[ad_1]

The cryptocurrency business has skilled a big downturn within the final 18 months resulting from issues about excessive inflation and its impression on funds. Nonetheless, there’s proof of accelerating institutional adoption of Bitcoin (BTC) amid these difficult market circumstances.

Adoption Of Bitcoin Amongst High Fintech Firms

Outstanding fintech firms have amassed substantial quantities of BTC over the previous three years, as revealed by a current report. Notably, Microstrategy’s BTC purchases quantity to almost $4 billion, regardless of the present BTC worth being 55% decrease than its all-time excessive (ATH). Different notable firms like Tesla, Block (previously Sq.), and Galaxy Digital Holding have additionally demonstrated dedication to retaining their Bitcoin holdings regardless of the market’s inherent volatility.

The report additionally highlights that sure regulatory uncertainties have hindered some prime firms from adopting Bitcoin. However nonetheless, current filings by famend asset administration companies point out a optimistic sentiment in direction of this digital gold, reflecting a bullish momentum.

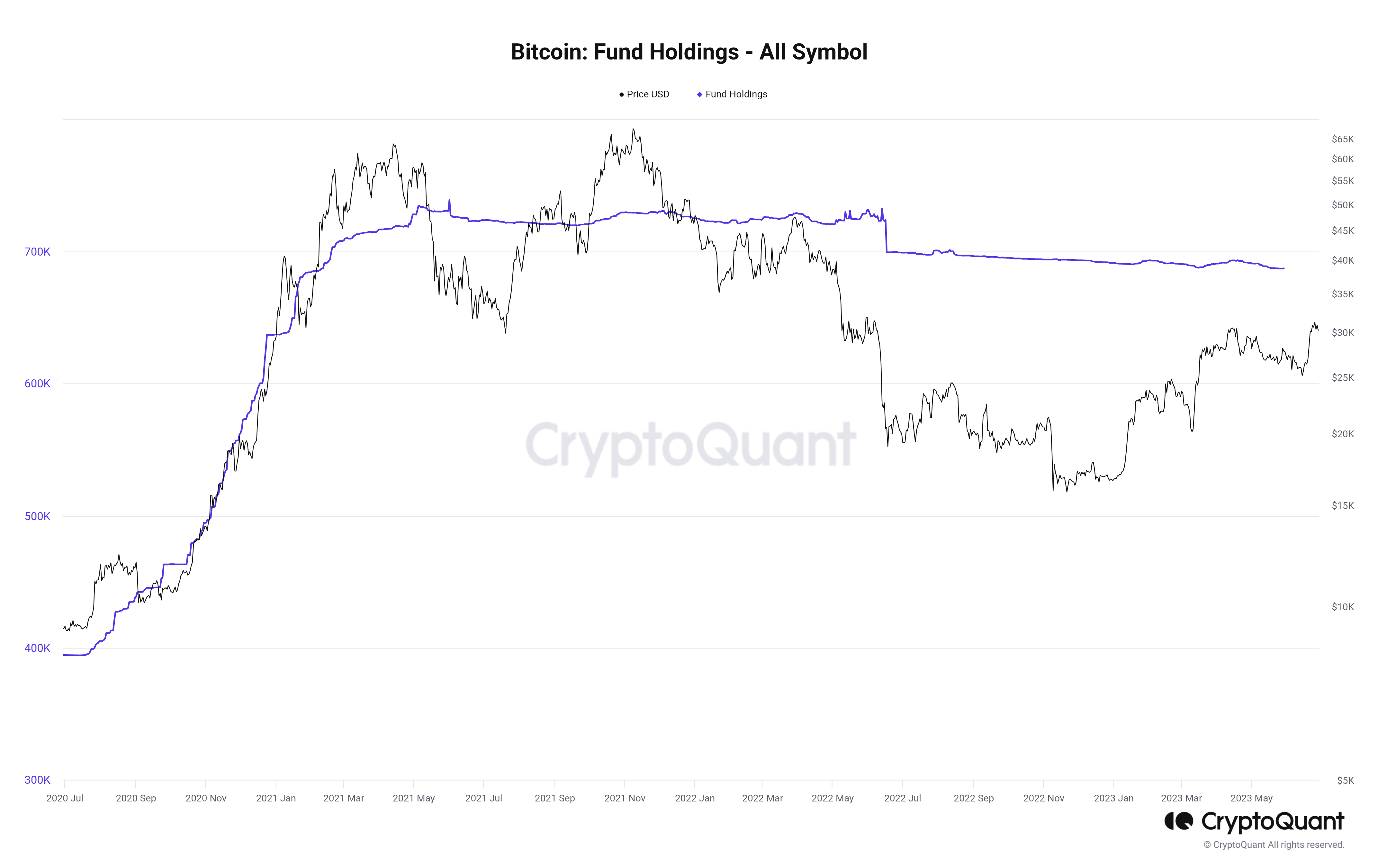

CryptoQuant chart reveals that the forthcoming wave of institutional adoption of BTC could not solely profit the businesses themselves but in addition have a big impression on their purchasers.

Spot Bitcoin ETFs Generate Investor Curiosity

The embrace of Bitcoin’s futures exchange-traded funds (ETFs) by the US Securities and Change Fee (SEC) in late 2021 triggered the entry of main gamers into the digital asset business, main others to push ahead and file for Spot Bitcoin ETFs.

Esteemed firms resembling BlackRock, Constancy, Citadel, Charles Schwab, and even Nasdaq have entered the fray. As monetary consultants analyze the state of affairs, they provide precious recommendation to traders searching for to capitalize on this evolving panorama.

On Wednesday, the worth of bitcoin surpassed the $30,000 mark, pushed by rising optimism surrounding spot BTC ETF purposes submitted by business giants like BlackRock, WisdomTree, and Valkyrie.

Nonetheless, whereas BTC has witnessed a outstanding 80% surge in worth in 2023, it nonetheless stays greater than 50% beneath its peak in November 2021.

Presently, US traders have entry to bitcoin futures ETFs, which contain investing in futures contracts of BTC—agreements to purchase or promote the asset at a predetermined worth sooner or later. However the long-awaited introduction of bitcoin spot ETFs would allow direct funding within the digital foreign money itself, marking a big growth available in the market.

Concerns For Buyers Amid Prospects Of BTC Spot ETFs

The potential introduction of a bitcoin spot exchange-traded fund (ETF) has raised expectations for elevated accessibility to the digital foreign money, enabling traders to purchase and promote bitcoin by way of a brokerage account. Nonetheless, you will need to method this growth with warning and thorough consideration, as emphasised by monetary consultants.

Whereas the prospect of simpler entry could also be engaging, it’s important to train prudence and keep away from speeding into investments with out correct analysis.

Featured picture from iStock, charts from TradingView.com

[ad_2]

Source link