[ad_1]

Based on the newest report by Messari, Avalanche (AVAX) has proven a robust rebound within the first quarter of 2023. The market cap of the blockchain platform elevated by 65.8% quarter on quarter (QoQ), reflecting the broader market pattern and the thaw of the crypto winter that took by storm the crypto trade in 2022.

Avalanche’s Q1 2023 Efficiency

Based on the report, Avalanche skilled a decline in each day common lively addresses and transactions throughout Q1 2023. The 20.7% and 31.9% decline adopted an anomalous spike and a excessive development interval of subnet exercise in This autumn.

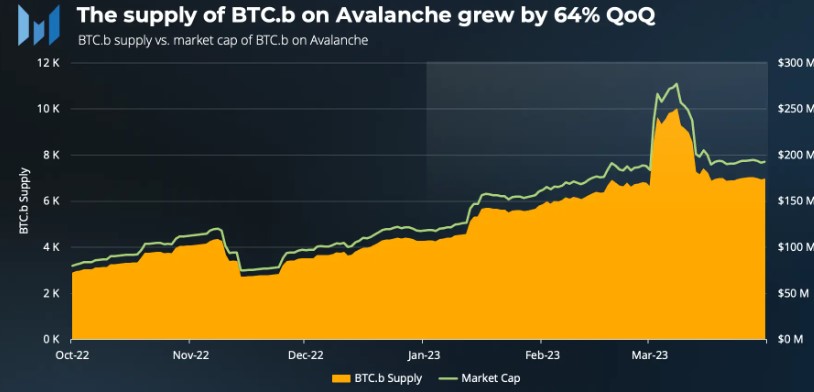

Nevertheless, the report additionally highlights that Avalanche’s provide of Bitcoin BEP2, a token on the Binance chain (BTC.b), elevated by 64% throughout Q1, reaching over $250 million in market cap. This can be a constructive signal for the platform’s development and demonstrates the rising curiosity in Avalanche as a blockchain platform.

The report additional notes that mainstream curiosity in Avalanche community infrastructure continued to develop throughout Q1, with partnerships with blockchain companies (AWS) and Tencent Cloud, a safe, dependable, and high-performance cloud computing service. This demonstrates the rising recognition of Avalanche as a significant participant within the blockchain area.

As well as, Avalanche launched a number of notable developments throughout Q1 geared toward ushering in builders. These embrace the launch of HyperSDK, Glacier API, and integration with The Graph. These developments are anticipated to extend the adoption of Avalanche as a blockchain platform and appeal to extra builders to construct on the platform.

The Avalanche Impact

Based on Messari, Avalanche’s Whole Worth Locked (TVL) denominated in USD elevated by 4.2% QoQ in Q1 2023, following the crypto market reduction rally in January. Nevertheless, TVL denominated in AVAX declined by 34.3%, suggesting that the rise in USD was as a result of asset value will increase slightly than new capital influx.

Regardless of this decline, liquid staking derivatives (LSDs) and yield farming platforms supported Avalanche and its DeFi ecosystem. Benqi liquid staking TVL grew by 88.6% QoQ to $100 million by the top of Q1, and Vector Finance, a yield optimization platform, elevated by 50% QoQ to $36 million. Collectively, these two protocols completed Q1 within the prime 10 by TVL, with ~$136 million in TVL.

Avalanche’s most distinguished protocol by TVL denominated in USD, Aave, was down barely 5% QoQ, however Benqi Lending, Dealer Joe, and GMX grew by 49%, 24%, and 70%, respectively. Nevertheless, there remained focus threat within the main software, with Aave making up 43% ($432 million) of Avalanche’s DeFi TVL by the top of Q1.

Avalanche Validators Present Volatility

Based on the report, Avalanche’s community well being remained secure in Q1 2023, with the common variety of validators, whole stake, and common engaged stake remaining constant. Nevertheless, the common variety of delegators grew by 26.1% QoQ, indicating rising participation within the community.

Regardless of the soundness of stake throughout a larger variety of validators and delegates, there was some volatility within the variety of validators that went offline throughout Q1. Each the common quantity of unresponsive stakes and the variety of unresponsive validators elevated by over 70% QoQ. Nevertheless, the share of unresponsive stakeholders and validators remained excessive sufficient to maintain block manufacturing.

General, the Messari report signifies that Avalanche’s community well being remained secure in Q1 2023, with constant numbers of validators, whole stake, and common engaged stake. The expansion within the variety of delegators additionally suggests rising participation within the community.

Whereas there was some volatility within the variety of validators that went offline throughout Q1, the share of unresponsive stakes and validators remained excessive sufficient to maintain block manufacturing. These findings reveal the continued development and resilience of the Avalanche community and its potential for additional growth and adoption within the blockchain area.

Featured picture from Unsplash, chart from TradingView.com

[ad_2]

Source link