[ad_1]

Are NFT costs indicative of a sinking ship for the market? The yr 2023 hasn’t been variety to a few of the greatest NFTs that dominated the market in 2022. A number of notable initiatives have skilled vital declines of their token values, portray a difficult image for NFT traders.

Information supplied by NFTGo reveals that the Blue Chip Index, a measure of the general efficiency of top-tier NFTs, has additionally witnessed a downward development. It has dropped to 7,446 ETH from its peak of 12,394 ETH recorded in July 2022. Let’s take a more in-depth take a look at the efficiency of some distinguished NFT initiatives.

TL;DR:

NFT market sees vital worth declines, elevating considerations in regards to the business’s stability.

Fashionable initiatives like Doodles and Invisible Pals expertise substantial drops in token values.

Regardless of the downturn, some traders stay optimistic, whereas others select to carry or promote their property.

NFT Worth Market Actions: Going All The Method Down?

Based on present tendencies, a few of the extremely fashionable NFT initiatives are experiencing large downturns of their costs. Does this mark the start of a bubble burst? Or are founders merely not doing sufficient? Or is the neighborhood at massive responsible, with scams and tomfoolery working plentiful? Among the most affected undertaking are as underneath:

Doodles, as soon as extremely sought-after, has seen a dramatic drop in worth. Beforehand valued at 23 ETH, the token now sits at a mere 2.3 ETH—a considerable lower that highlights the volatility of the NFT market.

Invisible Pals, one other notable undertaking, has additionally suffered a major decline. With its token beforehand valued at 8 ETH, it has now plummeted to 1.15 ETH, leaving traders grappling with losses.

Moonbirds, which as soon as commanded a hefty 32 ETH, has seen its worth drop to a meager 2 ETH. This substantial decline has undoubtedly left traders upset and anxious about the way forward for the undertaking.

Goblintown, beforehand valued at 6 ETH, now stands at a mere 0.26 ETH. It is a staggering lower that rattles the NFT neighborhood.

The decline doesn’t cease there, although. NFT giants Bored Ape Yacht Membership (BAYC), has additionally skilled a major lower in its ground worth. As soon as boasting a ground worth of 550,000 USD, it has now dipped under 100,000 USD—a drastic plunge that has caught the eye of many market individuals.

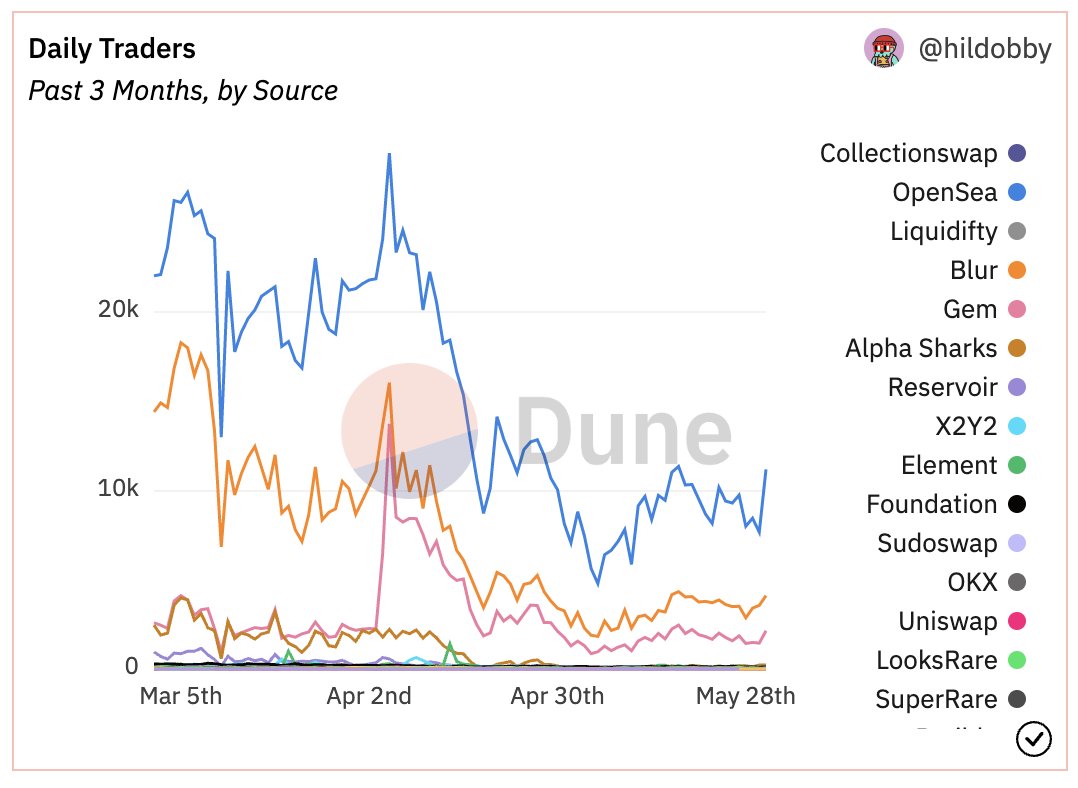

However fear not, it so occurs that regardless of the value fall, distinctive NFT holders are steadily on the rise from the previous three months.

Silver Linings In The Downturn

Regardless of these troubling numbers, some NFT traders stay surprisingly unaffected by the continued decline in worth. In truth, a handful of traders view this as an opportune time to speculate, believing in a possible market restoration.

Opposite to this optimistic view, there has additionally been a notable improve within the variety of blue chip NFT holders over the previous yr, indicating a sustained curiosity in these initiatives. Nonetheless, sellers have additionally elevated by 32%, whereas the variety of patrons has decreased by 30%. These statistics counsel a cautious sentiment amongst market individuals, as some select to carry onto their property, whereas others choose to money out.

Because the NFT market continues to navigate these turbulent occasions, it stays to be seen whether or not these initiatives will regain their former glory or if the downward development will persist. Traders and fanatics alike are preserving a watchful eye available on the market, eagerly awaiting indicators of a possible comeback or additional depreciation in NFT costs.

All funding/monetary opinions expressed by NFTevening.com usually are not suggestions.

This text is instructional materials.

As all the time, make your individual analysis prior to creating any form of funding.

[ad_2]

Source link