[ad_1]

Be a part of Our Telegram channel to remain updated on breaking information protection

In response to the broader startup downturn, Sequoia Capital, a number one enterprise agency in Silicon Valley, is scaling again funds allotted for startups, together with cryptocurrency ventures.

The agency is taking this measure to deal with previous extreme spending throughout its enlargement part and navigate the challenges it confronted underneath the management of latest CEO Roelof Botha, who took over from Doug Leone in April 2022.

This strategic transfer goals to make sure the corporate’s sustainability amid the prevailing setbacks within the startup ecosystem.

Cryptocurrency Fund Minimize from $585 Million to $200 Million

Sequoia Capital’s cryptocurrency fund and ecosystem fund have skilled important reductions, with the previous being halved from $585 million to $200 million and the latter from $900 million to $450 million, as reported by the Wall Road Journal.

Though the enterprise agency didn’t formally disclose these particulars, it knowledgeable buyers in March 2023 about adjusting the funds to raised align with the evolving market circumstances.

The cryptocurrency fund was initially designed to assist younger startups that had been impacted by the crypto winter triggered by FTX and the following decline in total crypto curiosity.

Sequoia Capital’s transfer to scale back the funds got here forward of experiences that crypto buyers had departed from the agency following modifications within the VC workforce, based on Bloomberg’s protection.

These changes mirror the dynamic nature of the cryptocurrency market and the efforts of enterprise corporations to adapt to the ever-changing panorama to offer optimum assist for startups within the crypto house.

Crypto buyers depart Sequoia Capital in VC workforce reshuffle: Bloomberg https://t.co/YzXswAuv9Q

— The Block (@TheBlock__) July 20, 2023

TA latest VC reshuffle at Sequoia resulted within the departure of 5 companions, together with crypto-investors Daniel Chen and Michelle Fradin.

The reshuffle was prompted by FTX’s decline, which inflicted a major lack of $213.5 million on Sequoia’s world progress fund, resulting in reputational harm for the agency.

This loss performed a task within the resolution of the 2 crypto buyers to go away the corporate.

Funds Minimize to Handle Worst Stoop of the Decade

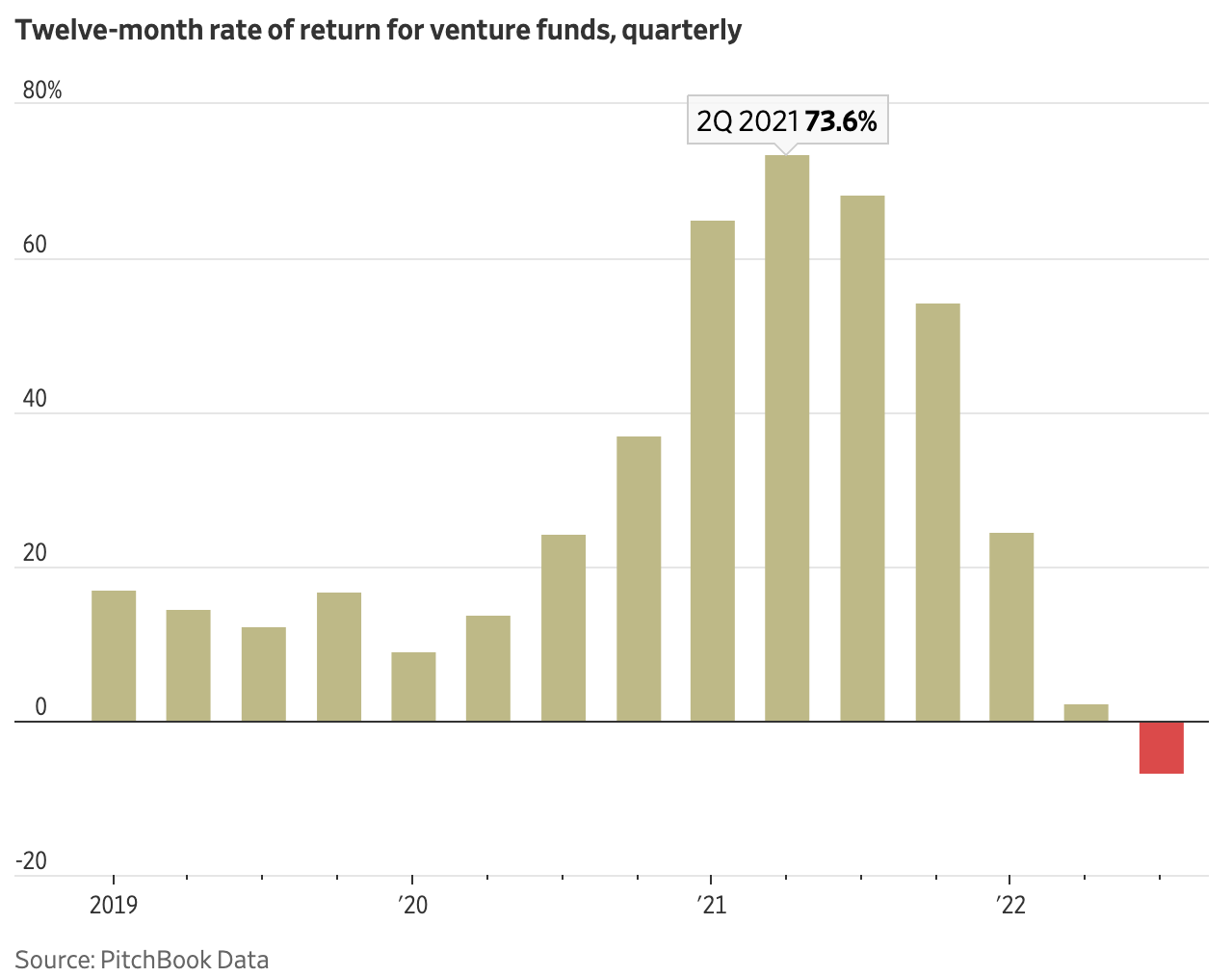

On March sixteenth, Wall Road Normal highlighted that Sequoia skilled a major return decline attributed to the startup downturn.

The damaging development endured for 3 consecutive quarters, as reported by Pitchbook Information.

The info revealed an inside price of -7% within the third quarter, marking the bottom determine since 2009. This decline signifies challenges for Sequoia in navigating the present market circumstances affecting startups.

Sequoia, as soon as optimistic about its technological developments, confronted setbacks as returns triggered fears amongst fund buyers, resulting in lowered publicity.

The agency’s aggressive investments in the course of the bull run, enabled by a brand new fund construction, precipitated excessive spending by restricted companions.

Nonetheless, the abrupt market crash of 2022 resulted in sub-par returns, inflicting worry and frustration amongst Sequoia’s stakeholders.

In response to the harm, the enterprise agency is now decreasing the investments required from its restricted companions, advising them to handle their expectations because the state of affairs could stay difficult earlier than enchancment.

Implications for Wider Crypto Market?

Sequoia, a as soon as optimistic enterprise agency, encountered setbacks amid market turbulence as returns fell wanting expectations, inflicting considerations amongst fund buyers and prompting a lower in publicity.

The agency’s aggressive investments in the course of the bull market, facilitated by a brand new fund construction, led to heightened spending by restricted companions. Nonetheless, the sudden market crash of 2022 resulted in sub-par returns, triggering worry and frustration amongst Sequoia’s stakeholders.

In gentle of the challenges confronted, Sequoia is now taking measures to mitigate the harm.

The agency is decreasing the funding necessities from its restricted companions and advising them to handle their expectations, because the state of affairs could stay tough earlier than displaying indicators of enchancment.

Associated

Wall Road Memes – Subsequent Large Crypto

Early Entry Presale Stay Now

Established Group of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Finest Crypto to Purchase Now In Meme Coin Sector

Workforce Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be a part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link