[ad_1]

PEPE lately reached a brand new peak, pushed by the numerous hype surrounding Bitcoin Change-Traded Funds (ETFs). Nonetheless, because the preliminary pleasure surrounding ETFs subsided, Bitcoin (BTC) skilled a interval of fluctuation.

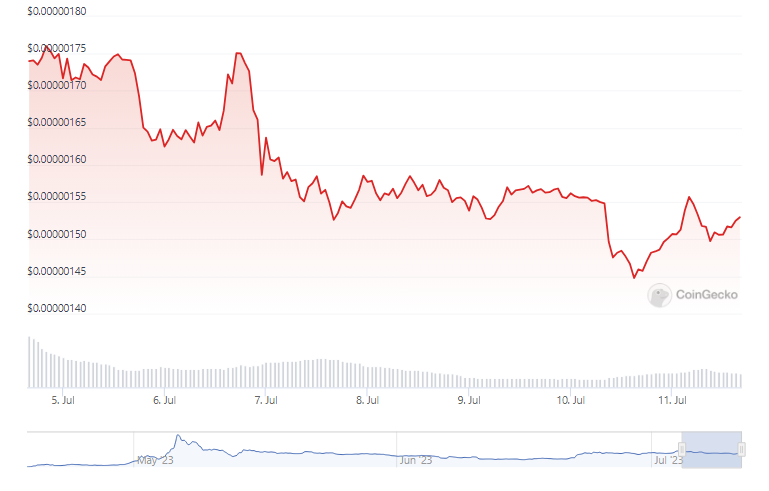

Notably, throughout this time, PEPE has been progressively making decrease highs. Amidst these fluctuations, it turns into important to look at the underlying components which have contributed to the declining pattern in PEPE’s worth perfomance.

Are there exterior market forces at play, or is it indicative of a broader shift within the cryptocurrency panorama? Moreover, how will this growth impression the longer term trajectory of PEPE and different cryptocurrencies?

PEPE Value Efficiency: From Highs To Fluctuations

PEPE lately reached a brand new excessive of $0.00000190. Nonetheless, its present worth on CoinGecko stands at $0.00000152, reflecting a modest 4.3% rally prior to now 24 hours. However, over the course of the final seven days, PEPE has skilled a big decline of 13%.

Technical indicators additional emphasize the shift in PEPE’s worth trajectory. A PEPE worth report highlights that numerous indicators have flashed promote indicators. Notably, the Relative Energy Index (RSI) has made decrease highs, indicating a decline in shopping for strain over the previous few days.

Furthermore, the On Stability Quantity has eased, suggesting a lower in demand, whereas the Common Directional Index (ADX) has dropped under 20, indicating a scarcity of a powerful pattern for PEPE.

These technical indicators trace on the challenges PEPE has confronted within the face of its current fluctuations.

Altcoins’ Large Pullbacks Amidst Bitcoin’s Prolonged Consolidation

In the meantime, Bitcoin (BTC) has entered a section of prolonged consolidation, with its worth fluctuating above the $30,000 mark for almost two weeks. This extended interval of stability, coupled with intermittent fluctuations, has had a cascading impact on the broader cryptocurrency market, resulting in important pullbacks in most altcoins, together with PEPE.

BTC’s standing because the main cryptocurrency makes its worth actions an important issue influencing the market sentiment and efficiency of different digital property. When Bitcoin experiences prolonged consolidation, traders and merchants typically train warning and turn out to be extra hesitant to make important strikes.

In consequence, altcoins, which depend on BTC’s stability and constructive market sentiment, are typically extra inclined to pullbacks and corrections.

The pullbacks in altcoins have been notable, with many experiencing substantial declines in worth throughout this era of Bitcoin’s consolidation. The excessive correlation between Bitcoin and altcoins like PEPE exacerbates the impression of the crypto’s fluctuations on their costs.

Because the alpha coin’s consolidation continues, carefully monitoring its worth actions and assessing the next impression on altcoins and meme cash like PEPE turns into paramount for market watchers.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing includes danger. Once you make investments, your capital is topic to danger).

Featured picture from PBS

[ad_2]

Source link