[ad_1]

The current decline in Bitcoin (BTC) has raised considerations amongst market contributors as the biggest cryptocurrency struggles to take care of its upward momentum.

With the lack of key transferring averages and the $27,000 degree, BTC’s sharp decline has been exacerbated by detrimental market sentiment and delays within the approval of spot Bitcoin Change-Traded Funds (ETFs) by the US Securities and Change Fee (SEC).

Including to the bearish outlook is the evaluation of on-chain knowledge, which suggests a scarcity of robust assist beneath the $25,400 mark.

Famend crypto analyst Ali Martinez has emphasised this concern, highlighting the potential for a swift correction right down to $23,340. Nonetheless, the risky nature of the Bitcoin market signifies that the result stays unsure.

Bitcoin Faces Prolonged Downtrend

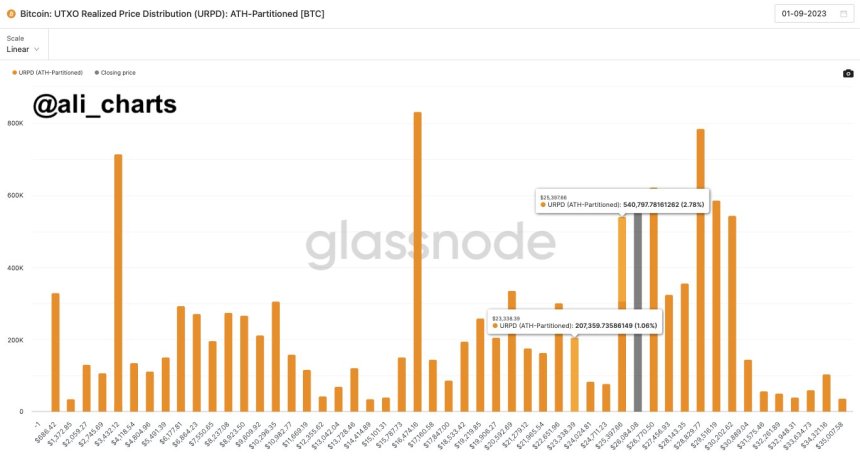

Ali Martinez’s current publish on X (previously Twitter) has make clear the on-chain knowledge evaluation for Bitcoin. Martinez factors out that BTC is at the moment missing strong assist beneath the $25,400 degree.

This statement is predicated on BTC’s UTxO Realized Worth Age Distribution, which supplies insights into totally different cohorts’ holding habits by overlaying a spread of realized costs together with age bands.

The evaluation signifies a vulnerability in BTC’s value construction, suggesting {that a} break beneath the $25,400 threshold might set off a swift correction downward to $23,340.

Furthermore, the detrimental sentiment out there, coupled with regulatory delays within the approval of spot Bitcoin ETFs by the SEC, has added to the bearish outlook for Bitcoin.

Many market contributors had anticipated that the introduction of Bitcoin ETFs would act as a catalyst for a possible restoration within the close to time period. Nonetheless, the extended delay of their approval has dampened investor sentiment and elevated uncertainty surrounding the cryptocurrency’s future value trajectory.

The dearth of a positive regulatory framework has additional contributed to the prolonged downtrend and heightened market volatility.

This stated, if Bitcoin breaks beneath the crucial assist degree at $25,400, as urged by the on-chain knowledge evaluation, it might result in a fast correction right down to $23,340. Such a big decline would heighten considerations amongst buyers and probably set off additional promoting strain.

Wholesome BTC Correction?

Including to the evaluation of the Bitcoin market, crypto analyst Egrag Crypto supplies a broader context by highlighting the probability of the CME (Chicago Mercantile Change) hole closure and the importance of the $23,000 degree as robust assist.

In keeping with Egrag Crypto, even when BTC retraces up to now, it must be seen as a pure correction throughout the framework of an ongoing bull market.

Egrag Crypto means that the CME hole closure is a phenomenon the place the value of Bitcoin fills the value hole created between the closing and opening costs of the CME futures market over the weekend.

On this case, the hole exists across the $23,300 degree, which signifies a possible space of robust assist. This statement aligns with the notion that Bitcoin tends to fill these gaps over time.

Whereas a retracement to $23,300 could trigger concern amongst buyers, Egrag Crypto emphasizes that it must be seen as a wholesome correction throughout the broader context of a bull market.

Corrections are a standard a part of any market cycle, and Bitcoin has traditionally skilled intervals of consolidation and retracement earlier than persevering with its upward trajectory.

Presently, Bitcoin is buying and selling at $25,990, representing a 4% decline throughout the 24-hour interval and a considerable 11% drop over the previous 30 days. Regardless of these current losses, the flagship cryptocurrency has efficiently maintained its year-to-date features, boasting a exceptional revenue of over 29% since September 2022.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link