[ad_1]

Be part of Our Telegram channel to remain updated on breaking information protection

Ethereum value lastly crossed the $2,000 market on April 13, just a few hours after the Shanghai/Capella improve which went stay on the Ethereum mainnet at 10.27 pm UTC on April 12 at epoch quantity 194,048. ETH has held above this degree since then as market members count on the entry to staked Ether (stETH) to spark investor curiosity within the second-largest token by market capitalization, propelling its value increased.

$ETH flashes above $2K after a profitable #EthereumUpgrade pic.twitter.com/5CBNTmFFmv

— ErmoFi (@ErmofiNews) April 13, 2023

This text attracts on technical and on-chain knowledge to dive into Ethereum’s value motion following a profitable Shapella improve that noticed it attain a excessive of $2,142 for the primary time in 11 months. The Improve seems to have resulted in a “bullish unlock” as was beforehand predicted by IntoTheBlock in the beginning of the 12 months.

The Shapella Gives ETH With Hindwinds

The Ethereum Shanghai improve was efficiently carried out, marking a brand new period of staked Ether withdrawals. The improve incorporates modifications to the execution layer – the Shanghai improve, the consensus layer- the Capella improve, and Engine API.

The execution layer’s Shanghai improve is a major achievement within the Ethereum roadmap. It permits stakers to withdraw each their staked tokens (stETH) and any earned staking rewards they might have earned.

Based on IntoTheBlock’s publication by Pedro Negron, permitting customers to withdraw their staked tokens simplifies the staking course of, making it extra interesting to potential customers. There are a number of fascinating metrics following the Shanghai upgrades as summarised beneath:

117,261 ETH price $234 million at present charges, has been deposited into staking over the past 24 hours, in line with knowledge from Nansen.

Accounting for withdrawals made prior to now 24 hours, the online stability of staked Ether is -71,166 ETH.

There are 850,536 ETH at present within the queue ready to be processed for the total exit.

17,304,039 ETH are at present actively validating the community with a complete of 18,597,079 ETH on the Beacon Chain together with rewards.

Lido is the second largest platform engaged in Ether staking at 25%, after others categorized as impartial stakers coming in first place at 30.6%, adopted by Coinbase, Kraken, and Binance respectively.

63.3% of the ETH ready to be withdrawn by entities belongs to Kraken.

Observe that solely validators which have supplied 0x01 credentials are eligible to course of full and partial withdrawals. Thus monitoring the variety of validators with 0x01 credentials permits the info analytics platform to trace the variety of validators ready to withdraw within the close to future.

Due to this fact, 83.2% of Validators with 0x01 withdrawal addresses have up to date their 0x01 credentials. 16.8% haven’t up to date to allow them to’t be thought of for withdrawals but.

The profitable implementation of this improve has doubtless boosted investor confidence in Ethereum’s future prospects, resulting in elevated demand and better costs for ETH.

Ethereum Worth Crosses Above $2,000 – Is $3,000 Subsequent?

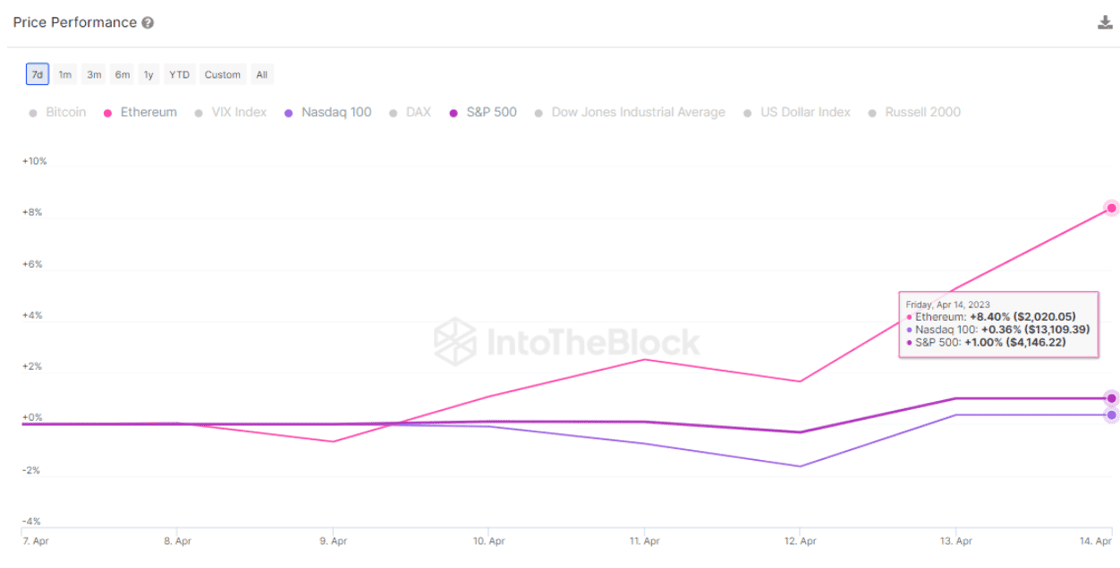

Ethereum climbed above $2,000 on April 13, ranges final seen in Could 2022. Information from IntoTheBlock reveals that the 30-day correlation between the Nasdaq 100 and ETH has decreased over the past week from 0.88 to 0.64.

Ethereum-Nasdaq Correlation

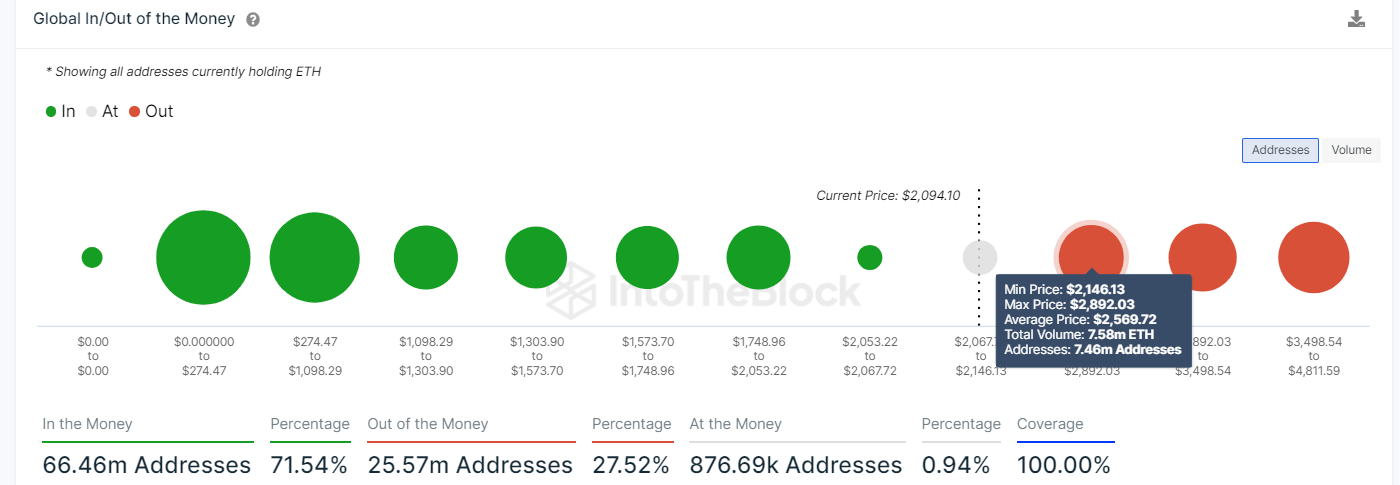

Because of the latest value surge, 71.54% of addresses at the moment are holding worthwhile positions. Based on IntoTheBlock’s World In/Out of the Cash (GIOM) mannequin, the following important degree at which numerous addresses have traded lies inside the vary of $2,146 to $2,892.

Ethereum GIOM Chart

That is the place roughly 7.58 million Ether have been beforehand purchased by roughly 7.46 million addresses. These suppliers might stifle Ethereum’s uptrend in the event that they choose to take income both at present costs or when the worth reaches this provide zone.

This provider congestion zone coincided with a major liquidity zone stretching from $2,150 and $2,900 as seen on the day by day chart beneath. This space was a significant roadblock for the Ethereum value.

ETH consumers have been required to beat a lot of boundaries sitting inside this area, beginning with rapid resistance supplied by the decrease restrict of the liquidity zone at $2,150. Extra roadblocks emerge from the $2,500 psychological degree, after which the $2,800 barrier.

Above that, Ethereum value could rise to achieve $3,000. Such a transfer would symbolize a 44.16% uptick from the present value.

ETH/USD Day by day Chart

The up-facing shifting averages and the place of the Relative Power Index (RSI) within the constructive area validated the constructive outlook for Ethereum. The value energy at 70 urged that there have been extra ETH consumers than sellers who have been controlling the restoration,

Additionally supporting the constructive narrative for the Ethereum value was the TRIN (Arms) index which was valued at 0.87. This worth was beneath 1, suggesting that there have been extra consumers than sellers out there.

Furthermore, each the GIOM mannequin and the day by day chart above confirmed that Ethereum loved strong assist on the draw back, in comparison with the resistance it confronted on its approach up.

On the day by day chart, these have been areas outlined by the 50-day Easy Transferring Common (SMA) at $1,760, the 100-day SMA at $1,670, and the 200-day SMA at $1,483.

These assist areas are strong sufficient to soak up any promoting strain threatening to drag the Ethereum value decrease.

However, the overbought circumstances displayed by the RSI implied that the present correction might be prolonged to areas round $1,900. Merchants might count on ETH to take a breather right here earlier than making one other try at restoration.

Noteworthy, the following main improve that’s coming for the now proof-of-stake Ethereum community is Ethereum Enchancment Proposal (EIP) 4844 (known as Proto-danksharding. This replace is geared toward addressing two crucial points for the blockchain: bettering transaction velocity and lowering transaction prices.

These are important points that have to be addressed to attain scalability and allow the Layer 1 blockchain to deal with a better quantity of transactions. Because the community continues to evolve, these upgrades will play a major position in enhancing the general performance and usefulness of the Ethereum blockchain.

Promising Options To ETH

It’s anticipated that the Shapella Ethereum improve will proceed to draw extra buyers to put money into ETH, with hopes of capitalizing on the features to $2,000 to push the worth to $3,000. Nonetheless, buyers could need to discover a number of the finest altcoins with promising returns for optimum portfolio diversification alternatives.

One among these is Love Hate Inu’s presale, which has raised $4.38 million since its launch lower than a month in the past, promoting LHINU tokens in levels 1, 2, 3 and 4 of the presale.

Hey #LoveHateInu Gang!👋🏼

Our #Presale elevate has surpassed $4.3 million!🤑🎉

Thanks a lot to all our voters and future creators!🙏🏼

Be part of us as we speak and change into part of the most effective #MemeCoin ever!💯

Get your self some $LHINU and solid your vote!🗳️💰https://t.co/Pu2Bo8WOUy pic.twitter.com/pVfW69BNPN

— Love Hate Inu (@LoveHateInu) April 17, 2023

Final week, Love Hate Inu revealed Carl Dawkins – advisor to the UK All Celebration Parliamentary Group on Crypto and Digital Belongings, identified for his success with the highest 10 ranked meme coin Tamadoge, as CEO after the elevate crossed the $3 million mark.

With the elevate at present above $4 million, it really reveals the excessive degree of curiosity buyers have within the first-ever meme coin primarily based on a vote-to-earn (V2E) mannequin that lets customers vote on a variety of points, incomes crypto within the course of.

Love Hate Inu is a top-of-the-line voting token with the flexibility to permit everybody, with out the worry of judgement or prejudice, to precise their opinions on vibrant subjects—and whereas doing so, they’ll earn rewards and eek a residing.

Go to Love Hate Inu right here for extra particulars on easy methods to take part within the presale.

Associated Information:

Be part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link