[ad_1]

Fast Take

Miner capitulation danger represents the potential for miners to stop operations resulting from unprofitability, resulting in a major discount in hash price. A drop in hash price can additional exacerbate promoting stress as miners liquidate their holdings to cowl operational prices.

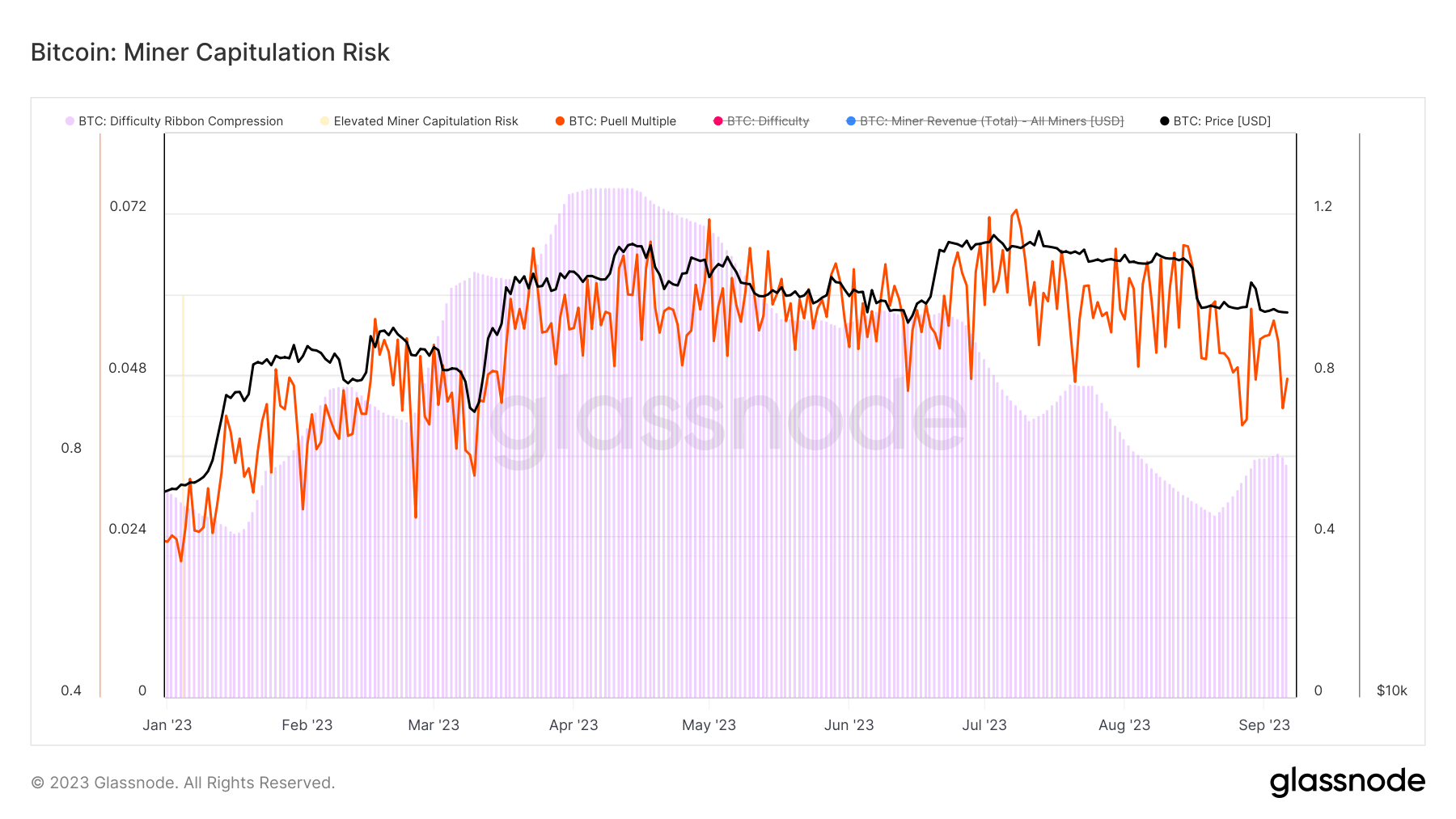

This danger is assessed via two metrics — the Puell A number of and the issue ribbon compression (DRC). The Puell A number of represents an implied stress mannequin, with low values signaling a better chance of miner revenue stress. DRC is an express stress mannequin, exhibiting how a lot of the hash price is coming offline.

As of Sep. 6, knowledge from Glassnode has proven no elevated danger of miner capitulation. The Puell A number of dropped beneath the 1 mark on Sep. 3, but it surely’s nonetheless standing effectively above the 0.6 stage the place the inherent danger of capitulation units in. Regardless of seeing sharp drops brought on by Bitcoin’s stoop, neither the Puell A number of nor the Problem Ribbon Compression (DRC) are signaling significant lows.

Whereas miners could be feeling the monetary pressure, they aren’t at risk of capitulation. Regardless of value volatility, this stability within the mining sector exhibits that the market isn’t dealing with an instantaneous risk from elevated sell-offs by miners.

The put up Miner capitulation danger nonetheless not elevated regardless of Bitcoin’s value drop appeared first on CryptoSlate.

[ad_2]

Source link