[ad_1]

Polygon worth has been in a freefall for the previous few days, dropping under the essential assist stage of $0.95. The altcoin has dipped almost 9% over the previous week and 13% previously 4 days. The asset is up by 15.20% within the 12 months up to now. Polygon’s market cap has crashed to $8 billion over the previous few days, whereas its whole quantity fell additional. The asset at present ranks because the tenth largest cryptocurrency by market cap, after Solana and forward of Polkadot.

Polygon worth has been below immense strain for the previous few weeks, dipping greater than 43% from its highest stage this 12 months in February. At press time, the asset was buying and selling 2.91% decrease at $0.8750. The asset’s selloff has been intricately linked to the latest dip within the world crypto market cap.

Information by Coinmarketcap reveals that the worldwide crypto market cap has crashed to $1.14 trillion over the previous few days, whereas the full crypto market quantity decreased by 27.86% during the last day. Bitcoin’s latest dip under the essential assist stage of $28,000, has additionally seen the MATIC worth plunge. Bitcoin, the most important digital asset by market cap, has been altering arms at $27,500 over the previous few days amid congestion on the asset’s community.

Binance, the most important cryptocurrency alternate, lately halted the withdrawals of the BTC token briefly because of congestion on the blockchain. The congestion additionally resulted in a surge in transaction charges, the very best since 2017. These occasions noticed the Bitcoin worth plummet by greater than 8% previously few days.

Buyers shall be intently watching the US shopper worth index information for April, in addition to the producer worth index information, to gauge the financial outlook. The US Federal Reserve elevated its rate of interest by 25 foundation factors earlier final week, a transfer that didn’t largely have an effect on the crypto market as traders had already priced within the rate of interest hike. Even so, the Fed introduced that it was dedicated to attaining its 2% objective.

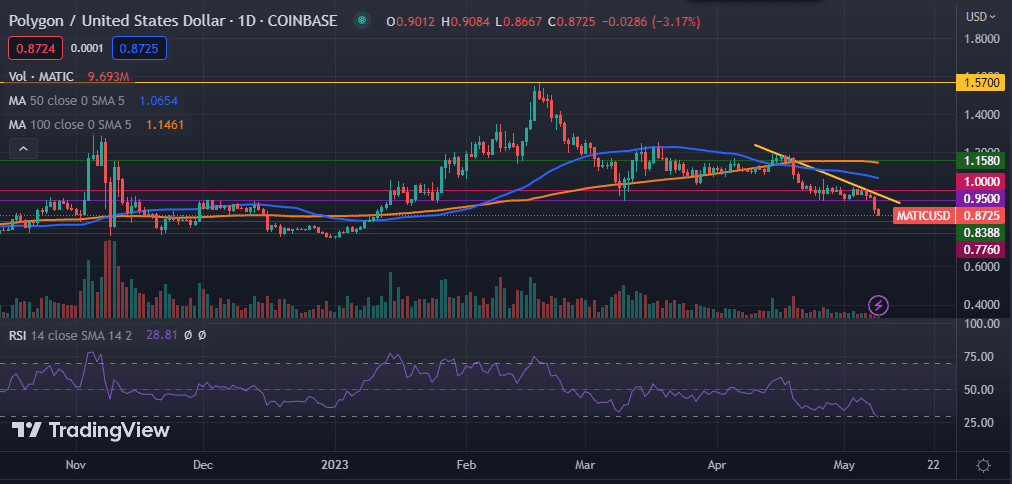

Polygon worth has been in a correction part for the previous two months, falling greater than 40% from this 12 months’s excessive of $1.57. As highlighted on the every day chart, the asset has remained under the 50-day and 100-day transferring averages, in addition to the 50-day and 200-day exponential transferring averages. It has additionally moved under the 50-day and 100-day easy transferring averages.

Its Relative Power Index (RSI) has moved decrease into the oversold area, suggesting a protracted selloff within the ensuing periods. The Shifting Common Convergence Divergence (MACD) indicator can be bearish.

Subsequently, I count on the Polygon worth to fall additional as bears eye the subsequent assist ranges at $0.8338 and $0.7760. Nevertheless, a transfer previous the necessary stage of $0.95 may create a brand new alternative for the bulls.

[ad_2]

Source link