[ad_1]

Be part of Our Telegram channel to remain updated on breaking information protection

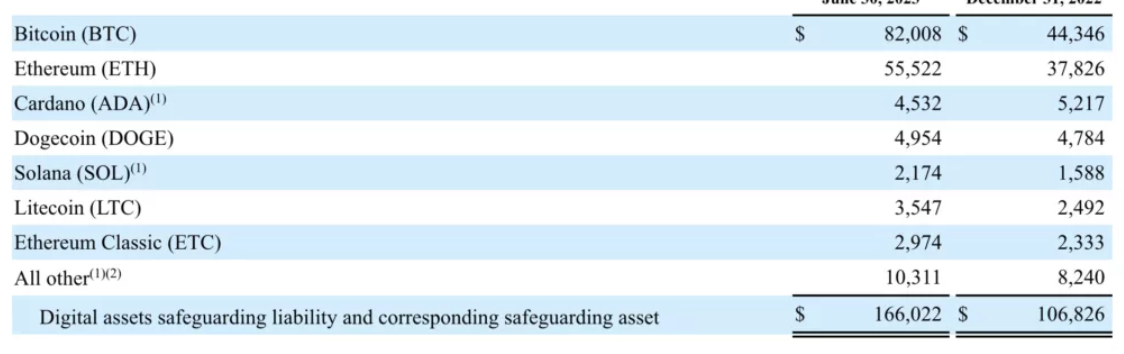

San Francisco-based SoFi Financial institution has revealed in its quarterly earnings report that it holds $170 million price of crypto, made up of Bitcoin, Ethereum, Litecoin, Solana, Ethereum Basic, and Dogecoin.

Bitcoin kinds the majority of its crypto holding, valued at $82 million, adopted by Ethereum ($55 million) and Dogecoin $5 million. Cardano comes fourth as SoFi holds $4.5 million price of ADA tokens.

The financial institution affords a singular worth to buyers by permitting them to take a position a portion of their deposits when it comes to digital belongings with none digital charges. In keeping with the official web site, US customers additionally rise up to $100 price of Bitcoin for buying and selling crypto.

The FAQ part of the official web page of the SoFi crypto buying and selling app says that after situations are met, SoFi deposits the Bitcoin bonus inside 7 days of making an account.

SoFi Financial institution – From Crypto Buying and selling App To A Financial institution

When SoFi began its crypto buying and selling services in 2019, it wasn’t a financial institution. Again then, the 800,000 prospects it aided may commerce upwards of 10 crypto belongings.

The buying and selling platform’s transition to financial institution occurred in February 2022 when it was acquired by Golden Pacific Bancorp and Golden Pacific Financial institution

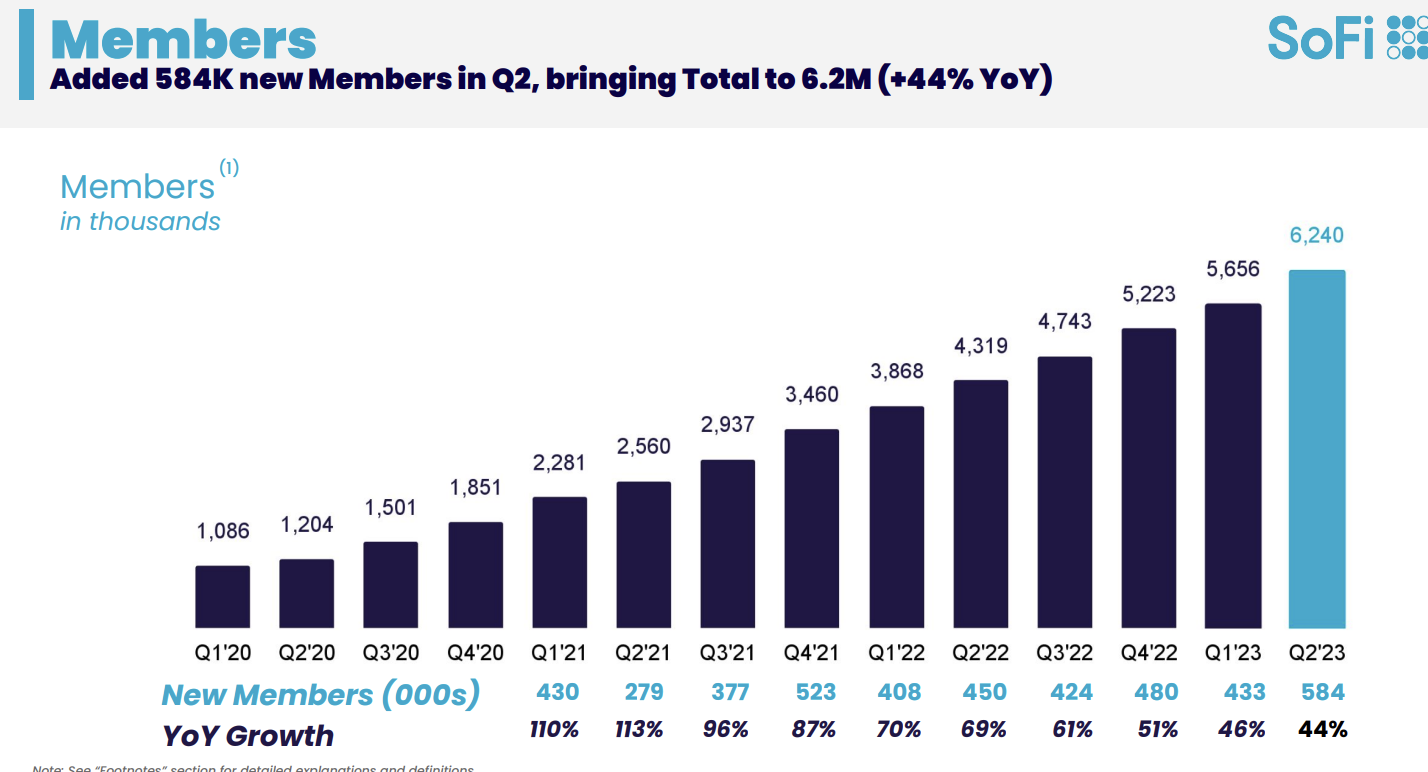

An investor presentation accompanying the Q2 earnings report revealed that SoFi had onboarded 584,000 extra prospects and now helps over 22 cryptocurrencies. It additionally holds Federal Reserve shares and affords customers crypto by way of its Coinbase partnership.

Throughout SoFi’s transition to a full financial institution, Fed offered a roadblock, stating that the corporate was engaged in crypto buying and selling. It gave SoFi two years to align with Fed’s insurance policies, which means the financial institution has till January 2024 to convey its insurance policies as much as Fed’s requirements.

The rationale was the lacking capital reserves. Banks are legally required to carry some capital in reserves once they put loans of their steadiness sheets, permitting them to offset some losses utilizing the capital contained in the reserves.

Nonetheless, SoFi solely holds loans for six months earlier than accumulating curiosity and promoting them to buyers. This added dynamism means SoFi doesn’t maintain any capital in reserves in case of potential losses.

The quarterly earnings report doesn’t go into any progress it has made relating to aligning its insurance policies with the Federal Reserve, nor does it focus on what number of crypto prospects it has.

What it does present, nonetheless, is that it holds $12.7 billion in deposits, a rise of $2.7 billion within the second quarter of 2023.

SoFi’s Quarterly Earnings Report Present 37% Yr-on-Yr Progress

The press launch by SoFi, which is accompanied by a quarterly earnings report, exhibits that the corporate has made 37% year-on-year progress.

5 years in the past, we targeted on robust unit economics per product. Now, Q2 marks our ninth consecutive quarter of file income and 4th consecutive quarter of file adjusted EBITDA.

Watch CEO, @anthonynoto and the @CNBC group focus on $SOFI. ⤵️ pic.twitter.com/BJlhV8J1Yn

— SoFi (@SoFi) August 3, 2023

Associated

Imposter Tokens Utilizing PYUSD Pop-Up on A number of Blockchains

Digital Commerce Chamber Lauds SEC vs Ripple Ruling in New Report

Wall Road Memes – Subsequent Massive Crypto

Early Entry Presale Dwell Now

Established Neighborhood of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Greatest Crypto to Purchase Now In Meme Coin Sector

Group Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link