[ad_1]

Amidst the fixed worth swings and uncertainties that plague the crypto market, stablecoins have turn out to be a useful asset for traders and merchants. Nonetheless, analysts have revealed a number of stablecoins which were struggling to take care of the esteemed stability reserved for a lot of these belongings.

Stablecoins Below Stress

The inherent volatility of the crypto market and the persistent worth fluctuations of cryptocurrencies are a relentless expertise within the crypto trade. On account of this, stablecoins like USDT, USDC, and DAI have lengthy been revered as a dependable bridge between the volatility and instability of cryptocurrencies.

Nonetheless, a latest report has raised considerations in regards to the stability of among the hottest stablecoins. The report noticed analysts from S&P International discover the highest 5 stablecoins together with Tether (USDT), Dai (DAI) Binance USD (BUSD), USD Coin (USDC), and Paxos (USDP).

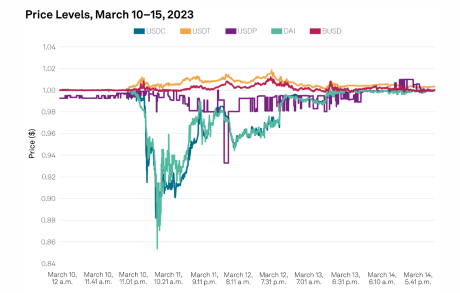

The analysis paper from Dr. Cristina Polizy, Anoop Garg, and Miguel de la Mata revealed that USDC and DAI have failed to take care of their greenback peg a number of instances within the final two years, as in comparison with different stablecoins like USDT and BUSD.

The evaluation revealed that the de-pegging occasions for USDC and DAI have taken place extra typically than these of USDT and BUSD. Circle’s USDC was named because the stablecoin with probably the most extended de-pegging occasion, dropping to $0.90 for 23 minutes whereas DAI de-pegged for 20 minutes.

USDC de-depegged for the longest period | Supply: S&P International

In distinction, USDT dropped beneath the one-dollar peg for only one minute, whereas BUSD has not skilled any de-pegging occasion since June 2021 and June 2023.

Attainable Instigations For Stablecoin De-pegging Occasions

March 2023 noticed the autumn of three distinguished banks in the USA, together with Silicon Valley Financial institution (SVB), Silvergate Financial institution, and Signature Financial institution. As a result of affiliations of those banks with the crypto trade, their collapse had a big affect on the costs of digital belongings within the house.

Circle’s USDC skilled a decline of 13% beneath the one-dollar mark after studies revealed that a good portion of Circle’s money reserves, including as much as $3.3 billion, had been saved in Silicon Valley Financial institution (SVB). Nonetheless, the stablecoin has since recovered and maintained its peg following an announcement that confirmed that the Federal Reserve would endorse the banks’ collectors.

Subsequently, Michael Barr, a high-ranking official at the USA Federal Reserve raised considerations in regards to the adoption price of unregulated stablecoins like USDT and USDC, that are at present the highest stablecoins by market capitalization.

Because the broader crypto market watches carefully for extra discrepancies within the stablecoin greenback peg, monetary companies like PayPal, have launched their very own stablecoins.

Outstanding platforms like Binance, and Huobi are already incorporating the brand new PYUSD into their crypto portfolio. As well as, financial establishments like Visa are profiting from stablecoins like USDC to propel growth into new markets.

USDC market cap sitting at $26 billion | Supply: Market Cap USDC on Tradingview.com

Featured picture from StormGain, chart from Tradingview.com

[ad_2]

Source link