[ad_1]

Fast Take

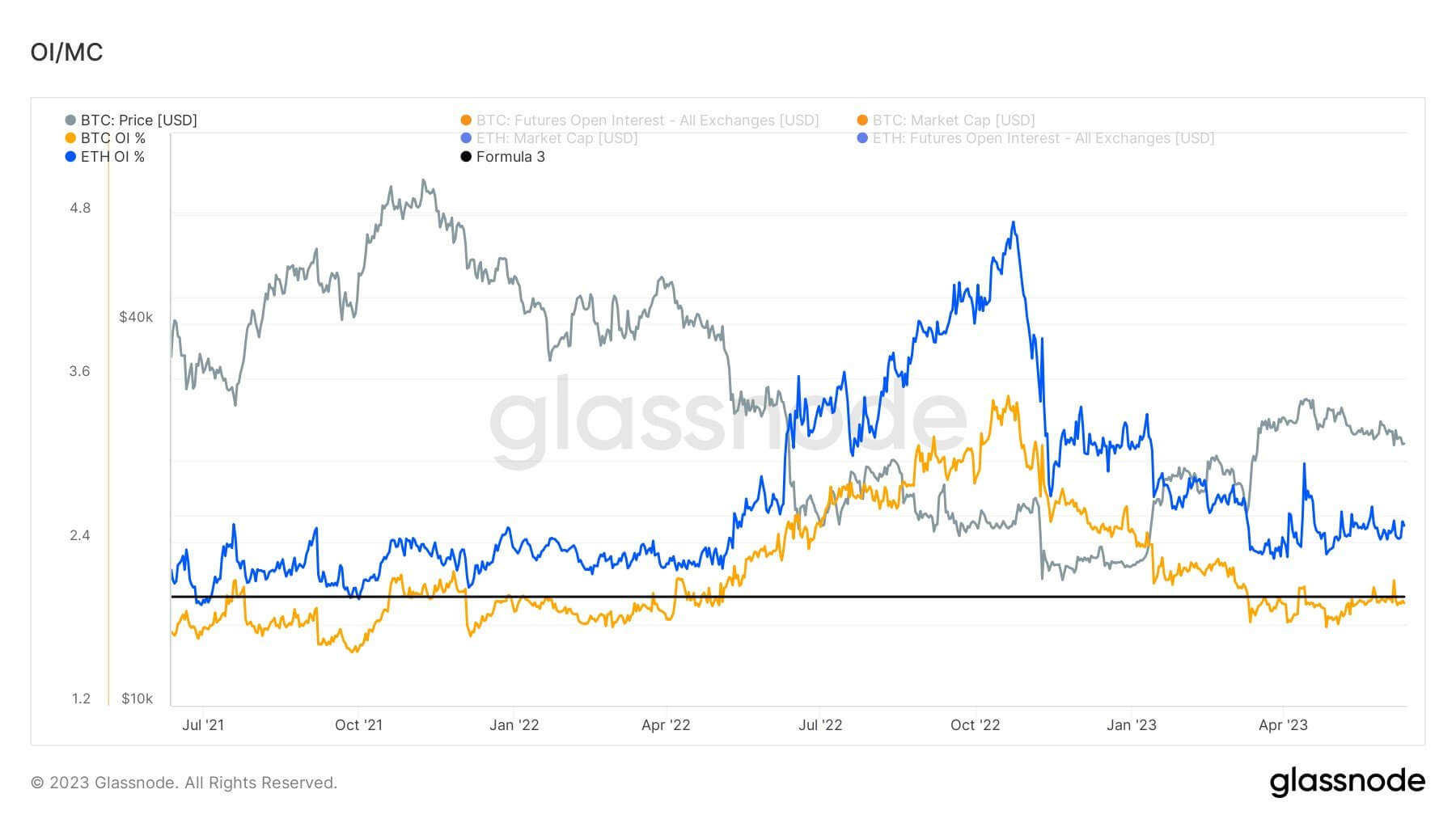

In a deflationary collapse, a sell-off happens that first ends in leverage being worn out first earlier than then affecting panic sellers.

Bitcoin open curiosity is minimal, remaining at or under 2% of the market cap since Silicon Valley Financial institution’s collapse, whereas holders stay value agnostic.

The present worth of the futures open curiosity is roughly $9.8 billion, whereas the market cap is simply over $500 billion.

Ethereum’s open curiosity is barely extra leveraged than Bitcoin when it comes to open curiosity in comparison with market cap.

Ethereum’s open curiosity divided by market cap is 2.5%, roughly $5.2 billion in open curiosity with a market cap of $210 billion.

We are able to additionally see a scarcity of long-term holders sending Bitcoin to exchanges for the reason that SVB collapse in March.

The put up Ought to we concern a deflationary collapse in Bitcoin? appeared first on CryptoSlate.

[ad_2]

Source link