[ad_1]

This story comes from GG. Your Web3 Gaming Energy-Up

Uncover GG

Sabastien Borget, co-founder and Chief Working Officer of The Sandbox, responded at this time to the bombshell lawsuits filed towards two main crypto exchanges this week—and addressed the impression of its SAND token doubtlessly working afoul of U.S. securities legal guidelines.

The USA Securities and Change Fee (SEC) ramped up its crypto enforcement this week, focusing on main exchanges Binance and Coinbase with lawsuits on back-to-back days. As a part of the motion, a slew of tokens has been named by the SEC as unregistered securities—together with SAND from the Sandbox metaverse recreation.

SAND was amongst dozens of cryptocurrencies and tokens that the company recognized as such this week, becoming a member of different notable cash like Solana (SOL), Polygon (MATIC), and Cardano (ADA), together with the AXS governance token of fellow NFT recreation Axie Infinity and Decentraland’s MANA token.

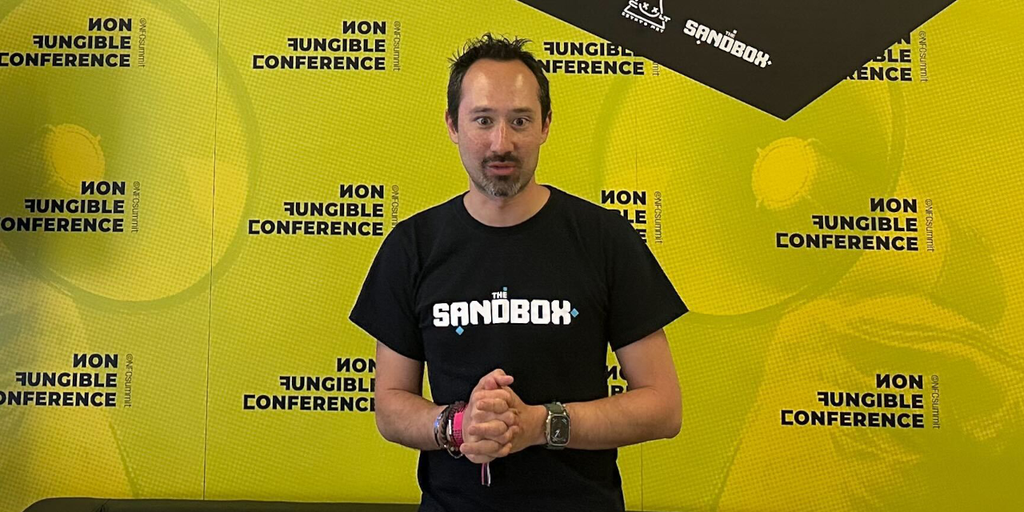

“We’re clearly conscious of the litigation superior towards Binance and Coinbase within the U.S. from the SEC,” Borget mentioned throughout a press occasion on the Non Fungible Convention (NFC) in Lisbon. “We don’t essentially agree with the characterization that’s been put in that litigation, together with the qualification of SAND as a safety there.”

Borget added that The Sandbox’s token has “been named,” however added that the staff is “not ourselves instantly topic to litigation.”

“This doesn’t change our enterprise on a day-to-day foundation,” he added.

Whereas the SEC’s fits towards the exchanges arrived in tandem, on Monday and Tuesday respectively, its expenses towards Binance and Coinbase range.

Binance was focused for allegedly providing and promoting unregistered securities, not limiting entry by United States-based customers to its worldwide alternate, and working an unregistered alternate, dealer, and clearing company. Coinbase, in the meantime, was additionally sued for that final allegation, together with allegedly working staking providers that present interest-like earnings for token holders.

The strikes got here amid a broader U.S. crackdown on crypto corporations led by SEC Chair Gary Gensler, who informed CNBC on Tuesday, “We don’t want extra digital foreign money.”

The Sandbox is an Ethereum-based metaverse recreation that lets customers personal and customise land plots (bought as distinctive NFTs), together with avatars and different in-game content material, in a free-to-play recreation that also has but to launch absolutely. The SAND utility token is used for purchases together with options like decentralized governance voting.

Over the previous few years, The Sandbox has inked partnerships with a whole bunch of celebrities and types which can be constructing inside the world, together with rapper Snoop Dogg, entertainer Paris Hilton, Warner Music Group, online game writer Ubisoft, skateboarder Tony Hawk, attire model Adidas, and leisure model The Strolling Lifeless.

Regardless of the regulatory risk, Borget emphasised at NFC Lisbon that “the U.S. remains to be an necessary marketplace for The Sandbox,” highlighting that the sport has seen roughly one-third of its customers come from the nation.

He added that the idea of a decentralized recreation world through which customers can personal belongings and contribute recreation content material is “an necessary mission that ought to go on.”

Keep on prime of crypto information, get each day updates in your inbox.

[ad_2]

Source link