[ad_1]

Bitcoin miners are the spine of the cryptocurrency ecosystem because of their twin position of validating transactions and securing the blockchain. Their operational choices, particularly these associated to their Bitcoin reserves, can considerably affect the market dynamics.

The strategic decisions miners make about retaining or liquidating their Bitcoin earnings can considerably affect the supply-demand equilibrium out there.

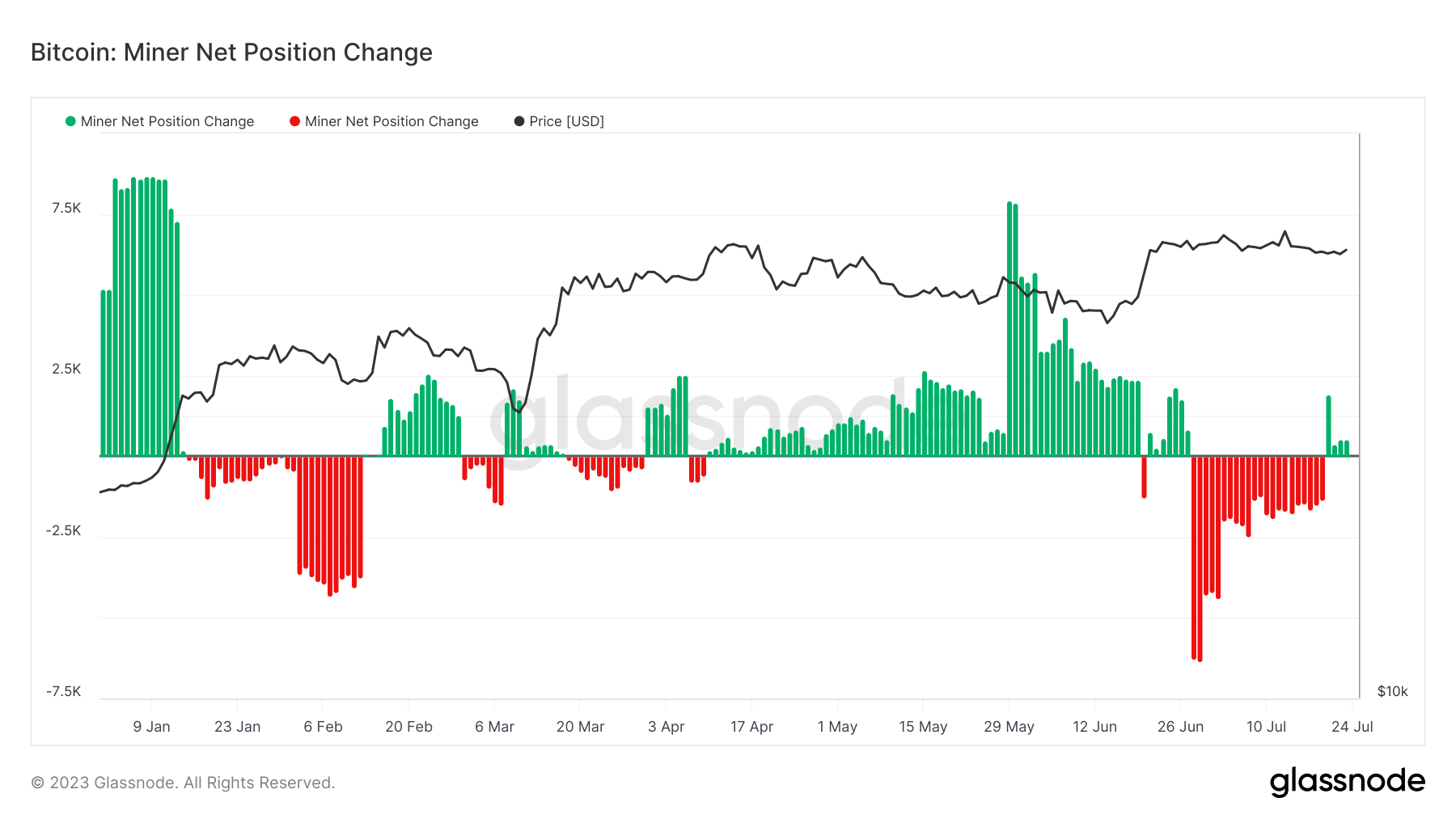

Traditionally, modifications in miner positions have been carefully tied to Bitcoin’s value actions. Damaging modifications, the place miners promote extra Bitcoin than they earn, typically correlate with short-term value slumps and extended downtrends or bear markets. That is seemingly as a result of such promoting will increase the provision of Bitcoin in the marketplace, placing downward strain on the value.

Then again, constructive modifications, the place miners accumulate extra Bitcoin than they promote, can help value will increase. It is because accumulation reduces the provision of Bitcoin in the marketplace, serving to to maintain or improve the value.

All through 2023, miners have spent a lot of the yr rising their Bitcoin positions, indicating bullish sentiment. Nevertheless, the market has seen a number of durations with detrimental place modifications, all correlated with elevated value volatility or downtrends.

In July, miners spent nearly the whole month rising their holdings.

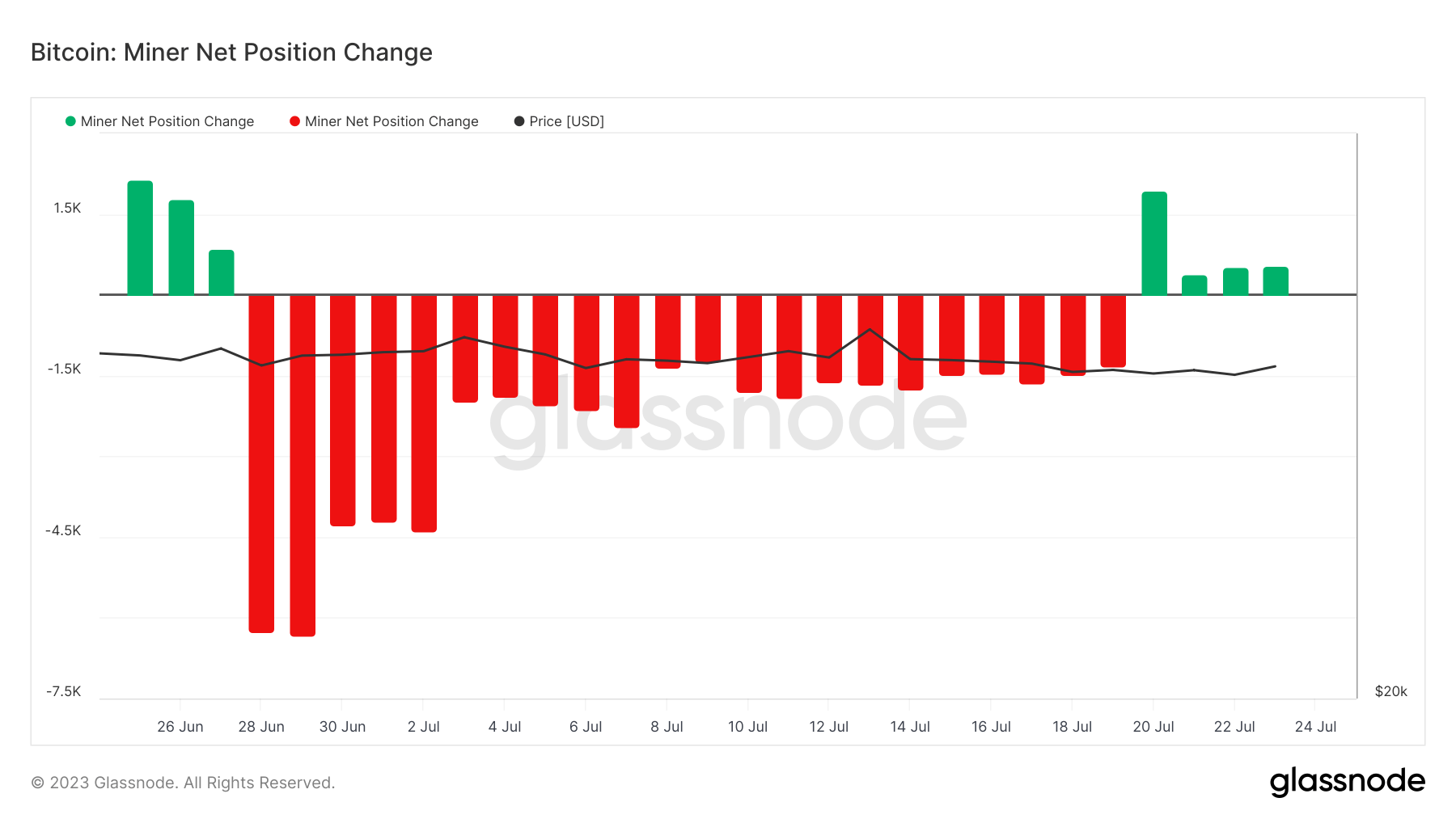

This pattern modified on July 20, when information from Glassnode confirmed a constructive shift in miner positions. Between July 20 and July 24, miners added over 451 BTC to their holdings. This accumulation of Bitcoin by miners might be a bullish signal for the market, because it reduces the provision of Bitcoin in the marketplace, probably supporting and even rising the value.

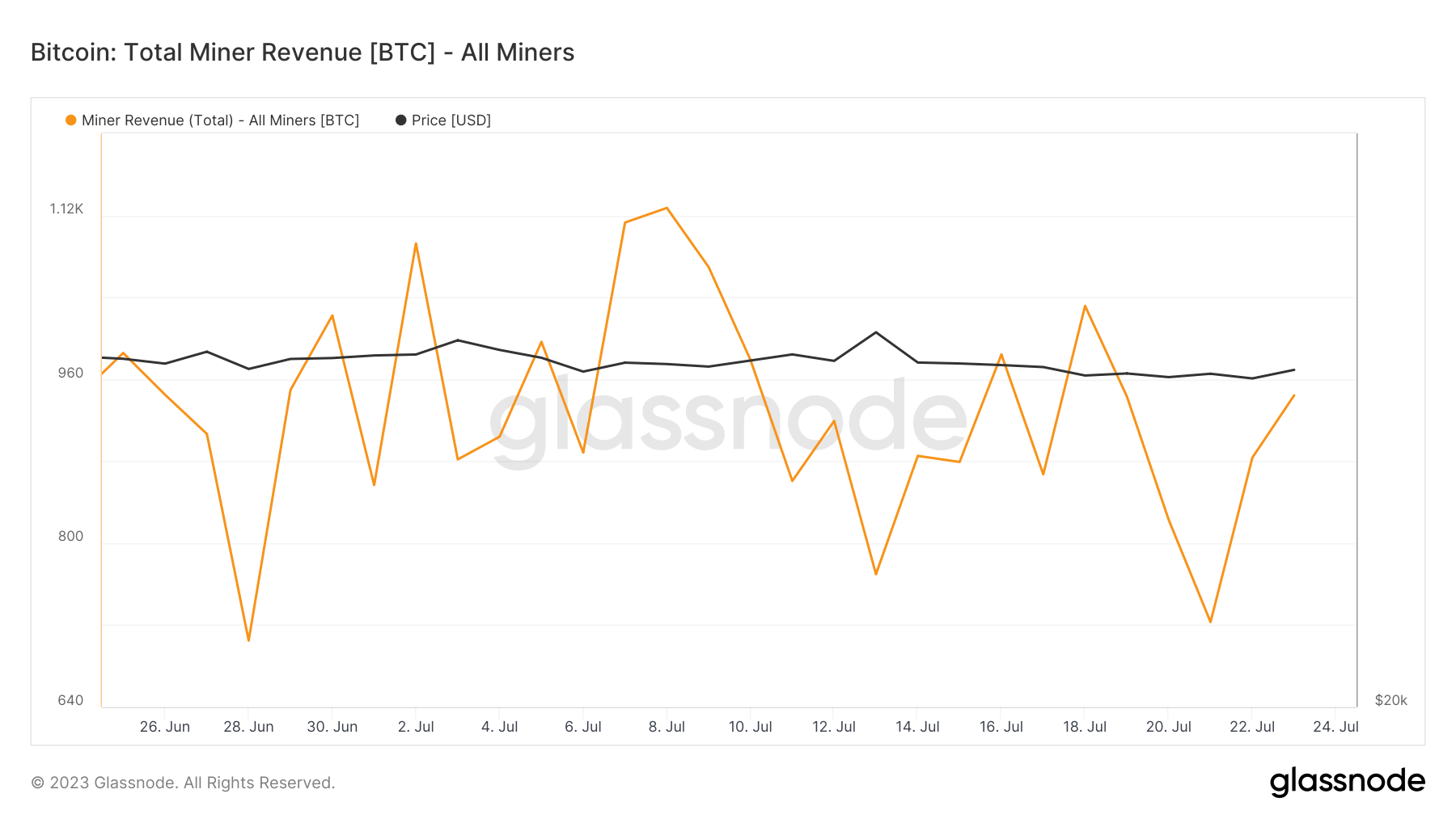

Nevertheless, it’s not simply the conduct of miners that may impression the Bitcoin market but additionally their revenues. Whole miner income from charges and block rewards noticed a pointy dip on July 21 however has since recovered to ranges recorded on July 19 at 944 BTC. Regardless of the constant volatility in miner income, the income recorded on July 24 aligns with the month-to-month common.

Apparently, miners have been rising their holdings regardless of revenues primarily remaining flat. This might point out a bullish sentiment amongst miners, who select to carry onto their Bitcoin slightly than promote it for quick revenue. This conduct might be a response to market expectations or a strategic transfer to affect market dynamics.

Regardless of flat revenues, miners’ current improve in Bitcoin holdings suggests a bullish sentiment amongst this key market group. It may positively impression Bitcoin costs within the quick time period.

Nevertheless, miner conduct alone received’t exert sufficient strain in the marketplace to push Bitcoin’s value above its present stage.

The put up Miners are rising their Bitcoin balances once more appeared first on CryptoSlate.

[ad_2]

Source link