[ad_1]

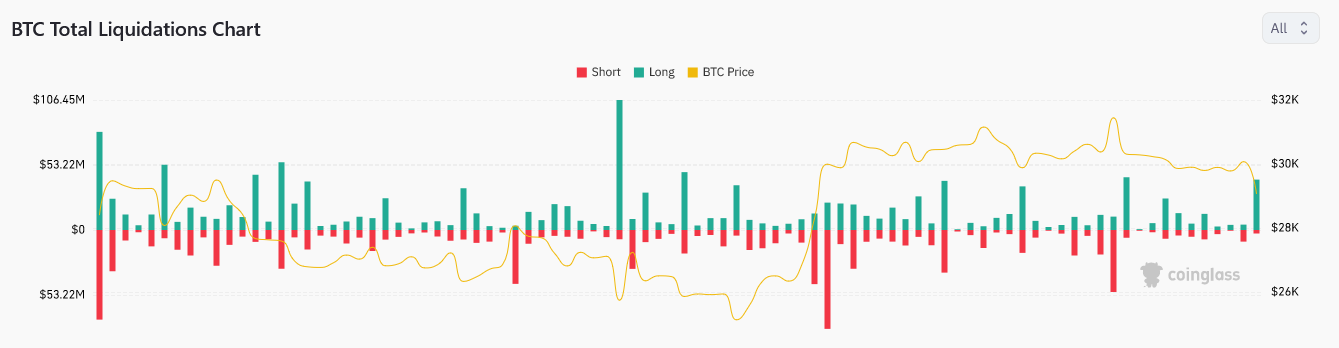

On July 24, 2023, Coinglass information revealed that over $41 million price of Bitcoin lengthy and quick leveraged positions have been liquidated because the BTC costs unexpectedly crashed under a consolidation stage of round $29,500, shrinking by over 4%. The drop under the first assist is heaping stress on the coin.

It could draw extra promoting stress in upcoming classes, pushing costs towards fast response strains, the subsequent being at about $28,300.

Bitcoin Drops, Over $41 Million Of Longs Liquidated

In crypto buying and selling, liquidation occurs the facilitating trade, for instance, OKX or Binance, forcibly takes over the collateral securing the leverage place at any time when costs transfer towards the dealer’s prognosis. On this case, the latest liquidation was triggered by the fast sell-off in Bitcoin, resulting in a greater than 4% value decline inside just a few hours throughout the New York Session on July 24.

Binance, the world’s largest crypto trade and a platform facilitating buying and selling crypto derivatives, liquidated most levered positions. Important liquidation quantities have been additionally noticed in ByBit and OKX.

An enormous chunk of liquidated positions have been “longs,” which means merchants anticipated costs to rise within the days forward. Coinglass stated over $41 million of cumulative lengthy positions have been closed. In the meantime, solely $2.5 million of quick positions have been closed regardless of Bitcoin plunging, shifting alongside the merchants’ value prediction.

Regardless of Bitcoin remaining in a bullish formation, costs have been shifting inside a consolidation, failing to breach the $31,800 stage recorded in mid-July 2023. Coinciding with this enlargement, a United States choose had dominated to favor Ripple Labs, saying XRP was not a safety, of their case towards the Securities and Change Fee (SEC).

Following this declaration, the broader crypto market edged increased, solely to chill off days later. Bitcoin has been no exception, as present value motion reveals.

Nonetheless, the collapse comes just a few days after the SEC accepted functions from main monetary establishments, together with BlackRock, a distinguished Wall Avenue big, to launch Bitcoin exchange-traded funds (ETFs). Information of BlackRock making use of for a Bitcoin ETF beforehand triggered a bull run, pumping costs to 2023 highs.

Bitcoin stays bullish as costs stay inside the leg-up established from June 15 to July 13. Despite the fact that basic components might assist costs, BTC could edge decrease ought to bulls fail to prop up costs and push them inside the consolidation of the higher half of July 2023.

Technically, a detailed above $31,800 and July 13 highs could drive the coin in the direction of the $36,000 zone and later $43,000 in a purchase development continuation formation. These are vital ranges from the Fibonacci extension ranges anchored on the latest leg-up from mid-June to mid-July.

Characteristic picture from Canva, chart from TradingView

[ad_2]

Source link