[ad_1]

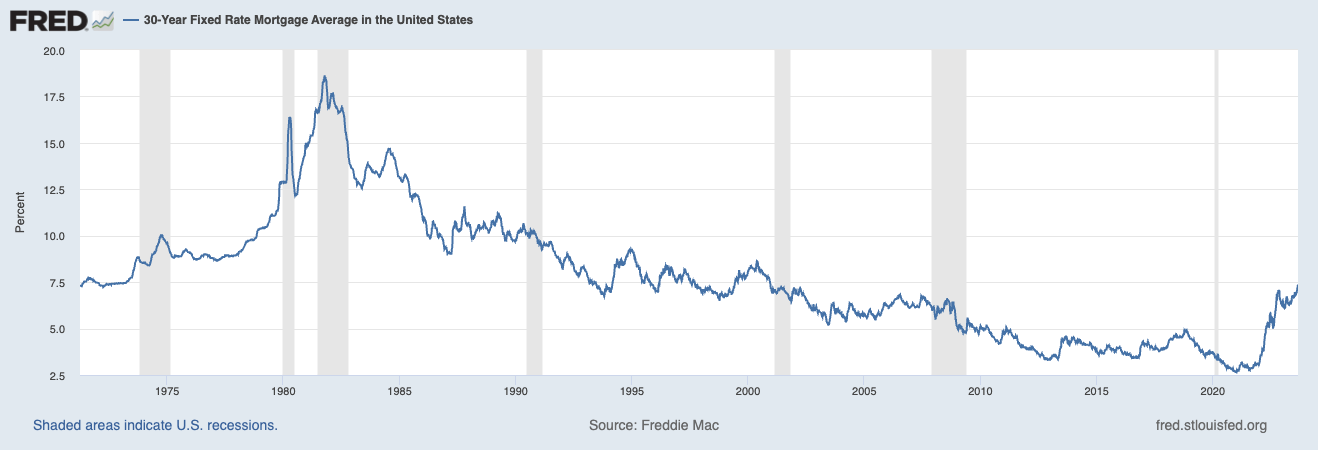

The monetary world has lengthy relied on conventional indicators to gauge market well being and predict future traits. Amongst these, the 30-year fastened mortgage charges and the 30-year Treasury yield are pivotal markers.

The unfold between these two metrics has not too long ago garnered important consideration, reaching historic highs and prompting discussions about its implications for the broader market.

The 30-year fastened mortgage fee represents the rate of interest lenders cost for a 30-year mortgage used to buy actual property. This fee is essential for a number of causes.

Firstly, it straight impacts owners’ month-to-month funds, influencing selections on residence purchases and refinancing.

Secondly, it serves as a mirrored image of lenders’ confidence within the financial system’s long-term stability. A better fee typically signifies perceived dangers within the housing market or broader financial uncertainties.

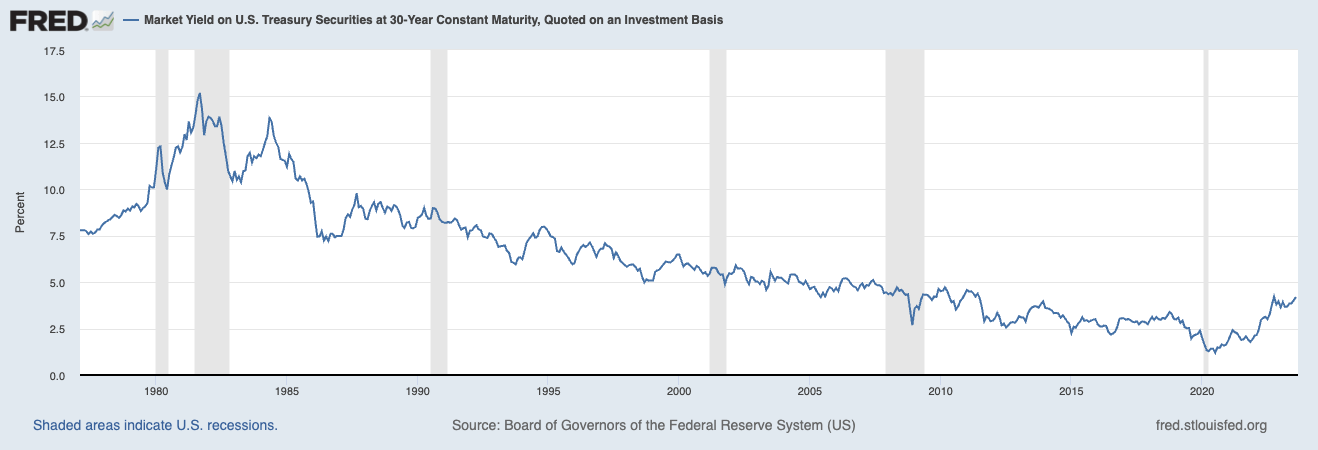

The 30-year Treasury yield is the return on funding for a U.S. authorities bond maturing in 30 years. Deemed one of many most secure investments, the total religion and credit score of the U.S. authorities backs it. This yield is a benchmark for different rates of interest and offers insights into investor sentiment about future financial circumstances.

A decrease yield usually means that traders are looking for safer property, presumably as a result of considerations about financial downturns or geopolitical tensions.

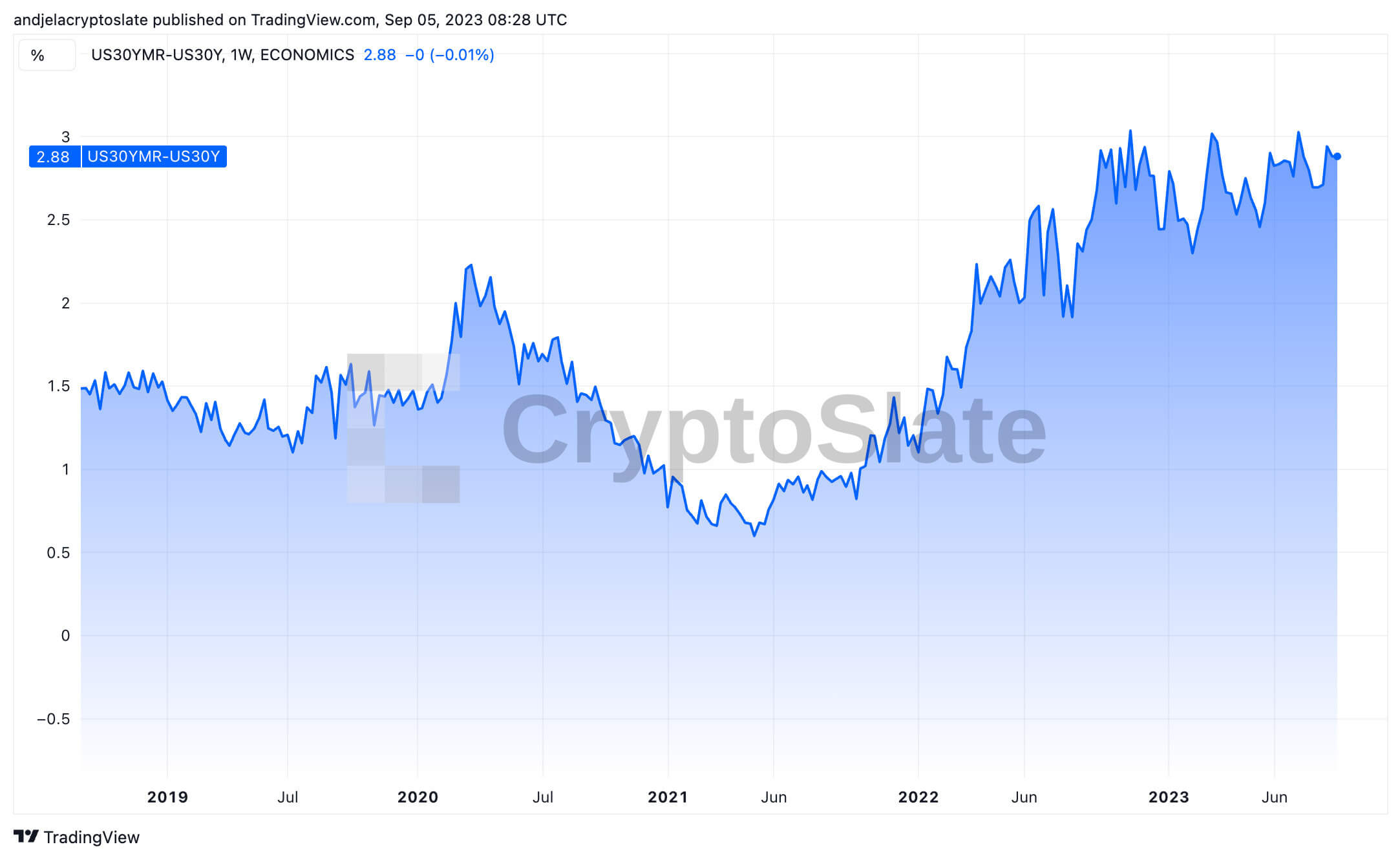

The distinction between the 30-year fastened mortgage fee and the 30-year Treasury yield is called the ‘unfold.’ This unfold is a barometer for credit score tightness within the system. A widening unfold means that whereas authorities securities stay a protected guess, the housing market is perceived as riskier.

Conversely, a narrowing or low unfold signifies that the perceived danger between the 2 is minimal. This might signify a secure housing market and a powerful financial system, the place lenders see mortgage lending almost as protected as government-backed securities.

The document low for the unfold was 0.11%, reached on June 1, 2011. Extra not too long ago, on Might 1, 2021, the unfold dipped to 0.67%, shortly after peaking at 2.17% on March 1, 2021. Such lows counsel durations of heightened confidence within the housing market, with lenders viewing it as virtually on par with the protection of presidency bonds.

The unfold hit an all-time excessive of two.97% on Aug. 1, 2023, adopted by a slight dip to 2.88% on Sept. 5, 2023.

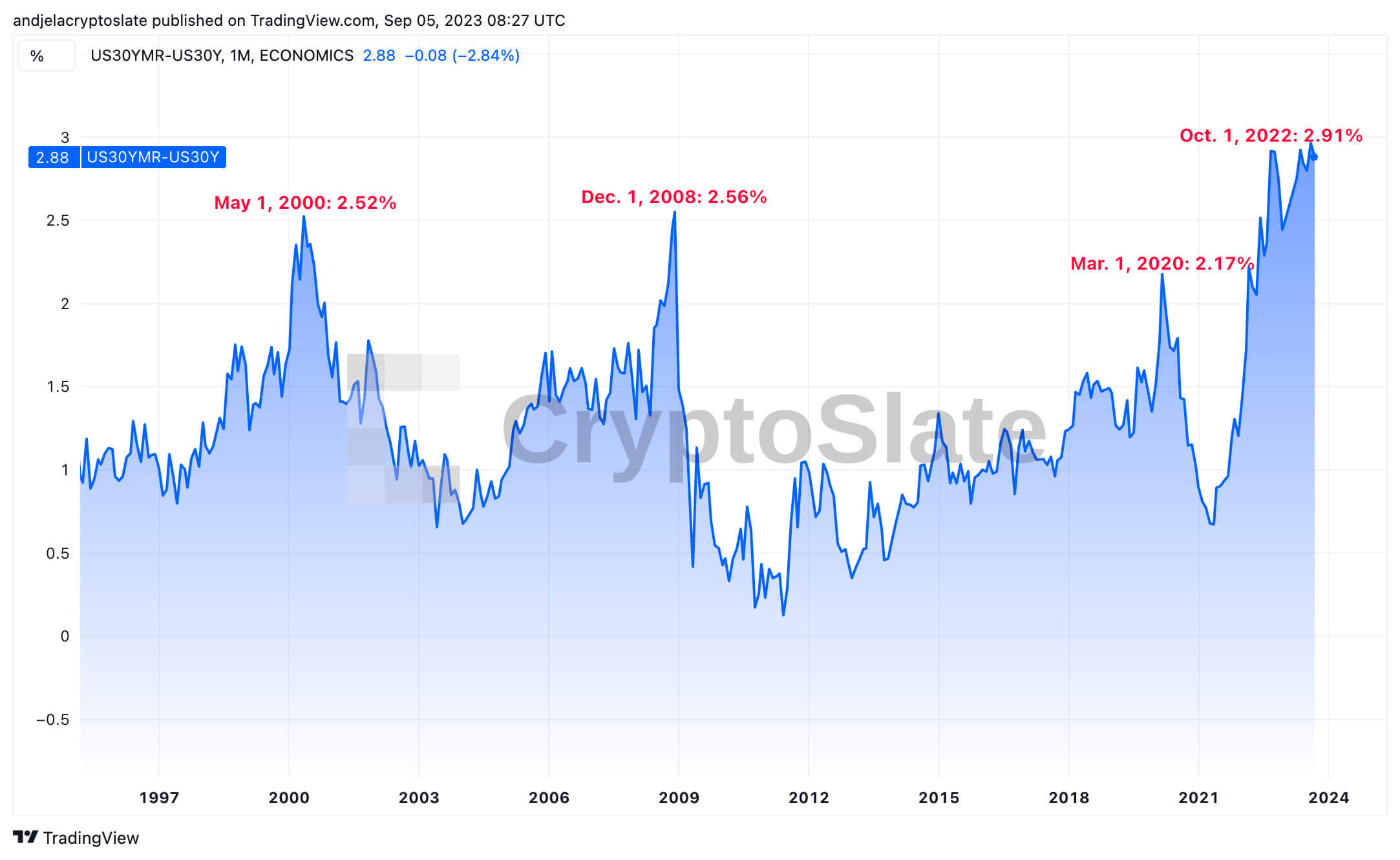

Earlier peaks embrace 2.91% on Oct. 1, 2022, 2.17% on March 1, 2020, 2.56% on Dec. 1, 2008, and a couple of.52% on Might 1, 2000.

Oct. 1, 2022 (2.91%): On condition that the earlier ATH was recorded lower than a 12 months in the past, it means that the pattern of a widening unfold has been ongoing for some time.

Mar. 1, 2020 (2.17%): The worldwide financial downturn and uncertainties related to the pandemic doubtless made lenders extra risk-averse, resulting in a broader unfold.

Dec. 1, 2008 (2.56%): An enormous spike within the unfold was recorded throughout the international monetary disaster. The worldwide financial system confronted an unprecedented downturn, with banks and monetary establishments dealing with extreme challenges. The broader unfold displays the heightened danger and uncertainty of that interval.

Might 1, 2000 (2.52%): An uncharacteristically widespread was recorded when the dot-com bubble burst. The broader unfold signifies that lenders perceived increased dangers within the housing market, presumably as a result of financial uncertainties stemming from the collapse of many tech giants.

The unfold between the 30-year fastened mortgage fee and the 30-year Treasury yield gives invaluable insights into the financial system’s well being and investor sentiment.

Its latest surge to near-historical highs suggests a cautious strategy by lenders and will sign a shift in funding methods. Given the uncertainness in conventional markets, traders could flip to various property resembling cryptocurrencies.

Bitcoin, particularly, may see elevated exercise because it gives potential hedging alternatives towards conventional market volatilities.

The put up Mortgage-treasury spreads hit historic highs revealing Bitcoin alternative appeared first on CryptoSlate.

[ad_2]

Source link