[ad_1]

Current on-chain exercise involving the Ethereum deal with ‘0xd275e‘ has caught the eye of the crypto group.

Via CryptoSlate‘s on-chain evaluation, no concrete proof pointing to the proprietor of the account has been found. Nonetheless, the account has actively traded massive quantities of tokens throughout key business occasions.

The whale account has been recognized throughout on-chain evaluation of each the FTX collapse, Tether depeg, and now the motion of $75 million again onto crypto exchanges.

‘0xd275e’ strikes $75M tokens to exchanges.

In accordance with a tweet from Spot On Chain, the deal with deposited 1,140 WBTC ($32.89M) to Bitfinex and 15,000 ETH ($27.17M) to Binance, Coinbase, and Kraken inside a span of 1.5 hours on June 21.

Spot On Chain recognized that this deal with has been actively transferring vital quantities of cryptocurrencies between main exchanges, doubtlessly indicating manipulation actions, given its murky historical past.

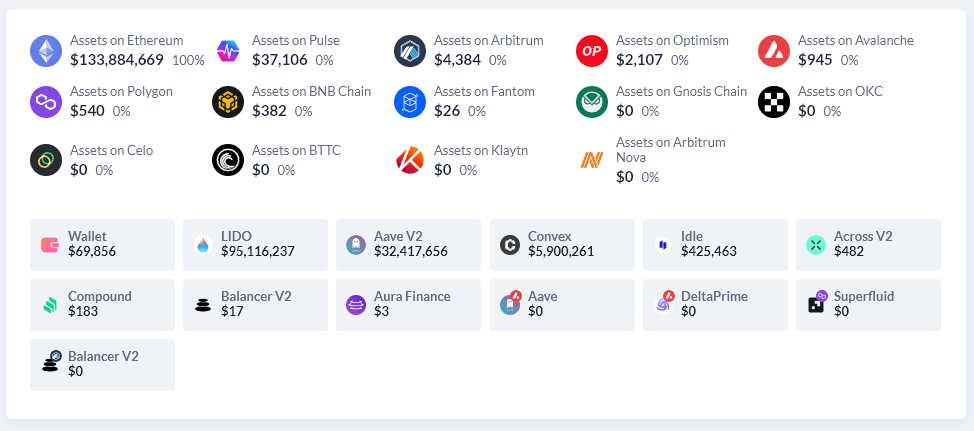

CryptoSlate reviewed latest ‘0xd275e’ transactions on Etherscan and located a collection of transactions, together with withdrawals, transfers, and repayments over the previous 24 hours. These transactions contain Aave interest-bearing Wrapped Ether (WETH), Wrapped Bitcoin (WBTC), and USD Coin (USDC), confirming the lively participation of this deal with within the DeFi ecosystem.

Nonetheless, the deal with has additionally appeared in earlier business analyses, in accordance with Noah_nftn. In November 2022, the account claimed that former FTX workers disclosed that ‘0xd275e’ was concerned in misappropriating buyer funds.

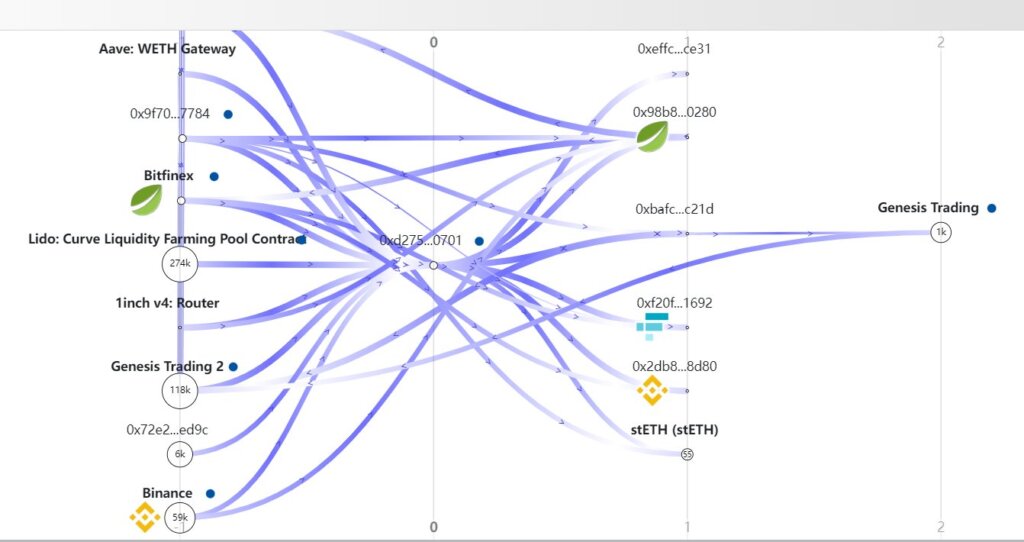

The diagram beneath reveals the account on the middle of a number of massive transactions between Aave, Bitfinex, Binance, Lido, Genesis Buying and selling, and FTX.

Tether Depeg

Extra just lately, the account additionally appeared on the coronary heart of the temporary USDT depeg that Tether CTO Paolo Ardoino known as a “good stress take a look at” for the corporate.

On June 19, Spot On Chain asserted that the deal with “seems to be promoting $ETH and repaying the debt on #Aave.” It additional posited that ‘0xd275e’ borrowed 50M USDC from Aave after the USDT depegging and began shopping for USDT to arbitrage, suggesting potential involvement in restoring the USDT peg.

Lookonchain has beforehand speculated that ‘0xd275e’ is perhaps associated to Tether or the FTX Accounts Drainer, which might have vital implications for the business. On June 15, it questioned whether or not the account may belong to Tether, whereas again in November 2022, it additionally steered ‘0xd275’ might belong to FTX Co-Founder Sam Bankman-Fried.

CryptoSlate contacted Bitfinex and Tether regarding ‘0xd275’ however has not but acquired a response. The account has solely $827 in Tether-issued tokens as of press time.

FTX Hack

In its evaluation of the FTX hack, which occurred after it filed for chapter in November, Lookonchain revealed that the deal with ‘0xd275e’ was concerned in large-scale transfers of ETH and USDC across the similar time FTX change suspended person withdrawals.

Lookonchain additionally famous the curious timing of buying and selling actions between ‘0xd275e’ and the FTX Accounts Drainer, hinting at a attainable connection, although they emphasised that this stays speculative.

The character of the connection between ‘0xd275e’ and the FTX Accounts Drainer, in addition to the identification of the latter, stays unknown.

Whereas ‘0xd275e’ has generated vital consideration throughout the crypto group, there is no such thing as a concrete proof to assist the claims of the misappropriation of buyer funds or connections to Tether or the FTX Accounts Drainer right now.

Whereas the account’s person stays a thriller, the pockets itself seems to be on the middle of among the most high-profile crypto occasions of the previous 9 months.

[ad_2]

Source link