[ad_1]

Fast Take

S&P 500 faces headwinds

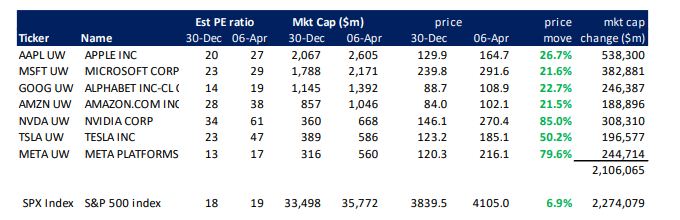

The S&P is roughly up 7% in 2023, however many of the features have come from seven tech shares, which coincidentally have the biggest market cap within the index.

Whereas these shares have extremely elevated PE ratios, excessive charges and an absence of stimulus will present headwinds for these shares and S&P 500 as an index. As Q1 earnings season approaches.

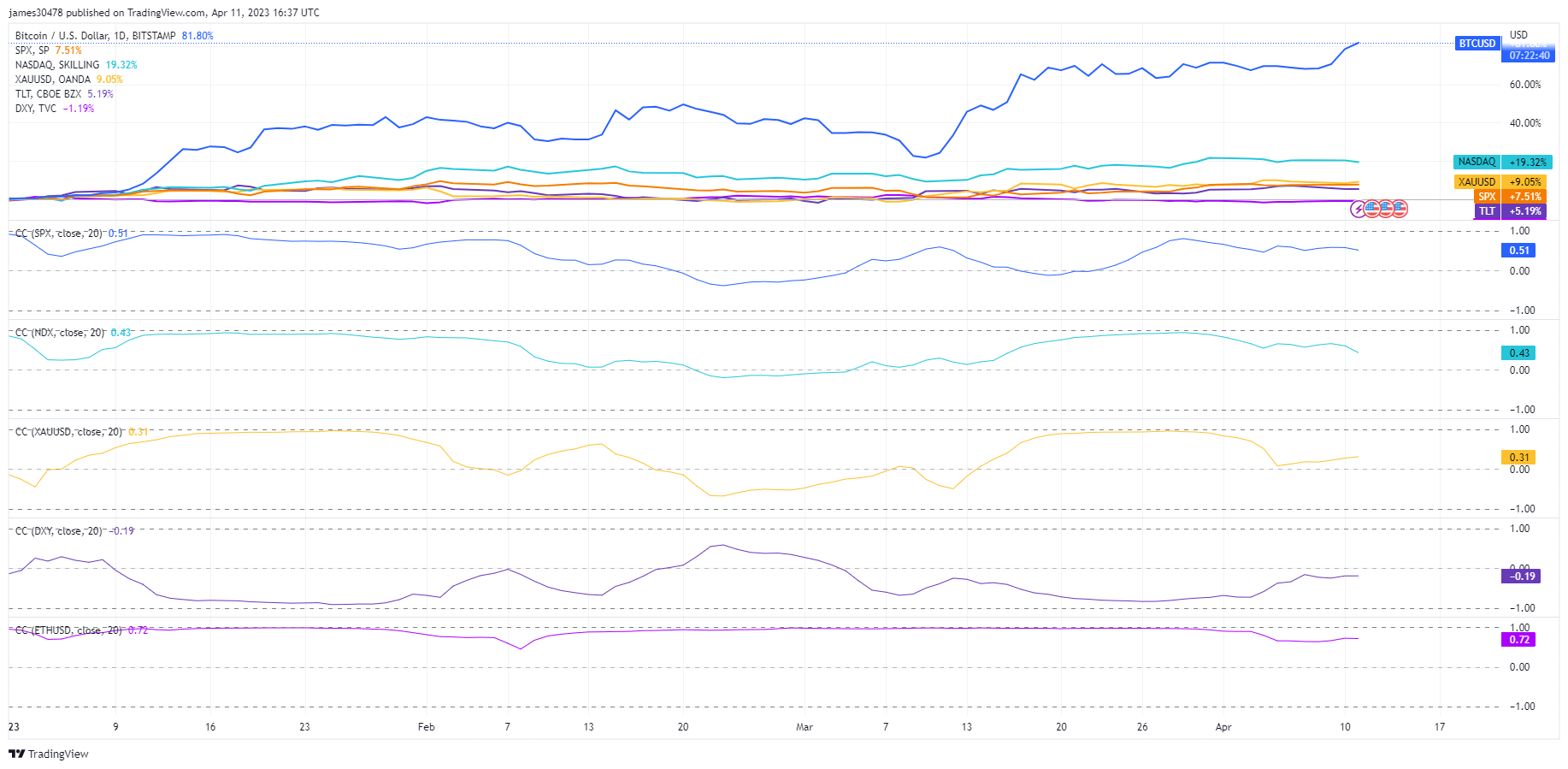

Whereas the S&P 500 is beginning to de-correlate farther from Bitcoin, roughly at a 50% correlation. On the identical time, the Nasdaq is all the way down to a 42% correlation with Bitcoin.

GBTC

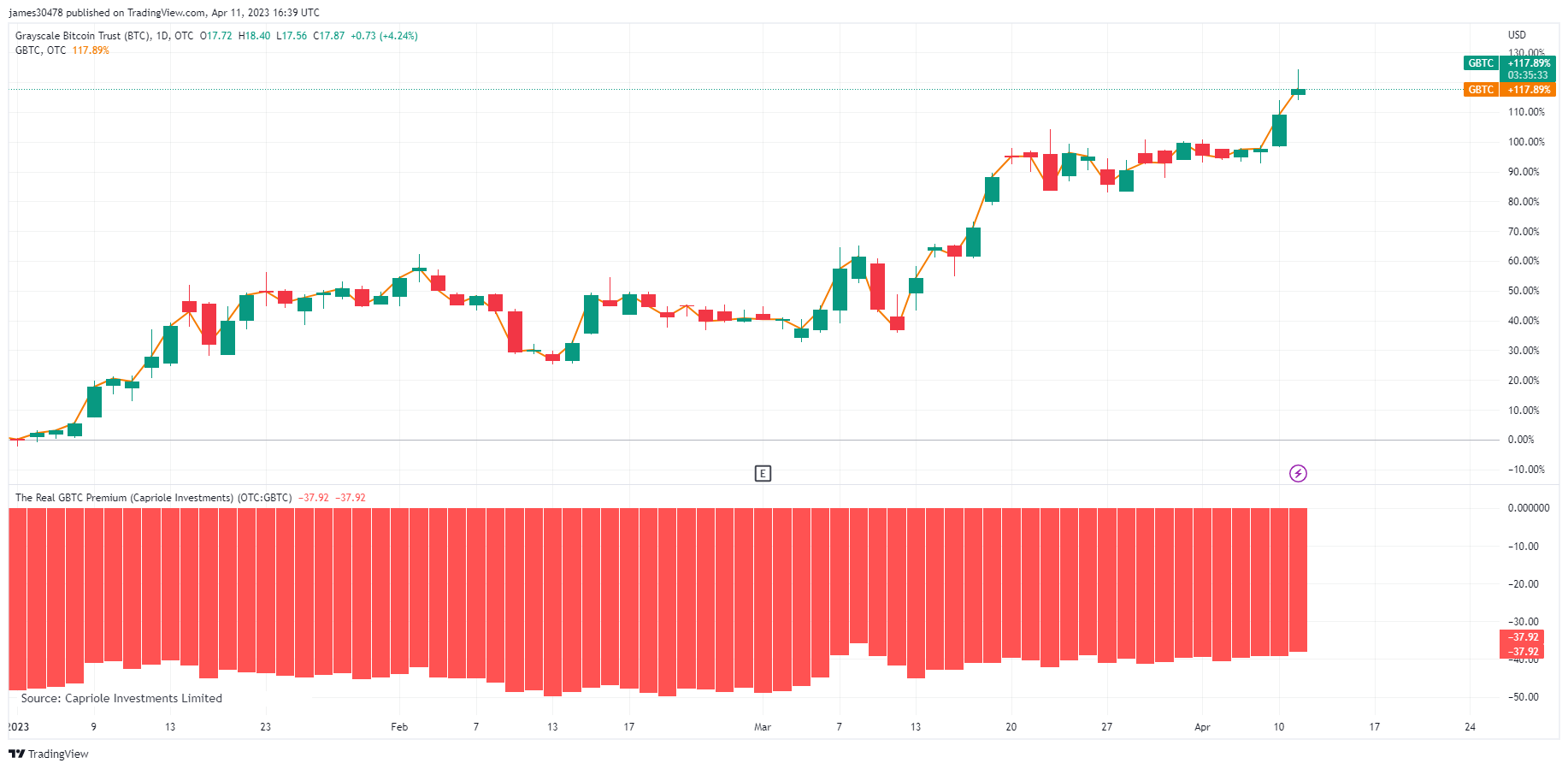

The GBTC low cost continues to slender, because the low cost to NAV is under 38%, whereas it was as excessive as 50% in This autumn of 2022.

GBTC is up 117% 12 months so far, outperforming Bitcoin, which has simply surpassed $30,000.

CryptoSlate did an in depth market report on the GBTC commerce that had additional implications for the crypto trade.

The publish S&P 500 index, Bitcoin present additional indicators of decoupling as tech shares prop up index appeared first on CryptoSlate.

[ad_2]

Source link