[ad_1]

Many individuals nowadays are lastly beginning to notice the shortcomings and limitations of off-chain channels restricted to 2 members, i.e. the Lightning Community, and the need to begin exploring designs for channels with greater than two members for this route in scaling to work efficiently in the long run. That necessitates accepting new trade-offs, particularly that the worth for fixing a few of Lightning’s current issues by packing greater than two folks right into a shared management association for a UTXO is the creation of a complete new class of issues.

The most important downside launched in making the transfer from two events to greater than two events is the interactivity requirement. In case you have 10 folks in a single channel sharing management of 1 UTXO, you want all 10 events on-line on the identical time to be able to replace the state of that base channel. This presents a a lot worse coordination downside than the present implementation of Lightning channels the place solely two folks must be on-line to utilize the channel.

At the moment one of the best considering relating to this difficulty is just to introduce belief into the state of affairs by means of what is basically a federation. Lightning (and future multiparty channel techniques) work as a self custodial system as a result of the multisig holding funds on chain is n-of-n, requiring 100% of the members to log off to alter the state of off-chain funds. Should you your self as a member to such an settlement refuse to signal a brand new replace, then it’s inconceivable in your funds to be reassigned in any method. Ignoring the requirement to remain on-line and watch the blockchain to take care of outdated states, this safety mannequin is equal to sole custody on the mainchain. Management of funds can’t be modified from the present state of issues with out your signature.

Lowering the important thing threshold from n-of-n to m-of-n fully undermines that safety equivalence to sole custody on-chain. It’s successfully custodial, in that your secret is not completely and non-negotiably required to be able to transfer management of your funds. ZmnSCPxj (not Zman!) has proposed an attention-grabbing answer to the interactivity downside.

OP_CHECKSEPARATESIG

This proposal would require two softforks, SIGHASH_ANYPREVOUT and OP_CHECKSEPARATESIG. The scope of OP_CHECKSEPARATESIG is so small and tiny of a change I might be amazed if there’s any critical competition with it, and APO has a comparatively giant consensus within the ecosystem as a fascinating change.

OP_CHECKSIG and OP_CHECKSIGVERIFY are the 2 most important methods signatures are verified in Bitcoin script at the moment. There are two components of a signature, the S worth and the r worth. OP_CHECKSIG(VERIFY) takes the r and S of the signature as one complete argument, and the general public key to confirm it towards as one other, for a complete of two arguments, after which checks whether or not the signature is legitimate or not. OP_CHECKSEPARATESIG takes the general public key, the r worth, and the S worth all as separate arguments (for a complete of three), and verifies the signature.

Sure, that’s actually everything of the proposal. A softfork even easier and easier than CHECKTEMPLATEVERIFY (CTV). Why is that this wanted? Effectively, you may see right here proper now.

State Updates With out Everybody On-line

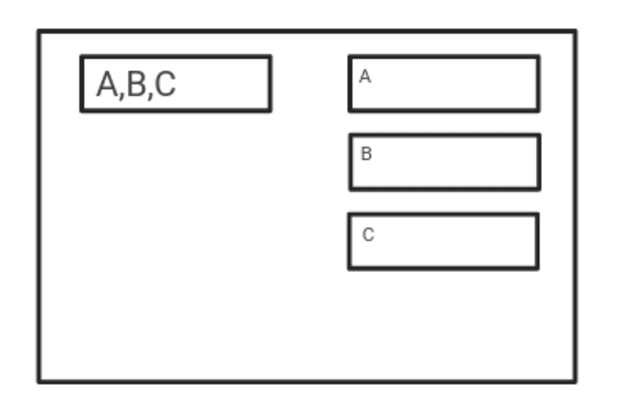

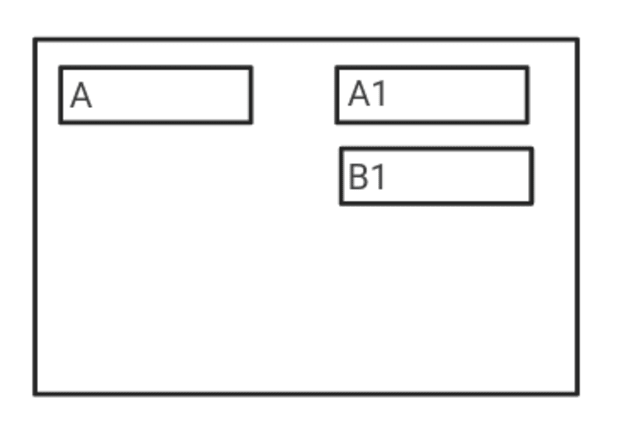

That is what the beginning state of a really primary multiparty channel would appear like. A pre-signed transaction needing Alice, Bob, and Charlie to signal for a UTXO they share management over with an output for every member. If Alice desires to pay Bob whereas Charlie is offline, the one possibility she has is to create a pre-signed transaction from her output within the channel state splitting these funds between herself and the cost to Bob like this:

The issue with this association is that Alice can merely signal a conflicting transaction taking again the cost to Bob at any time and use it earlier than Charlie comes on-line and everybody updates the channel, and since solely her secret is wanted to try this Bob can do nothing to cease her. We have to have some form of arbitrator that ensures Alice can not double-spend Bob when making funds on this method as a result of Charlie is unresponsive.

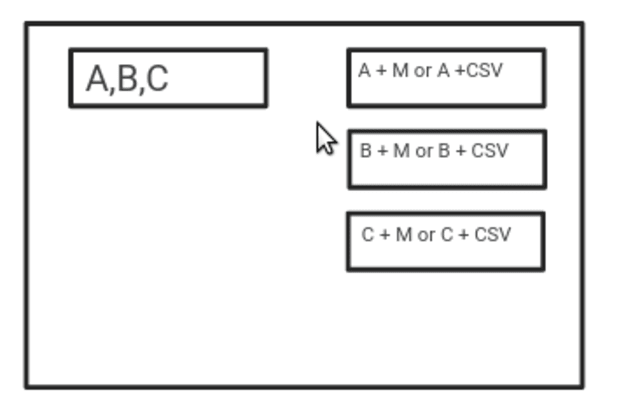

You may simply add a situation requiring {that a} Actuary (M) even be a keyholder for everybody’s outputs, which means they must signal to approve any transactions spending Alice, Bob, or Charlie’s outputs from the channel state. The issue with that’s, now Bob has to belief the Actuary as a substitute of Alice. If the Actuary cooperates with Alice, Bob can nonetheless be double spent.

That is the place OP_CHECKSEPARATESIG is available in. Here is how: the r worth in a signature is derived from the nonce used to signal. One of many key dangers in nonce dealing with is the chance of key leakage, reusing the identical nonce twice for various transactions will leak sufficient info for somebody with each of these transactions to have the ability to regenerate the non-public key used. This can be utilized to take the Actuary position from above and take away belief in them. No matter key the Actuary makes use of for this position, they’ll load with a bond that may be confiscated. From this level we add their key to everybody’s outputs like described above, besides specifying in every script precisely what r worth needs to be used within the signature from M forward of time. We even have a CSV timelocked path needing solely the proprietor’s key; this manner customers can at all times spend their funds nonetheless they need if the channel is closed on chain after a timelock.

Now when Alice goes to pay Bob whereas Charlie is offline utilizing a pre-signed transaction spending her output within the channel, she goes to the Actuary to log off on it. After the signatures are accomplished and Bob has a replica of the transaction, he has an immensely stronger assure that these funds is not going to be double spent. If the Actuary collaborates with Alice to double-spend Bob, his secret is leaked and the funds he put in a bond will be confiscated. If the channel is closed out on-chain on this state Bob will be capable to affirm the transaction co-signed by the Actuary earlier than Alice can double-spend him, as a result of Alice has to attend for a timelock to run out earlier than she will double-spend, Bob does not as a result of the Alice and Actuary spending path has no timelock. This may be added as a clause to each degree of the multiparty channel should you nest smaller channels on high as nicely.

This supplies a safety mannequin for Alice and Bob to replace the multiparty channel with out Charlie being on-line, which whereas not being strictly talking trustless, is about as shut as you will get with out assembly that bar. Bob can have a robust assure that he will not be double spent, which is just about 100% so long as the bond worth the Actuary makes use of is bigger than the cost worth, and Alice could make this cost with a assure adequate for Bob though Charlie is offline. This can be utilized in that probably very frequent state of affairs the place not everybody is obtainable to proceed processing updates, and cleanly cut-through at any time when everyone seems to be on-line to replace the bottom degree of the channel and take away the additional transactions utilizing this scheme.

OP_CHECKSEPARATESIG and the Actuary position it allows in multiparty channels clear up an enormous downside in truly making the idea of greater than two folks sharing a channel workable at scale. I am positive there are many different conditions apart from multiparty channels the place imposing with a bond that some occasion solely ever indicators one model of one thing. This ought to be one thing very significantly thought-about by Bitcoiners, it supplies an enormous answer to a identified downside with no complexity by simply barely altering a tiny side of how signatures are verified.

[ad_2]

Source link