[ad_1]

Solana Cell, a subsidiary of Solana Labs, introduced a big 40% value discount for its Saga smartphone, slashing the value from its preliminary $1,000 to a extra reasonably priced $599. This transfer comes simply 4 months after the cellphone’s launch, sparking a flurry of reactions from the crypto group.

The official assertion from the corporate means that the value lower is a strategic transfer to foster wider adoption of cellular web3 and to boost the person expertise for the Solana cellular group. Nonetheless, on-chain information paints a barely completely different image.

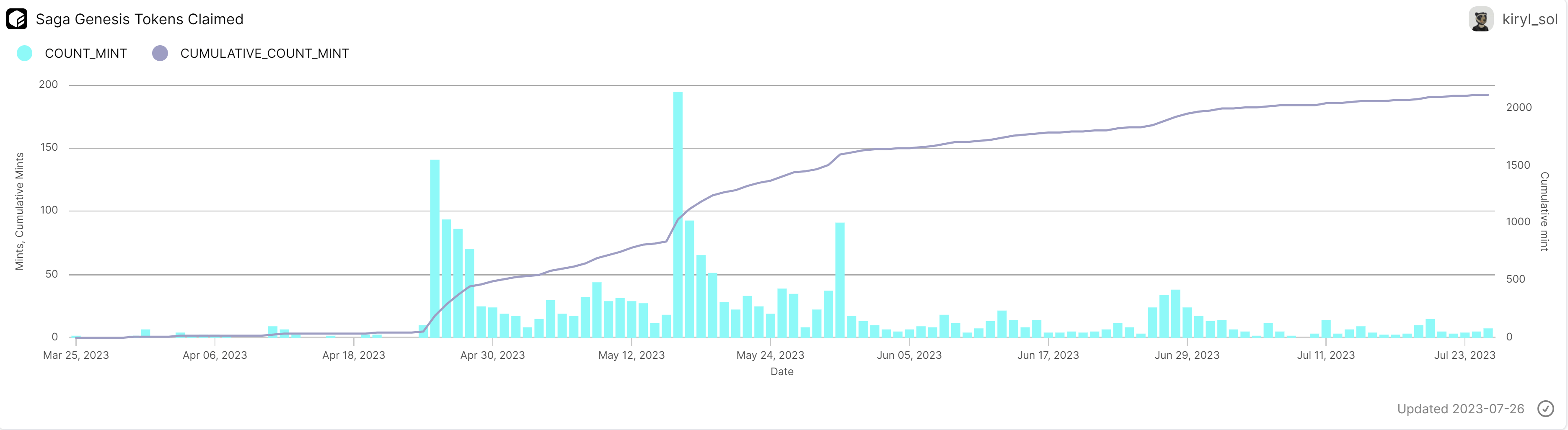

In keeping with information compiled by Flipside Crypto, gross sales of the Solana Saga have seen a pointy decline since their peak in April and Could. That is evidenced by the variety of Saga Genesis NFT mints, that are generated when a person units up their Solana Saga smartphone and accesses the Solana app retailer. The chart under exhibits a transparent downward development of gross sales. Since June gross sales quantity has been extraordinarily flat after a profitable Could 2023.

The value discount has elicited combined reactions on Twitter / X. Whereas some early adopters expressed their frustration at buying the system at its unique value, others defended the transfer, stating the advantages of being an early chook. Notably, early homeowners had the unique alternative to mint Claynosaurz NFTs, which at the moment have a ground value of round 33 SOL on Magic Eden, translating to over $800.

Solana (SOL) Value Evaluation

On the flip facet, the Solana (SOL) token is in bullish territory. On the time of writing, SOL was buying and selling at $24.38. A have a look at the every day chart exhibits that SOL was in a position to affirm the breakout from its downtrend channel on Monday after the value discovered assist at each the channel’s development line and the 200-day Exponential Transferring Common (EMA).

On account of this bullish affirmation, SOL broke above the 50% Fibonacci retracement degree at $23.94. For now, it seems like SOL can defend the extent and make a brand new run in the direction of the 61.8% Fibonacci retracement degree at $27.42.

Remarkably, on July 14, SOL reached its year-to-date peak of $32.36 and recoiled from the 78.6% Fibonacci retracement degree. Subsequently, SOL dipped under the 61.8% Fibonacci degree and couldn’t maintain a every day shut above it.

Given this context, the $27.42 value level emerges as essentially the most pivotal resistance at the moment. Ought to a breakout happen, a transparent path to the 12 months’s excessive could be established. On this case, a bullish breakout appears imminent. Nonetheless, robust revenue taking could be anticipated round $32.36. If the yearly excessive falls, although, the bulls may goal the 1.618 Fibonacci extension degree at $56.86.

Featured picture from Disruption Banking, chart from TradingView.com

[ad_2]

Source link