[ad_1]

Pal.tech is among the hottest issues to occur within the crypto business up to now two months. Within the comparatively quick time of its existence, the decentralized social media app has been by means of ups and downs. From averaging buying and selling charges rivaling high cryptocurrencies like Bitcoin and Tron, to being labeled lifeless only a few weeks after launch, to making an amazing comeback to a brand new all-time excessive when it comes to Whole Worth Locked (TVL), it has undoubtedly been an eventful interval for Pal.tech.

A just lately launched report by AMLBot, a platform that helps customers verify crypto wallets for illicit funds, has dived into the ins and outs of Pal.tech to discover whether or not the decentralized social media app is an funding alternative to think about.

The Constructive And Unfavourable Facets Of Pal.Tech

Constructed on Coinbase’s Base scaling community for Ethereum, Pal.tech’s social media app permits customers to commerce tokenized shares of different customers’ profiles utilizing ETH. Based on AMLBot’s report, the enterprise mannequin is value contemplating for funding. The app expenses a ten% charge each time a consumer buys “keys” (beforehand generally known as shares) of one other consumer, with 5% going to the account whose shares had been purchased. On the time of writing, Pal.tech has generated over $240.3 million in buying and selling charges.

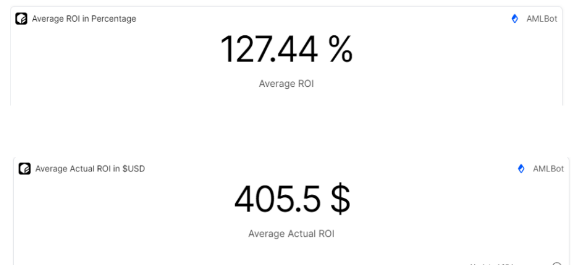

Pal.tech’s consumer base could be very numerous, as demonstrated by the assorted levels of wins and losses. AMLBot has proven that the typical return on funding for customers is 127.44% and $405.5 in US {dollars}, with the highest customers incomes as a lot as $254,000. Nonetheless, some customers have additionally misplaced round $6.3 million, displaying the potential draw back.

What’s Subsequent For Pal.tech?

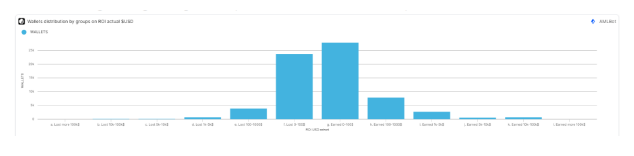

Profitability on Pal.tech usually depends upon how customers can wager on profile shares that may probably flip a revenue. Information has proven that the platform has really turned a revenue for almost all of its consumer base. Numerous wallets (27,800) have earned between $0-$100 on Pal.tech, and 684 wallets are on the upper finish of $10,000 to $100,000 in earnings. However, 9 wallets have misplaced greater than $100,000.

Pal.tech’s progress has exceeded different decentralized social media platforms, and its present success exhibits how shortly a crypto product can penetrate the market when there’s a robust market match. The decentralized social media app has demonstrated its potential for good points, however this in the end boils down to every consumer’s funding determination. Different analysts have proven skepticism concerning its early success, with some evaluating the platform to a Ponzi scheme.

Whole crypto market cap at $1.03 trillion on the weekly chart: TradingView.com

If somebody can please fill me in, how is #friendTech not a transparent as day Ponzi? You purchase and if extra individuals purchase that group it goes up. The one method to recognize is extra individuals coming in, with the inevitability of a load of bag holders. What am I lacking? pic.twitter.com/NyXvpo1pyT

— TheChartGuys (@ChartGuys) August 21, 2023

On the time of writing, Pal.tech has managed to do properly when it comes to consumer base with 233k customers. Based on one of many core builders behind DeFiLlama, a hack into Pal.tech can be extra devastating than the Balancer hack, as customers can lose funds by opening the app.

Featured picture from Shutterstock

[ad_2]

Source link