[ad_1]

MATIC is at present going through elevated uncertainty because it has been formally categorized as a safety by the US Securities and Trade Fee, as revealed within the current submitting towards Binance.

Consequently, the Polygon blockchain token skilled a big drop of 31% inside every week, setting a brand new document. Nonetheless, there may be some constructive information because it has managed to get better, witnessing a promising rebound of over 11% within the final 24 hours.

Supply: Coingecko

L2 cash would be the subsequent bullrun cash. Already knew, already confirmed.$SOL $ADA $MATIC and others L1’s received the safety stamp. Regulation will kick laborious = tight selection of L1/L2 cash. The place will all this cash move to? pic.twitter.com/jw5xpLRA4j

— Zoomer Oracle (@ZoomerOracle) June 5, 2023

MATIC is among the 13 tokens inside the Binance lawsuit to be designated as a safety. Polygon Labs, the developer of MATIC, issued an announcement on Twitter defending Polygon saying that the community is “developed outdoors the US, deployed outdoors the US, and targeted to this present day on the worldwide group that helps the community.”

This current lawsuit towards Binance was adopted up by the SEC’s lawsuit towards Coinbase, citing that the corporate is working an unregistered change in reference to the corporate’s staking service.

Worry, Uncertainty And Doubt In The Market

With the current classification of a number of cryptocurrencies as securities, the market has slid significantly inside the previous week. Bitcoin, the highest cryptocurrency, gained dominance in gentle of the current regulatory fillings towards Binance and Coinbase.

The opposite tokens within the record are SOL, ADA, FIL, ATOM, SAND, MANA, ALGO, and COTI. In accordance with the lawsuit, the tokens are listed as funding contracts. This made the SEC label them as securities in accordance with the Howey Take a look at, which is a check to know whether or not a sure asset is a safety or not.

MATIC market cap at $5.8 billion. Chart: TradingView.com

This transfer by the SEC was consistent with its current actions towards the crypto trade. Simply this February, the regulatory physique cracked down on Kraken’s staking service together with forcing the corporate to pay $30 million in penalties for the violations.

If the talked about tokens and corporations fail to adjust to the SEC, it might result in one other Ripple-like occasion which can have an effect on the market.

MATIC Bulls Ought to Watch This Stage

On the time of writing, MATIC is being supported on the $0.6 worth degree which can act because the launch pad for future bullishness. Nonetheless, exterior market forces nonetheless maintain sway within the token’s momentum and worth actions within the close to future. The current lawsuits already slashed tens of millions upon tens of millions of attainable good points for buyers.

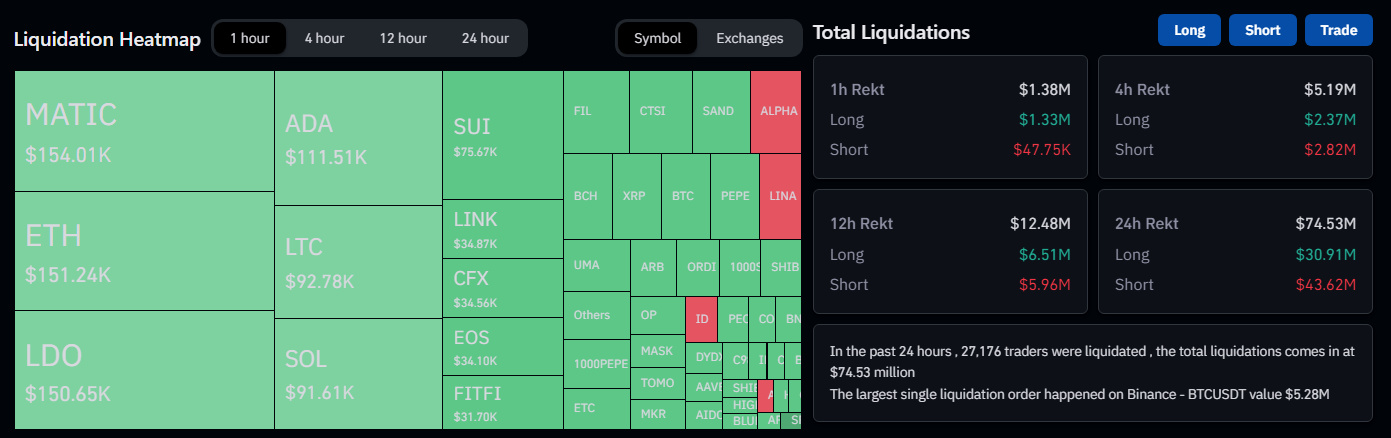

Supply: Coinglass

In the meantime, CoinGlass knowledge reveals MATIC lengthy positions being liquidated because the market crashed after the lawsuits had been made public.

Regardless of this, shopping for strain after the crash continued with MATIC bulls holding $0.6 help. If they’ll maintain on to this help degree, we would be capable to see a return in the direction of the $0.83 help within the medium to long run.

Featured picture from The Every day Hodl

[ad_2]

Source link