[ad_1]

Bitcoin skilled a major dip final week, shedding over 9% in 24 hours and dropping to $26,299 on Aug. 18. Its worth plunged even additional throughout the weekend, settling at $26,198 on Aug. 20.

An enormous exodus of leverage from the derivatives market primarily triggered this abrupt decline. As leverage was flushed out, the spot market shortly adopted go well with, exerting much more downward strain on Bitcoin’s worth.

And whereas Bitcoin’s worth at present stands above the $26,000 stage, its stability above this threshold is below query. There’s an underlying concern that if short-term holders begin offloading their holdings pushed by panic, the value might drop even additional.

Brief-term holders are entities which have held onto their Bitcoin for lower than 155 days. As newcomers to the market, they’re sometimes extra reactive to cost fluctuations, usually making buying and selling selections based mostly on short-term market dynamics somewhat than long-term potential.

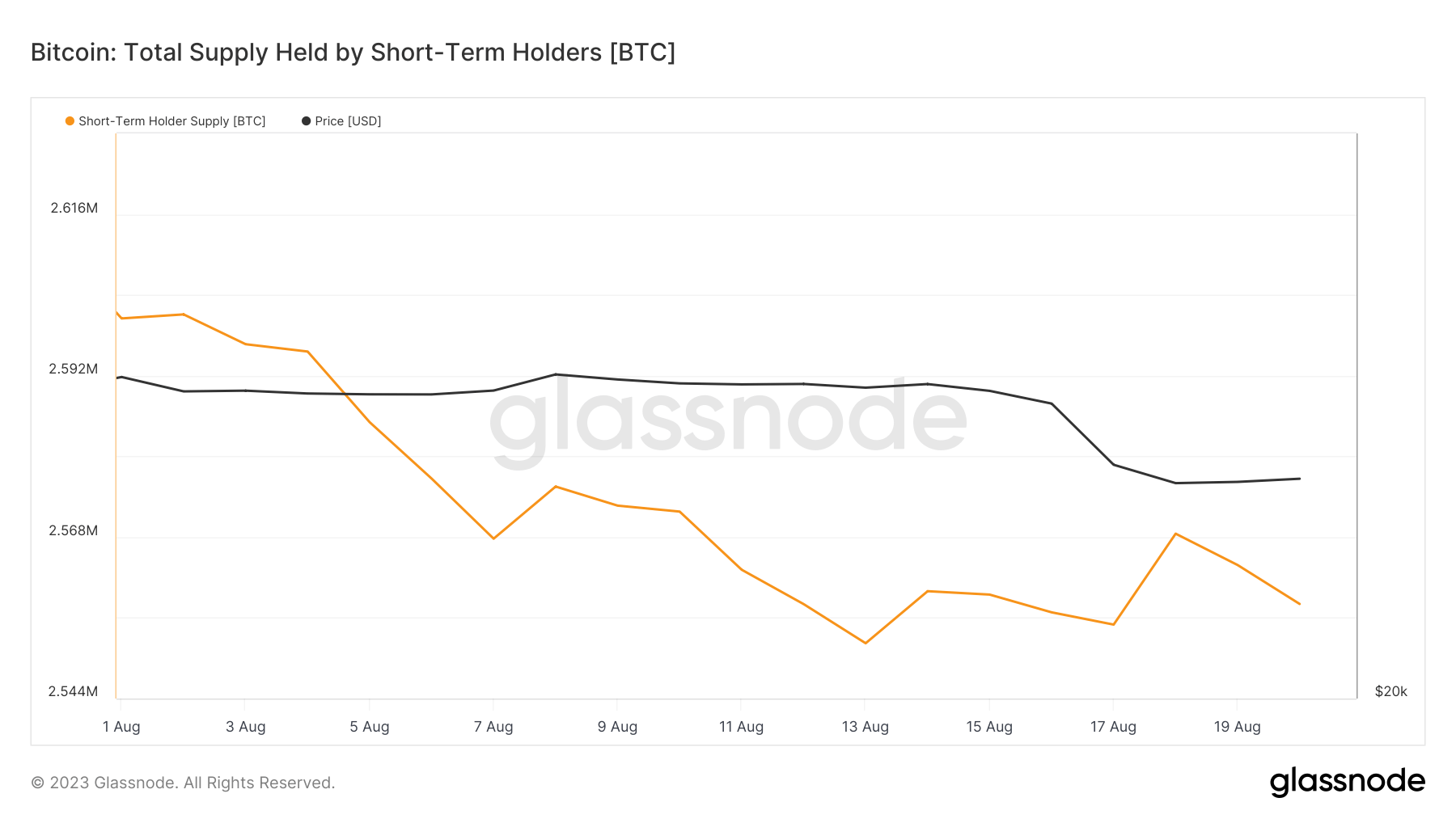

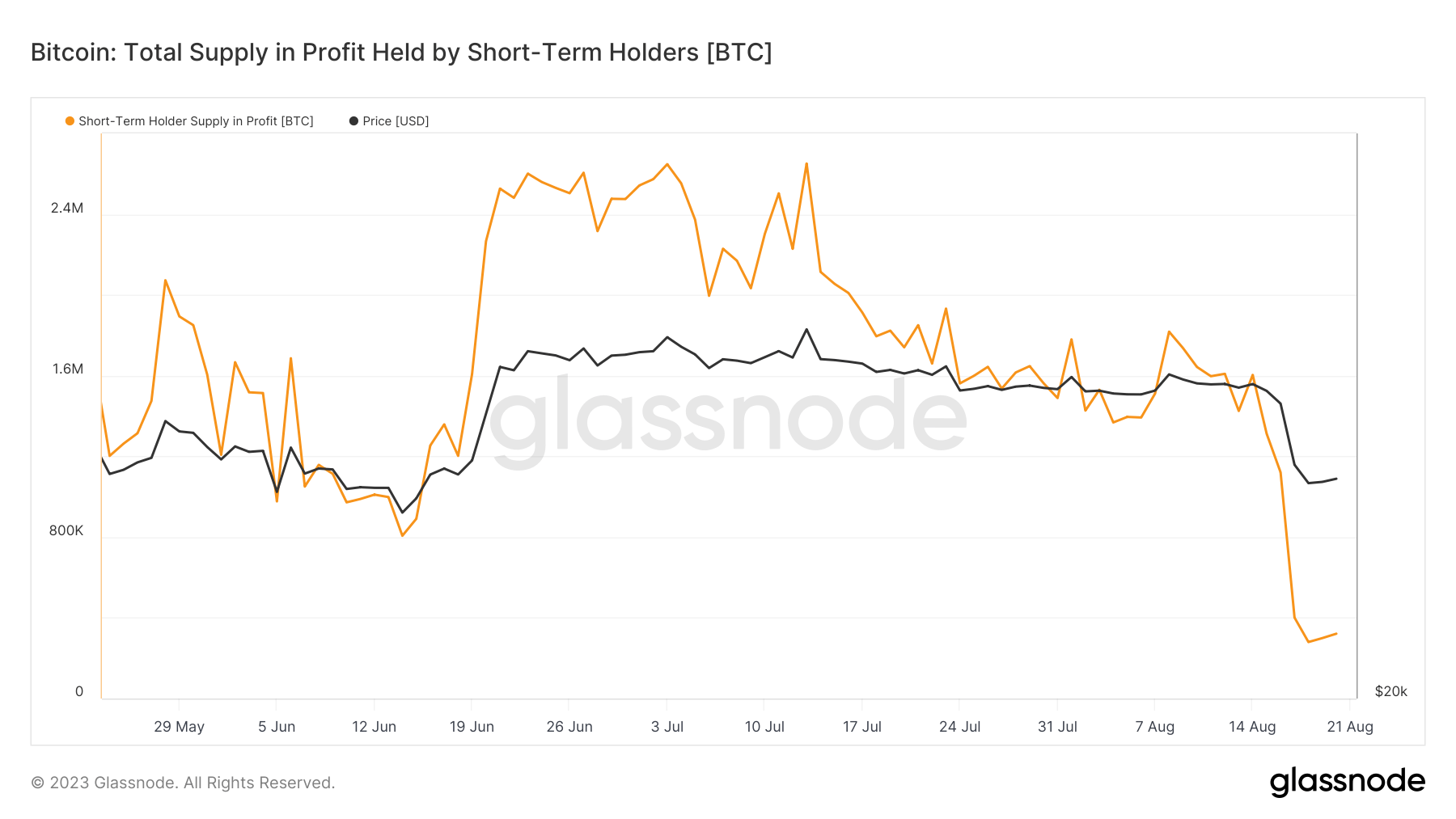

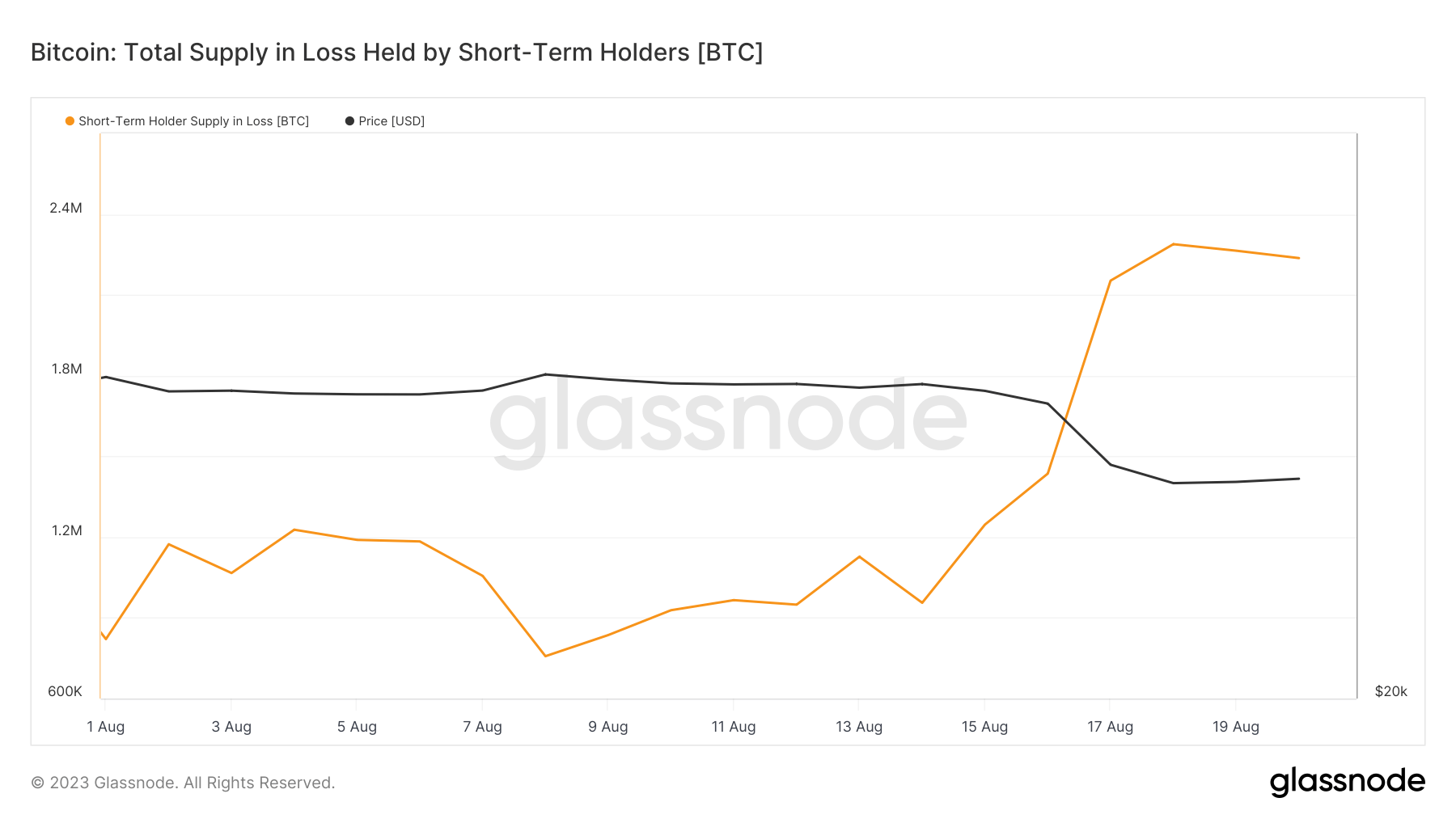

As Bitcoin’s worth took a nosedive, the portion of its provide held by short-term holders remained comparatively secure. Nonetheless, their unrealized losses noticed a major surge.

Information from Glassnode confirmed a near-vertical drop within the proportion of short-term holder provide in revenue. On Aug. 14, this determine stood at 2.56 million BTC. Per week later, on Aug. 21, it stood at 321,238 BTC. This represents a slight enhance from the 8-month low recorded on Aug. 18, when the short-term holder provide in revenue dropped to 279,907 BTC — an 82% drop from Aug .14.

Brief-term holders are at present sitting on roughly 1.28 million BTC at a loss. If Bitcoin’s worth trajectory continues on this risky course, there’s a looming danger {that a} sizeable portion of this BTC might flood exchanges. This might create immense promoting strain, probably triggering additional worth cascades.

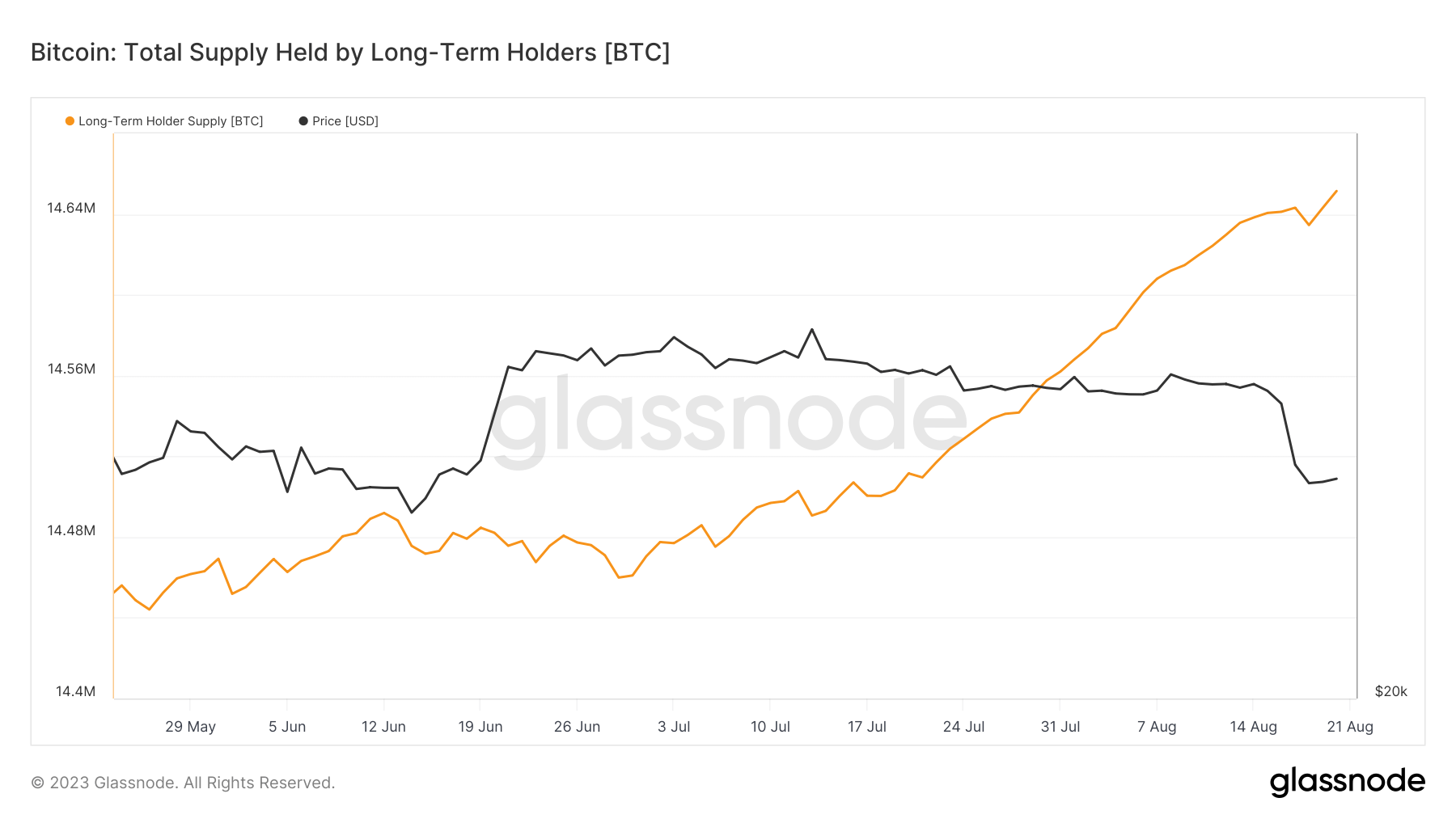

The market at present sits at a crucial juncture, because the actions of short-term holders within the coming days might considerably affect Bitcoin’s worth route. Traditionally, long-term holders have absorbed many of the cash distributed by short-term holders, shortly re-establishing equilibrium available on the market. Nonetheless, long-term holders have been rising their provide, and there’s a chance that they may lack the liquidity essential to cease additional worth drops.

The submit Brief-term holders are sitting on 1.3M BTC at a loss appeared first on CryptoSlate.

[ad_2]

Source link