[ad_1]

NFTs (non-fungible tokens) have skilled a surge in recognition lately as a way of buying, promoting, and proudly owning digital property.

In accordance with the 2021 NFT Market Research performed by Chainalysis, the market worth of non-fungible tokens (NFTs) has exceeded $40 billion on account of their elevated recognition.

The Blur NFT Ecosystem stands out as a notable addition to the NFT area, providing customers an intuitive platform for effortlessly shopping for, promoting, and buying and selling NFTs.

This zero-fee NFT market was launched in October 2022 to cater to the wants of skilled merchants. The platform gives a wide range of options and advantages that make it interesting to each collectors and creators.

In case you are new to NFTs, chances are you’ll start by looking out on-line for various NFT marketplaces. Nonetheless, it’s important to conduct thorough analysis to discover a dependable platform for buying NFTs. For example, many people who acquired NFTs by way of FTX have been left in misery when the alternate unexpectedly declared chapter.

This text extensively explores the Blur NFT ecosystem, together with its options and why it has outperformed a number of opponents.

What’s Blur?

Blur is an NFT market and aggregator created with skilled merchants in thoughts. Not like different prime marketplaces, it introduces quite a few new options to boost the NFT buying and selling course of, making it less complicated and extra user-friendly.

Customers can listing their NFTs on Blur domestically, and the platform additionally aggregates NFT listings from common websites like X2Y2, LooksRare, and OpenSea. In distinction to different NFT marketplaces that cost commissions, Blur maintains its promoting charges for NFTs at 0%.

The platform was initially launched in March 2022, gaining traction on distinguished social media platforms. Customers have been inspired to refer their family members to affix a waitlist. Blur was formally launched to the general public on October 19 of the identical yr. Main as much as the launch, a choose group of group members, together with these with essentially the most referrals, have been granted entry to beta take a look at it.

Blur’s Distinctive Options

The Blur NFT market shares the identical elementary options as different NFT marketplaces. Nonetheless, the Blur platform units itself aside by optimizing these options to supply one of the best consumer expertise.

Listed here are a few of the options that distinguish the Blur market from different NFT platforms:

Quick Buying and selling Velocity

Blur updates the listing of pending NFT transactions each 4 seconds and shows it in lower than one second. Subsequently, there isn’t a have to manually refresh the transaction web page. The moment show and near-real-time metadata updates profit customers seeking to purchase NFTs rapidly.

Moreover, Blur’s fuel precedence setting offers customers a aggressive edge, rising the chance of outbidding opponents on different exchanges or aggregators when bidding for a similar NFT.

Consumer-Pleasant Interface

Blur boasts a customizable consumer interface, permitting customers to modify between listing and block show modes whereas viewing their NFT assortment, catering to particular person preferences.

Not like OpenSea, which requires customers to modify tabs to entry gross sales historical past and different metrics, Blur presents all related NFT assortment knowledge on a single web page, simplifying navigation. Different built-in options embrace a fuel payment tracker, mild and darkish modes, and details about ETH feeds.

Prime-Notch NFT Instruments

Blur simplifies the method of viewing NFT attributes and prices. This characteristic is especially useful for NFT fans searching for particular attributes when selecting their most popular NFT.

Not like different NFT buying and selling platforms, Blur doesn’t have a separate NFT product element web page. As a substitute, it gives a drop-down menu containing important transaction data, comparable to the ground worth, present worth, variety of holdings, present holder, and shelf time. Moreover, it offers data on the present flooring worth, newest offered worth, and the share of every NFT with a particular attribute.

Crew and Supporters

In March 2022, Blur secured $11 million in its seed spherical, led by Paradigm. It could be a mistake to undervalue Paradigm’s funding in Blur, on condition that it is likely one of the most profitable crypto VC companies.

A number of distinguished figures within the NFT and cryptocurrency scenes additionally participated within the seed spherical, together with nameless collectors 6529, MoonOverlord, Cozomo de’ Medici, and Zeneca. Help from influential NFT figures like these underscores that Blur’s targets align carefully with the NFT group as a complete.

Nonetheless, it’s vital to notice that your entire Blur workforce at present maintains anonymity, selecting to function on-line beneath pseudonyms reasonably than their actual names.

Whereas anonymity will not be unusual within the cryptocurrency business, it does increase issues about workforce accountability. An nameless workforce might face challenges by way of belief and potential dangers of a workforce member appearing towards the venture’s pursuits sooner or later.

Moreover, there’s the likelihood {that a} core workforce member might have a questionable historical past, as seen when Michael Patryn, a co-founder of QuadrigaCX, was recognized as Wonderland’s 0xSifu. This underscores the significance of transparency and accountability inside cryptocurrency tasks.

Different Customized Options

Blur’s transaction pending time is beneath a second, with itemizing updates each 4 seconds.

Fuel precedence presets allow customers to compete with different patrons on completely different exchanges or aggregators.

Optimized contracts in Blur can save customers as much as 17% on fuel charges.

The platform shows NFT rarity and particular traits’ flooring costs, automating the method of discovering the bottom listings.

Customers can consider property or snipe NFTs with discounted qualities simply.

Blur offers instruments for purchasing a number of NFTs from a set on the lowest costs, referred to as “sweeping the ground,” with a flooring depth chart for purchaser steering.

Presently, Blur’s options are unique to Ethereum-based NFTs, however the workforce plans to increase to different chains like Polygon sooner or later.

Tokenomics

The $BLUR token airdrop was lately finalized after the Season 1 of the motivation program. Prospects obtained “Care Packages” as compensation for buying and selling and supplying liquidity on the platform. The venture started with a $400 million valuation, and a few merchants made as much as $3 million in BLUR tokens.

One other set of Blur airdrops is deliberate for “Season 2.” The easiest way to earn $BLUR tokens within the upcoming airdrop is to purchase, promote, and listing NFTs on the platform.

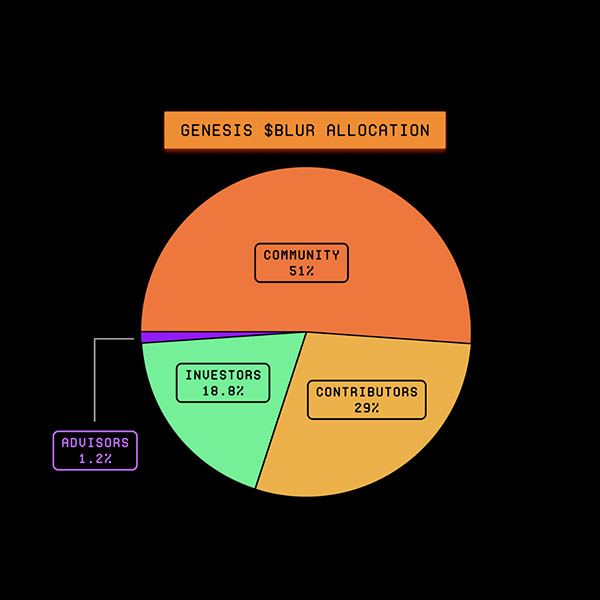

All through a 4- to 5-year interval, Blur will make 3 billion BLUR tokens obtainable. 51% of the tokens will probably be given to the group, 29% will probably be given to current and previous core contributors, 19% will probably be given to buyers, and 1% will probably be given to advisors. NFT merchants, those that have used Blur up to now, and builders can declare 12% of the whole variety of BLUR tokens.

The group treasury will distribute 39% of the BLUR provide by way of neighbourhood tasks, contributor awards, and incentive applications, with 10% put aside for the upcoming incentive launch. For every group of token receivers, the BLUR token vesting will happen repeatedly in step with a predetermined schedule.

How Did Blur Outperform OpenSea?

Blur shocked the NFT market by changing into the main NFT market by way of quantity in lower than two months into 2023.

In accordance with Nansen.ai, on February 15, Blur surpassed OpenSea by way of each day Ethereum buying and selling quantity. Over the previous month, varied knowledge aggregators have additionally reported on Blur’s constant progress.

Hildebert Moulié, a knowledge scientist, created a Dune dashboard that exposed that Blur’s each day buying and selling quantity elevated greater than 4 occasions after the discharge of its native token, which additional intensified the competitors between the 2 NFT marketplaces.

Based mostly on Nansen’s knowledge, Blur’s market had a buying and selling quantity of 6,602 ETH on February 15, whereas OpenSea’s buying and selling quantity stood at 5,649 ETH. In the meantime, sealaunch. xyz’s Dune dashboard recorded increased each day buying and selling volumes for each marketplaces, with Blur at 30,410 ETH and OpenSea at 7,232 ETH, indicating a better disparity between the 2 platforms in comparison with Nansen’s knowledge.

The aim of the Blur platform was to draw merchants from NFT marketplaces with zero royalties by providing extra substantial airdrops to merchants who prioritize paying royalties as an alternative of choosing platforms with no royalty charges.

Giant airdrop campaigns are a good way to realize new prospects, however they might compromise the standard of the ultimate product. For example, LooksRare was competing with OpenSea however was horrible on the product stage.

Since retaining prospects is simply as vital as getting new ones, Blur locations extra emphasis on liquidity than quantity, which makes it simpler for actual prospects to affix the platform.

So, how was it doable for Blur to incentivize liquidity with out risking manipulation?

Blur achieved this by incentivizing listings. Nonetheless, with completely different ranges of rarity in NFT collections, customers usually tend to listing issues close to the ground. Large gross sales boundaries will probably be created in consequence, which might not be what NFT marketplaces are on the lookout for.

That is the place Blur has incentive-based bidding. Their bidding factors system was created to provide “pro-NFT merchants” entry to extra liquidity than they’d have on OpenSea, the place they’d usually use a pending order transaction strategy.

Though {the marketplace} charges stay at 0%, the workforce will not be solely centered on making earnings for themselves. They perceive that even with the help of Paradigm, income streams and liquidity will ultimately turn out to be restricted. Subsequently, they’ve shifted their focus to bettering the product expertise.

Fairly than counting on charges for earnings, the workforce is devoted to enhancing the consumer expertise to draw and retain prospects. This exhibits the workforce’s dedication to making a profitable NFT market.

In Conclusion

Regardless of the continuing crypto winter, Blur serves for instance that there are nonetheless devoted groups of builders who preserve optimism relating to the long-term potential of cryptocurrency know-how.

Relating to Blur’s prospects, it stays to be seen whether or not it would finally outperform its opponents and set up itself as a number one cryptocurrency. Solely time will inform whether or not it’s a fleeting pattern or possesses the potential to endure for the long run.

Disclaimer: This text is meant solely for informational functions solely and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of monetary loss. All the time conduct due diligence.

If you want to learn extra articles like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, and Instagram, and CoinMarketCap Group.

“Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”

[ad_2]

Source link