[ad_1]

NFT market Blur has introduced the launch of its lending program. The brand new peer-to-peer lending protocol for non-fungible tokens is dubbed “Mix.”

In a approach, part of the lending program capabilities equally to a mortgage on a bodily asset. The function permits customers to purchase a share of a selected non-fungible token in case they don’t have the whole requested quantity. People can finance the remaining following. This “purchase now, pay later” perform permits customers to purchase NFTs by paying solely a fraction of the associated fee upfront.

It’s price noting that prospects can repay their borrow at any time and take full possession of their new tokens. Holders can even record the bought NFT and hold the revenue once they promote it.

On the identical time, house owners of non-fungible tokens wishing to get liquidity can borrow ETH towards their NFTs. Because of Mix, customers don’t must promote their NFTs on this case.

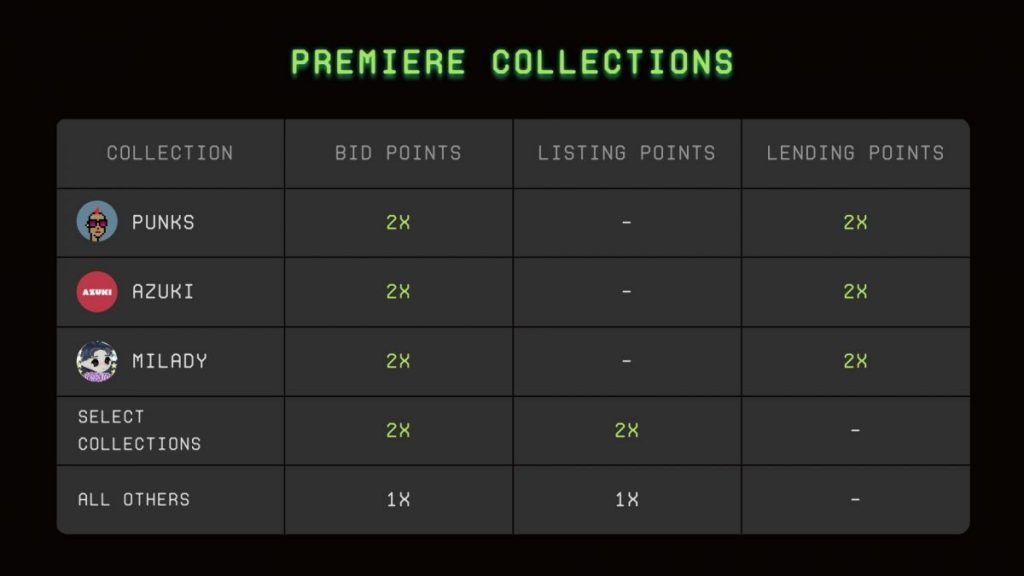

Earlier than launching Mix, Blur provided “bidding” and “itemizing” factors. With the brand new instrument, the platform provides “lending” factors. Notably, these rewards will be modified per assortment, which means that some collections obtain extra factors than others. You will need to word that Blur changed itemizing factors with lending factors on some tasks.

On the time of writing, {the marketplace} options three blue-chip collections of three totally different value factors: Azuki, CryptoPunks, and Miladys. So, Mix customers can already borrow as much as 42 ETH towards a CryptoPunk NFT or buy an Azuki token by lending 2 ETH on Blur.

The platform plans so as to add extra NFT collections within the nearest future. Group members can take part within the choice by commenting on the tweet and naming their favourite NFT tasks that must be added to {the marketplace}.

Learn associated posts:

[ad_2]

Source link