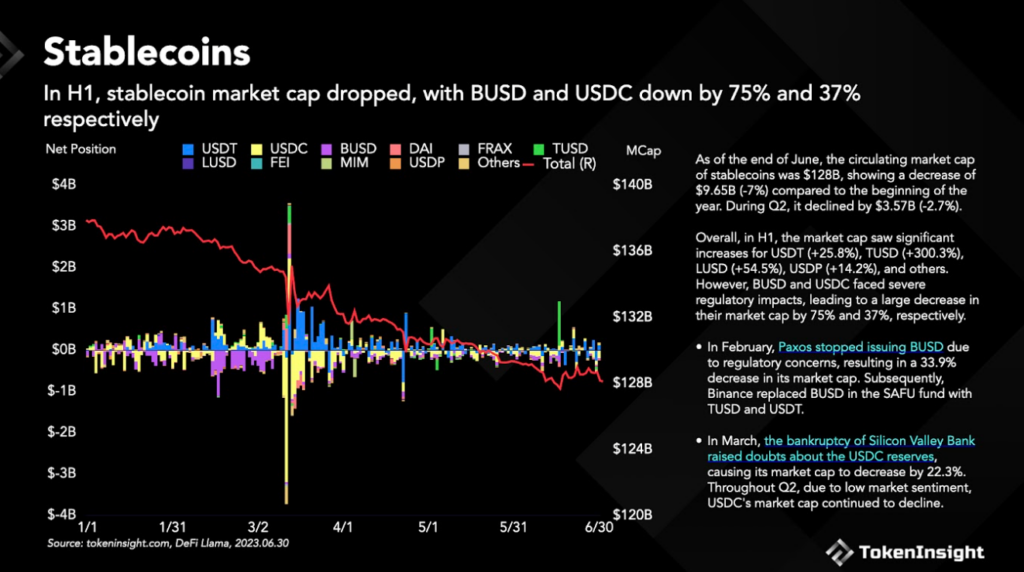

Throughout the identical interval, the lately launched Crypto Market Insights Report 2023Q2 by TokenInsight signifies the crypto market noticed a lower within the complete market capitalization of stablecoins.

In line with the report, the stablecoin market cap declined by 7% within the first half of 2023 to $128 billion as of the tip of June.

A CryptoSlate evaluation of the mixed BTC and ETH dominance charts reveals they rose a mixed 12%, which suggests that elements aside from a shift from stablecoins have contributed to the elevated dominance of Bitcoin and Ethereum.

The TokenInsight report highlights regulatory actions towards two main stablecoins, USD Coin (USDC) and Binance USD (BUSD), as drivers of the downward pattern for stablecoins. Following the chapter of considered one of its reserve banks, USDC’s market cap dropped 22.3% in March. In the meantime, the issuance of BUSD was halted, resulting in a 75% lower in its market cap.

Ethereum Staking Surges Put up Shapella Improve

Additional, the report notes the Ethereum Shapella improve in Q2 has confirmed to be a catalyst for elevated staking, displaying an uptick from 15% to almost 20%.

This variation has resulted in a pointy rise in staked Ethereum, reaching 23.54M ETH by the tip of June, up 48.4%.

Sustaining its dominant place, Lido noticed its staked ETH enhance by 32.6% to 7.5M ETH, demonstrating the market’s rising religion in Ethereum’s imaginative and prescient and the prospect of incomes passive revenue by way of staking.

LSDFi Market and Layer-2 Networks Exhibit Development

Breaking down the information additional, we discover that the LSDFi (Liquidity Staked DeFi) market noticed an eight-fold surge in its complete worth locked (TVL), with Lybra Finance rising as the most important LSDFi pool.

This fast development within the LSDFi market signifies the rising integration of DeFi protocols with LSD, underlining the increasing scope and affect of DeFi within the crypto sphere.

Layer-2 networks additionally demonstrated a formidable development trajectory. Notably, zkSync, the primary ZK-Rollup Layer-2 community, witnessed an 861.89% enhance in its TVL.

This implies the rising adoption and growth of Layer-2 options because the Ethereum neighborhood seeks scalable, safe, and environment friendly transaction processing paths.

Bitcoin’s NFT and Transaction Spike

Whereas Ethereum has been making strides, Bitcoin noticed a big uptick in each day common transactions in Could, tripling because the begin of the 12 months. The surge can partially be attributed to the rise of Bitcoin Ordinals like NFTs, which induced a spike in transactions and charges.

The expansion in Ethereum staking, the surge in LSDFi, and the event of Layer-2 networks are pivotal shifts that would form the longer term trajectory of the crypto market. The complete TokenInsight report is offered to obtain from its web site.

[ad_2]

Source link