[ad_1]

Knowledge exhibits the stablecoin market cap has returned towards equilibrium and could also be gearing up for a reversal. Right here’s how Bitcoin may benefit from this.

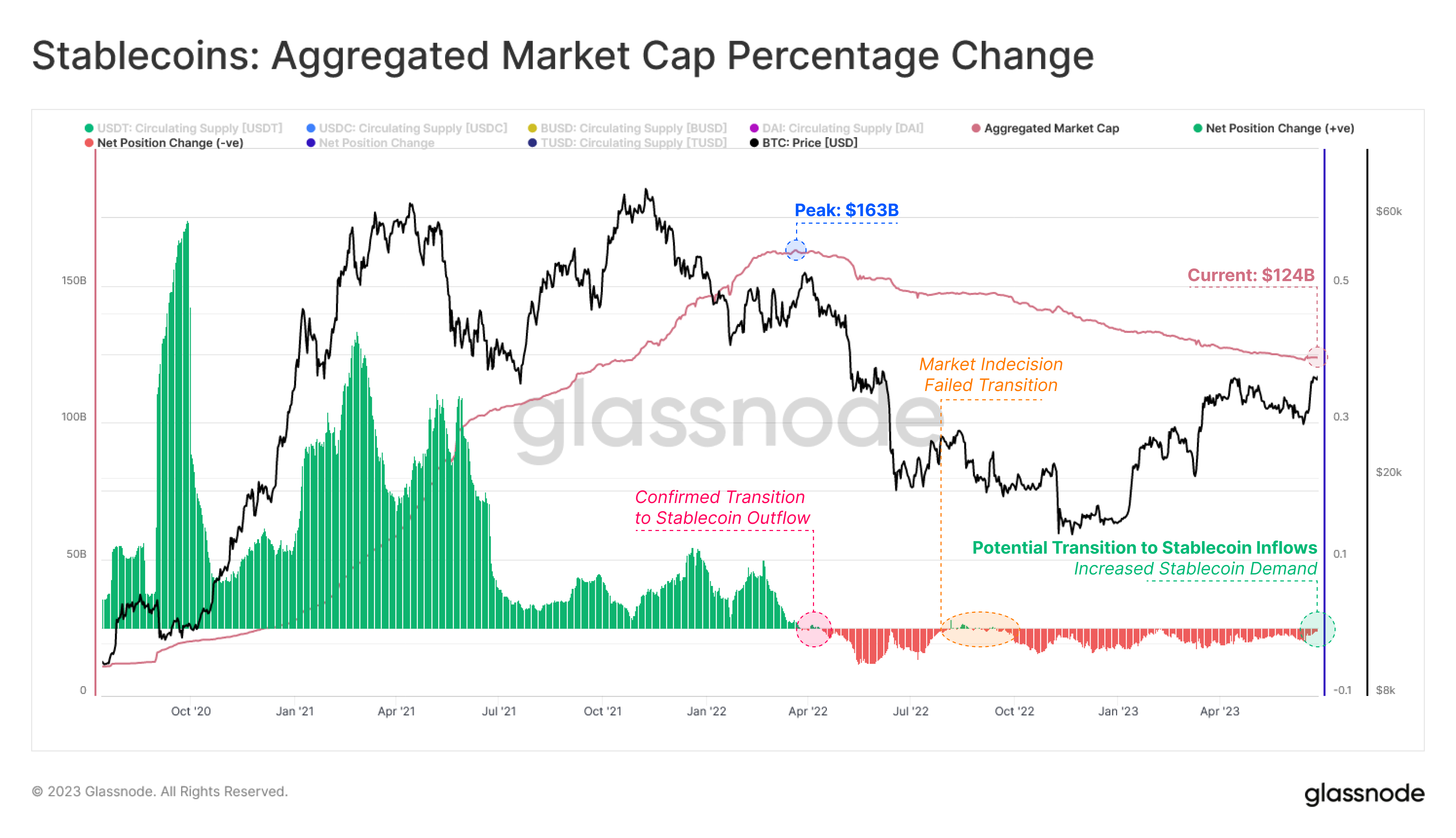

Combination Stablecoin Market Cap Change Has Returned To Equilibrium

In accordance with information from the on-chain analytics agency Glassnode, the combination stablecoin market cap had beforehand been in a decline for round 14 months. The “mixture stablecoin market cap” right here refers back to the mixed market cap (that’s, the overall valuation in USD) of the highest 5 stables within the sector.

Extra particularly, the related stablecoins within the present dialogue are Tether (USDT), USD Coin (USDC), Binance USD (BUSD), Dai (DAI), and TrueUSD (TUSD). The whole provide of those stables is taken into account right here, no matter how it’s distributed among the many completely different blockchains.

Associated Studying: Bitcoin Rally Stalls As Quick-Time period Holder Change Inflows Intensify

Traditionally, the mixed market cap of those property has held essential info for the sector, as it could possibly present hints about whether or not capital is flowing into or out of the market proper now.

To trace the circulation of capital, Glassnode has regarded on the 30-day proportion change within the mixture market cap of those fiat-tied tokens.

Here’s a chart that exhibits the pattern on this indicator over the previous few years:

The worth of the metric appears to have approached the zero mark in current days | Supply: Glassnode on Twitter

Naturally, when the worth of this metric is optimistic, it signifies that the highest 5 stablecoins have registered web inflows over the last thirty days. Then again, destructive values indicate outflows have taken place previously month.

From the graph, it’s seen that the 30-day proportion change within the mixture stablecoin market cap was fairly optimistic through the 2021 bull run. This may indicate that these property have been continually seeing an enlargement of their provides on this interval.

Often, traders make use of stables every time they wish to escape the volatility related to different cryptocurrencies. Such holders preserve their capital within the type of these property till they wish to purchase again right into a risky coin like Bitcoin or withdraw into fiat. Clearly, within the former situation, the buying can have a optimistic impact on the worth of the asset they’re shifting into.

Throughout bull markets, a ton of capital flows into the sector, which is what helps maintain such rallies. Thus, it’s not a shock that the stablecoin provide noticed enlargement through the 2021 bull run.

Because the bear market started in 2022, nonetheless, the indicator’s worth decreased towards the zero stage, implying that the outflows began to equal the inflows. A confirmed transition towards web outflows then occurred, because the bearish interval kicked into full gear.

There was a small interval through the aid rally in the course of the 12 months the place the 30-day proportion change once more approached the zero market. A transition towards inflows, nonetheless, failed, and the indicator grew to become destructive as soon as extra.

The destructive values have continued till now, that means that these prime stablecoins have been observing web redemptions for 14 straight months. Not too long ago, although, the metric has once more neared equilibrium, that means that there’s potential for breaking into the inflows regime.

It’s unclear whether or not this reversal shall be full, or if a rejection will occur like through the aforementioned aid rally. If the stablecoin market cap does start to see an enlargement, then it will be a bullish signal for Bitcoin, as it will imply that there’s now extra capital current out there within the type of the stables, which can be used to buy the asset.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $30,400, up 1% within the final week.

BTC continues to maneuver sideways | Supply: BTCUSD on TradingView

Featured picture from CoinWire Japan on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link