[ad_1]

Fast Take

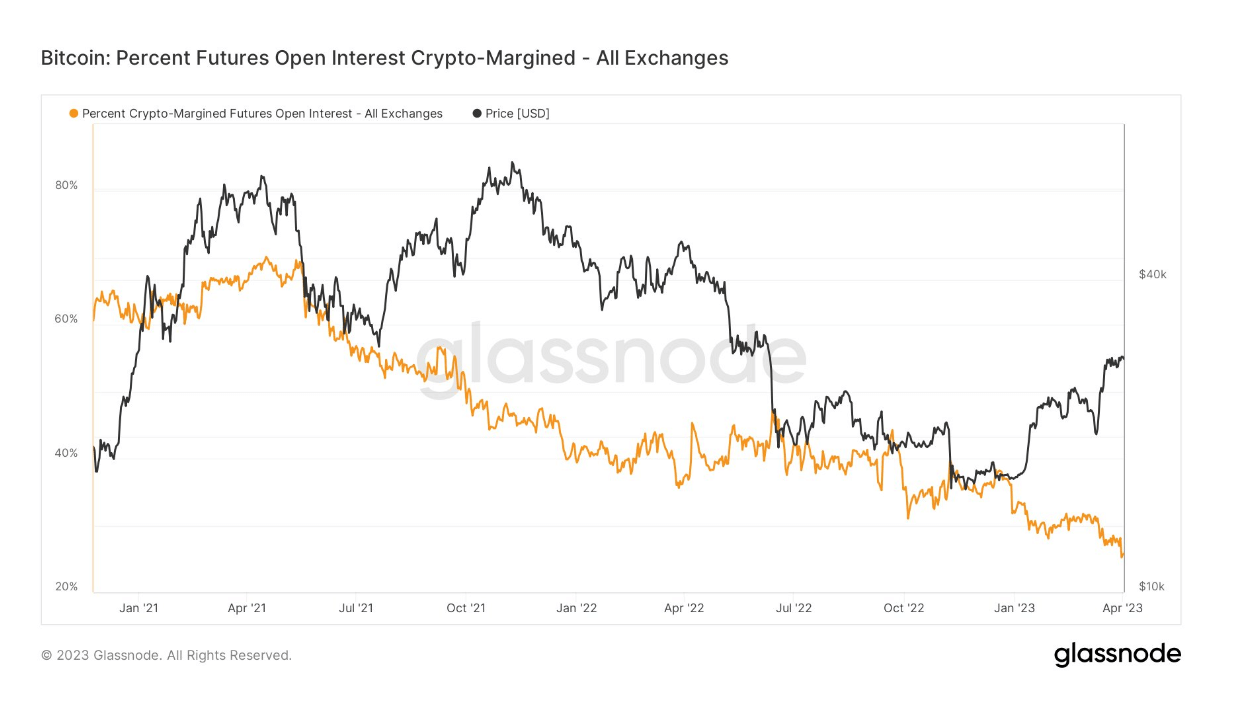

Within the first-quarter assessment of derivatives, CryptoSlate confirmed that futures open curiosity had hit a one-year low.

We are able to break this knowledge down additional. At present, the allocation of Bitcoin to futures open contracts is 361,000 BTC.

Whereas allocation through crypto-margin, i.e., utilizing the native coin (Bitcoin), is 92,000 BTC.

This places the share when it comes to futures contracts at roughly 26%, which could be seen trending down from the highest of the 2021 bull run in January, beginning at 64%.

The opposite 75% allotted in futures contracts is used through stablecoins or USD. As these devices aren’t risky, there may be much less threat than utilizing a margin corresponding to Bitcoin because of its volatility.

It is a sign that risk-on urge for food has evaporated, and we anticipate this ratio to proceed to play out into the brief time period.

The submit Threat-off sentiment evident as crypto-margin plummets to all-time low appeared first on CryptoSlate.

[ad_2]

Source link