[ad_1]

On-chain knowledge reveals that Bitcoin miners might have been promoting at a historic charge not too long ago, one thing that could possibly be bearish for the asset’s worth.

Bitcoin Miner Influx To Exchanges Has Registered A Spike Just lately

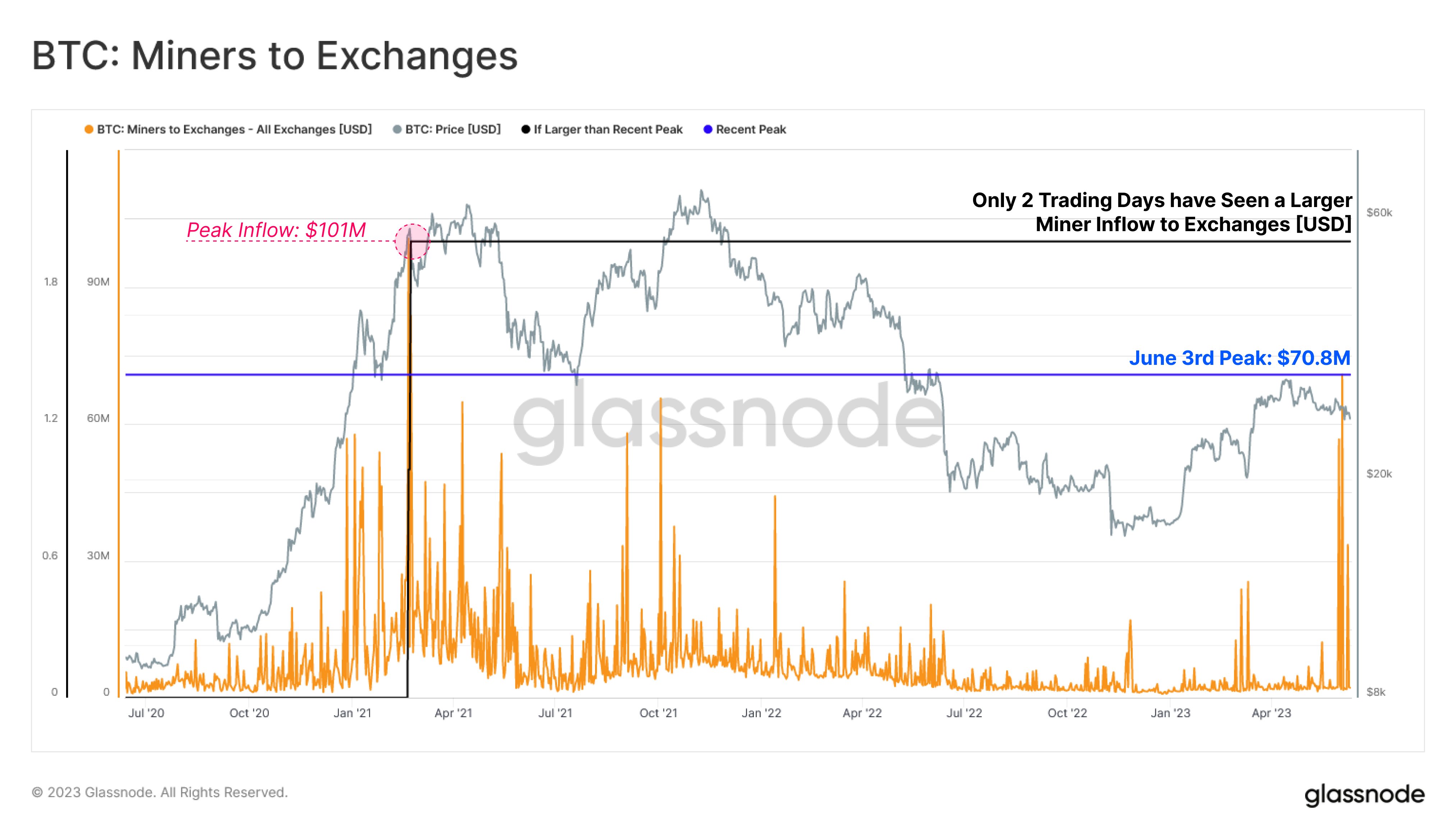

In line with knowledge from the on-chain analytics agency Glassnode, miner trade inflows hit a peak worth of $70 million not too long ago. The “miner influx to exchanges” is an indicator that measures the overall quantity of Bitcoin that miners are transferring to the wallets of all centralized exchanges.

When the worth of this metric is excessive, it means the miners are sending a lot of cash to those platforms at present. Usually, these chain validators deposit their BTC to exchanges for selling-related functions, so this sort of development can have a bearish impact on the worth of the cryptocurrency.

Then again, low values recommend the promoting strain coming from the miners could also be low proper now, as this cohort isn’t depositing any vital quantities to exchanges in the meanwhile.

Now, here’s a chart that reveals the development within the Bitcoin miner influx to exchanges over the previous few years:

The worth of the metric appears to have been fairly excessive in current days | Supply: Glassnode on Twitter

As displayed within the above graph, the Bitcoin miner influx to exchanges has noticed a spike in its worth not too long ago. This implies that miners have been sending slightly massive quantities to those platforms throughout the previous couple of weeks.

These excessive values of the indicator have come because the cryptocurrency has been regularly heading downwards. This will likely indicate that the current market atmosphere has made a number of the miners panic promote their holdings.

Since these inflows have develop into elevated, the asset’s worth has solely prolonged its decline additional, because it has now dropped under the $26,000 stage. This current decline within the worth could also be fueled partially by the dumping being accomplished by this cohort.

From the chart, it’s seen that the height of those inflows noticed on third June noticed the indicator attain a worth of round $70.8 million. It is a traditionally extraordinary stage for the metric as solely two buying and selling days in the complete lifetime of the coin have seen the miners depositing at a bigger scale.

Each of the cases the place miners despatched bigger quantities to those platforms passed off manner again throughout early 2021, when the bull market was in full circulate. The height influx spike again then (that’s, the most important worth the metric has ever recorded) measured to about $101 million, implying that the present surge is about $30.2 million away from it.

Naturally, Bitcoin miners promoting at such a excessive charge not too long ago might be dangerous information for the market. It now stays to be seen whether or not these chain validators proceed to promote extra within the close to future, or if they’re accomplished with their dumping spree for now.

BTC Value

On the time of writing, Bitcoin is buying and selling round $25,900, down 3% within the final week.

BTC appears to be like to have declined prior to now few days | Supply: BTCUSD on TradingView

Featured picture from Brian Wangenheim on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link