[ad_1]

Bitcoin miners have all the time managed an inexpensive portion of the BTC provide and as such, after they begin promoting, it may be very bearish for the digital asset. This time round, there was a major decline within the holdings of those BTC miners, which means that they made be promoting once more.

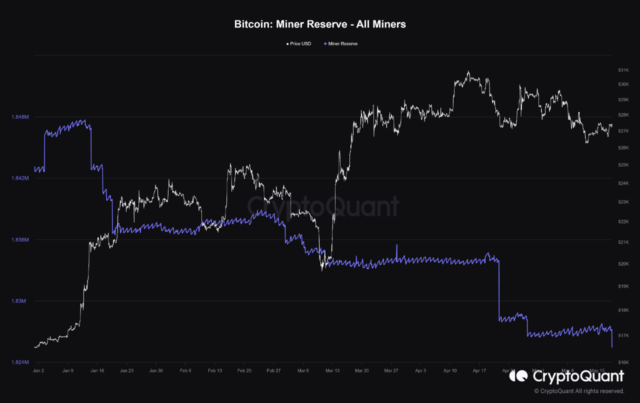

Bitcoin Miner Reserves See Sharp Decline

Because the 12 months started, Bitcoin miners have been leaning extra towards promoting to make ends meet for his or her operations. That is evident within the declines which were recorded of their balances after what appeared like an extended 12 months of accumulation again in 2022.

Because of this, the present Bitcoin miner balances are sitting at about 50% decrease than they did initially of the 12 months, and it doesn’t look like they’re finished promoting. It’s because knowledge from CryptoQuant exhibits that miners moved hundreds of BTC over the previous day with the vacation spot stated to be centralized change Binance.

Miners transfer over 2,500 BTC Supply: CryptoQuant

The on-chain knowledge aggregator highlighted two transactions carrying 1,750 BTC every headed towards Binance. On the time, each of those transactions have been price $47 million, resulting in the sharp decline that was recorded within the holdings of BTC miners.

Normally, shifting BTC from one pockets to a different isn’t alarming. However when the vacation spot of those cash occurs to be centralized exchanges, it turns into one thing to fret about for market members.

BTC Miners Might Tank The Market

With $47 million anticipated to maneuver into Binance from the Bitcoin miners, there could possibly be extra promoting strain being mounted on the cryptocurrency. BTC is already experiencing vital promoting strain, which has seen its value fall beneath $27,000 as soon as once more, and the miners promoting their BTC may make this even worse.

BTC value falls to $26,000 territory | Supply: BTCUSD on TradingView.com

Based on the chart posted on CryptoQuant, it’s apparent that there has all the time been a major decline within the BTC value every time miners moved such massive quantities. This time round, it appears the latest restoration above $27,000 is what spurred the transfer and it may level to miners attempting to benefit from the upper costs in the event that they anticipate Bitcoin to maintain declining.

The final time such a transfer occurred was in early April and BTC misplaced round $4,000 from its worth. If this repeated itself, then the digital asset may fall to $24,000 earlier than demand picks up sufficient to set off a restoration.

As of the time of writing, the BTC value is already falling. It’s buying and selling at $26,849 with a 1.88% decline in 24 hours.

[ad_2]

Source link