[ad_1]

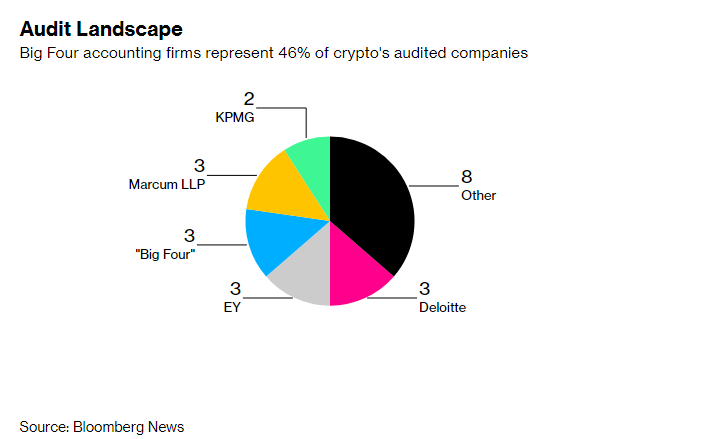

Most of the most well-known crypto companies are usually not adhering to fundamental governance requirements, the findings of a Bloomberg survey have proven. Solely 31 out of the 60 polled companies “at present procure a full monetary audit or reserve attestations from an impartial auditor.” Trade members have mentioned many crypto companies are usually not audited as a result of the “Huge 4” accounting companies are usually not keen to have them as shoppers.

Many Crypto Companies Lack Unbiased Boards

Among the most influential cryptocurrency companies are usually not adhering to established company governance requirements and plenty of others are believed to be working exterior the norm, a Bloomberg research has discovered. The research additionally discovered that out of the 60 crypto business companies that had been polled, about 10 corporations didn’t have a board with at the least one non-executive director.

In accordance with the research report, Tether, Huobi and Magic Eden are amongst these companies with out impartial firm boards. In cases the place a board really exists, the report mentioned these had been both advisory in nature or primarily comprised of firm executives, therefore they can’t move as impartial boards. Binance, the biggest cryptocurrency alternate by quantity traded, is ready to have a proper board in place by the tip of the yr, the report mentioned.

Though many buyers in crypto companies are mentioned to be insisting on elevated transparency and accountability following crypto alternate FTX’s collapse, the Bloomberg research discovered that simply over half (31) of the companies “at present procure a full monetary audit or reserve attestations from an impartial auditor.” Then again, the findings confirmed that the audit standing of some 22 out of the 60 corporations is unknown. Solely seven corporations mentioned they weren’t audited.

Blockchain Expertise’s Enchantment Mentioned to Be Undermined by Opaqueness of Crypto Companies

In the meantime, Ruth Foxe Blader, a companion at enterprise capital agency Anthemis, is quoted within the report lamenting the crypto business’s opaqueness which contradicts the blockchain expertise’s promise of transparency and tamperproof record-keeping.

“It’s an business of anonymity that’s masquerading as transparency,” Blader reportedly mentioned.

Blader argued that crypto companies ought to be subjected to the identical fundamental requirements — akin to audits and impartial boards — as different companies, as a result of that’s what any investor would count on, notably for a corporation working within the monetary providers business.

Whereas the research findings paint an image of an business whose members are unwilling to be audited, some have mentioned the true challenge is the so-called Huge 4 accounting companies’ reluctance to tackle crypto companies as shoppers. This argument is seemingly backed by the France-based accounting group Mazars Group’s choice to cease vouching for reserves held by crypto exchanges. As reported by Bitcoin.com Information, Mazars Group ended providing such providers in Dec. 2022 after citing considerations in regards to the public’s understanding of such experiences.

In the meantime, the specialists quoted within the Bloomberg report have warned that with out an intensive regulatory framework in place, the crypto business members is not going to be inclined to do extra to appease buyers and shoppers which might be mentioned to be demanding higher transparency.

What are your ideas on this story? Tell us what you assume within the feedback part under.

[ad_2]

Source link