[ad_1]

Be part of Our Telegram channel to remain updated on breaking information protection

Software program improvement firm MicroStrategy plans a share providing to boost $750 million and stated it’s going to use a few of the funds to purchase extra Bitcoin.

One of many largest company Bitcoin holders, MicroStrategy, introduced the plan to promote shares in a doc submitted to the Securities and Alternate Fee on August 1. The funds may also be used for common enterprise targets and dealing capital, it stated.

TRENDING: MicroStrategy plans to promote as much as $750 million of inventory to probably fund extra #Bitcoin purchases.

— LunarCrush (@LunarCrush) August 2, 2023

“As with prior applications, we might use the proceeds for common company functions, which embody the acquisition of Bitcoin in addition to the repurchase or compensation of our excellent debt,” stated MicroStrategy Chief Monetary Officer Andrew Kang within the firm’s second quarter earnings name.

MicroStrategy recorded a internet revenue of $22.2 million within the second quarter, in contrast with a $1.1 billion internet loss a yr earlier. At $120.4 million, whole revenues had been flat.

A big portion of the variance was introduced on by a digital asset impairment loss within the quarter that was $24.1 million, as opposed to an enormous $917.8 million loss the earlier yr.

Extra Bitcoin Investments

MicroStrategy founder and chairman Michael Saylor disclosed by way of X that the corporate had spent greater than $14.4 million in July to buy an extra 467 Bitcoins (BTC). With this newest acquisition, it held 152,800 BTC on the finish of July 31 valued at virtually $4.5 billion.

In July, @MicroStrategy acquired an extra 467 BTC for $14.4 million and now holds 152,800 BTC. Please be part of us at 5pm ET as we focus on our Q2 2023 monetary outcomes and reply questions in regards to the outlook for #BusinessIntelligence and #Bitcoin. $MSTR https://t.co/SCHeBJ80TH

— Michael Saylor⚡️ (@saylor) August 1, 2023

“Our bitcoin holdings elevated to 152,800 bitcoins as of July 31, 2023, with the addition within the second quarter of 12,333 bitcoins being the most important enhance in a single quarter since Q2 2021,” CFO Kang revealed.

Kang stated that the corporate used money from operations to extend the quantity of Bitcoin on its steadiness sheet. This was performed in opposition to a “promising backdrop” of institutional curiosity, accounting transparency, and rising regulatory readability for Bitcoin.

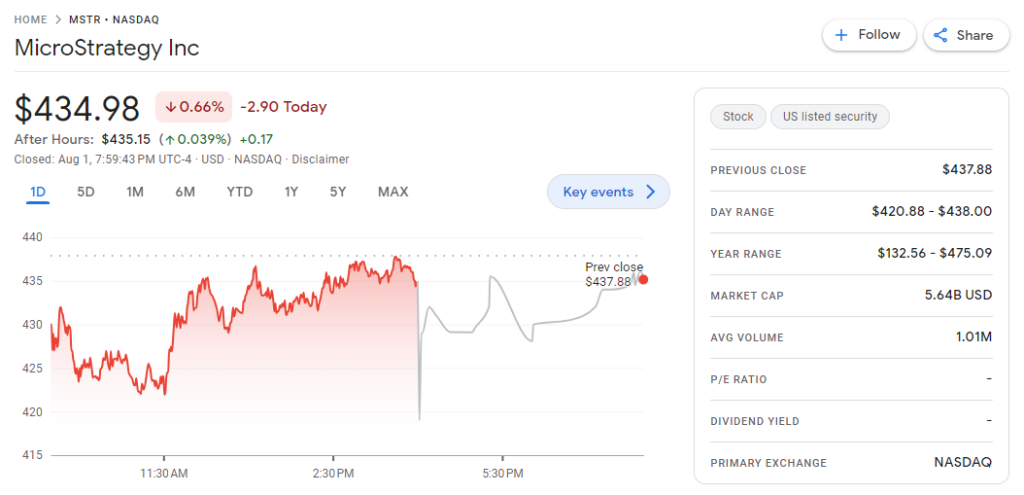

The enterprise acquired most of its new digital gold by promoting 1.08 million shares of inventory for $333.5 million, or round $309 per share, by means of a cope with brokers Cowen and Canaccord Genuity. The shares surged to $434.98 on the quarter’s finish, closing at $342.42.

Regardless of these lofty projections, the company reported that the carrying worth of its Bitcoin was solely $2.3 billion, that means the asset’s unique price was much less any depreciation, amortization, or impairment prices.

With a mean carrying worth per Bitcoin of $15,251, that determine represents cumulative impairment losses of $2.196 billion since MicroStrategy’s first buy.

The corporate additionally reported that Bitcoin and MicroStrategy’s MSTR shares outperformed a number of different indexes and property. Whereas Bitcoin has elevated by 145% since MSTR carried out its Bitcoin technique in August 2020, MSTR has profited 254%.

The share worth of MSTR was $145.02 a share on January 3, in accordance with Google Finance. It has since jumped to $434.98 as of this writing. In July, New York-based funding agency Berenberg Capital printed a bullish forecast for MicroStrategy.

Over 2023, the worth of Bitcoin has progressively elevated, rising 79% for the reason that yr’s starting. Within the second quarter, the price of Bitcoin fluctuated between $25,000 and $30,700, with a considerable enhance in mid-June following the SEC submitting of quite a few new spot Bitcoin exchange-traded funds.

Associated Articles

Wall Road Memes – Subsequent Massive Crypto

Early Entry Presale Stay Now

Established Neighborhood of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Finest Crypto to Purchase Now In Meme Coin Sector

Group Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link