[ad_1]

Amidst the crypto market’s battle to maintain bullish momentum, enterprise capital funding within the crypto house reached an all-time low in June, elevating $520.1 million throughout 84 funding rounds, in response to RootData. It is a lower of 23.11% in comparison with the month of Could.

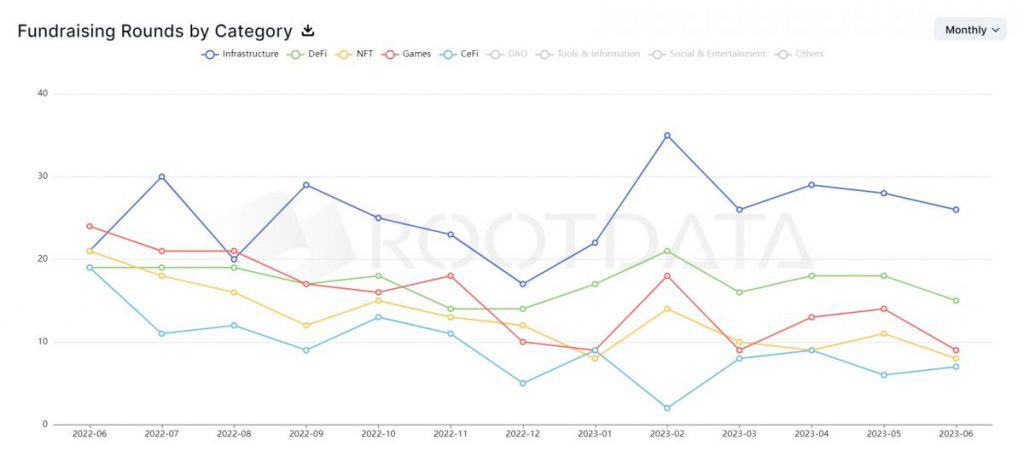

In February, the crypto fundraising panorama reached its peak this yr, with a complete of $947 million raised via 123 funding rounds. Nonetheless, since then, there was a constant decline in fundraising actions inside the crypto business.

Whereas funding quantity has declined throughout all classes within the crypto house, RootData exhibits that infrastructure has emerged because the main funding vacation spot for VCs with over $210 million raised throughout 26 rounds in June.

Within the final 30 days, decentralised machine studying compute protocol Gensyn, Legendary Video games, One Buying and selling, and Galaxy Finance are amongst the highest 10 corporations which have raised essentially the most funds in Collection A, B, and C1 rounds. Gensyn led with $43 million raised in Collection A as VCs search to capitalize on machine studying and cloud infrastructure amidst the AI frenzy. Notably, Thai cryptocurrency alternate Bitkub raised $17.8 million at a valuation of $193 million.

Funding in CeFi tasks noticed the most important decline over the previous six months, going from $369 million in December to $101 million in June. The gaming and DeFi sectors additionally noticed a gentle decline in funds raised.

Unsurprisingly, the NFT house has been seeing the bottom quantity of funding since Oct 2022 with $12.3 million throughout 8 rounds in June. This displays a wider cooldown within the NFT market as the ground value of blue-chip tasks comparable to Bored Ape Yacht Membership plummeted to a 20-month low of beneath 30 ETH on Sunday. Final week, Azuki mother or father firm Chiru Labs, noticed the ground value of its new assortment, Elementals, dip under challenge value inside 24 hours after launching.

[ad_2]

Source link