[ad_1]

The U.S. Securities and Trade Fee (SEC) alleged that Binance despatched a overseas affiliate of stablecoin issuer Paxos practically $20 billion of commingled funds in 2021, based on a declaration made by Sachin Verma, an Assistant Chief Accountant of the Fee.

In a June 7 courtroom submitting, Verma acknowledged that Binance and its CEO Changpeng Zhao managed a number of accounts on the defunct Silvergate and Signature Banks, which had been used to hold out varied transactions that concerned Zhao-owned firms.

Advantage Peak

The declaration alleges that Binance.US, beneath the identify BAM Buying and selling, and a number of other different Binance-related accounts despatched hundreds of thousands of {dollars} from accounts at Silvergate Financial institution to a buying and selling agency referred to as Advantage Peak Ltd.

Advantage Peak is a British Virgin Islands firm beneficially owned by Zhao. The submitting described the character of its enterprise as an OTC desk and proprietary buying and selling of digital belongings, and Silvergate closed its account in mid-2022.

Almost $20 billion despatched to Paxos’ overseas affiliate

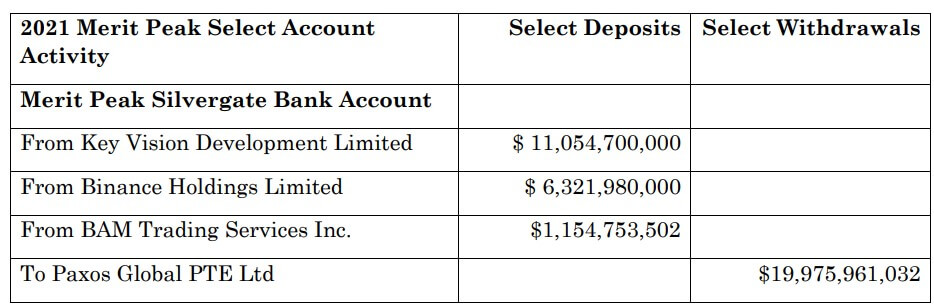

Earlier than the closure of the account, Verma acknowledged that “hundreds of thousands of {dollars} from Binance-related accounts had been commingled in Advantage Peak’s accounts” and was later transferred to a overseas affiliate of the stablecoin issuer, Paxos. The official stated:

“For instance, in 2021, funds from Key Imaginative and prescient ($11.05 billion), Prime Belief ($1.1 billion) (by way of BAM Buying and selling) and Bifinity UAB ($6.3 billion) (by way of Binance Holdings Restricted) had been transferred to Advantage Peak and Advantage Peak transferred all of that cash as a part of its transfers of virtually $20 billion to a overseas affiliate of Paxos in 2021.”

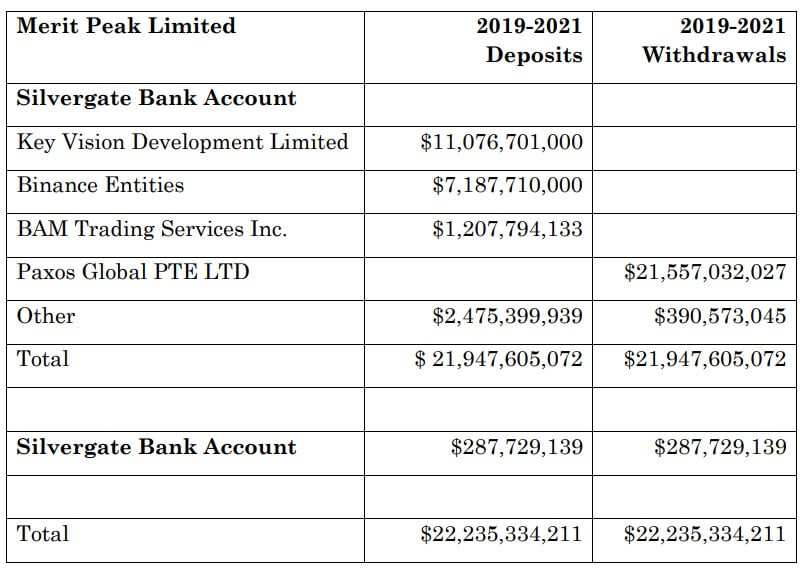

A better take a look at the accounts’ transactions between 2019 and 2021 confirmed that Advantage Peak obtained $22 billion from a number of Binance-related accounts, together with $1.2 billion from Binance US. Throughout this era, the buying and selling agency transferred $21.6 billion to this overseas affiliate of Paxos.

This declaration corroborates earlier reviews that acknowledged that Binance had commingled customers’ funds in financial institution accounts at Silvergate Financial institution.

Binance has persistently maintained that the reviews had been false however was but to answer CryptoSlate’s request for extra commentary as of press time.

In the meantime, Paxos is the issuer of Binance USD (BUSD) stablecoin. In February, New York regulators ordered the stablecoin issuer to cease different mints of BUSD. Binance and Paxos have additionally rejected the SEC’s classification of BUSD as a safety.

Paxos has not responded to CryptoSlate’s request for remark as of press time.

The publish SEC alleges Binance despatched Paxos practically $20B in commingled funds by way of Advantage Peak in 2021 appeared first on CryptoSlate.

[ad_2]

Source link