[ad_1]

Be part of Our Telegram channel to remain updated on breaking information protection

The deliberate conversion of BitDAO (BIT) tokens valued at $43 million to Mantle (MNT) by Alamada Analysis, in addition to the operations of the now defunct FTX trade, have encountered a roadblock.

This growth is available in gentle of an initiated dialogue by a group member inside the Mantle decentralized autonomous group (DAO). The proposal seeks to cease the collapsed entity from the token swap course of amidst the continued token migration.

Automated Migratability of FTX Teams Token To be Restricted

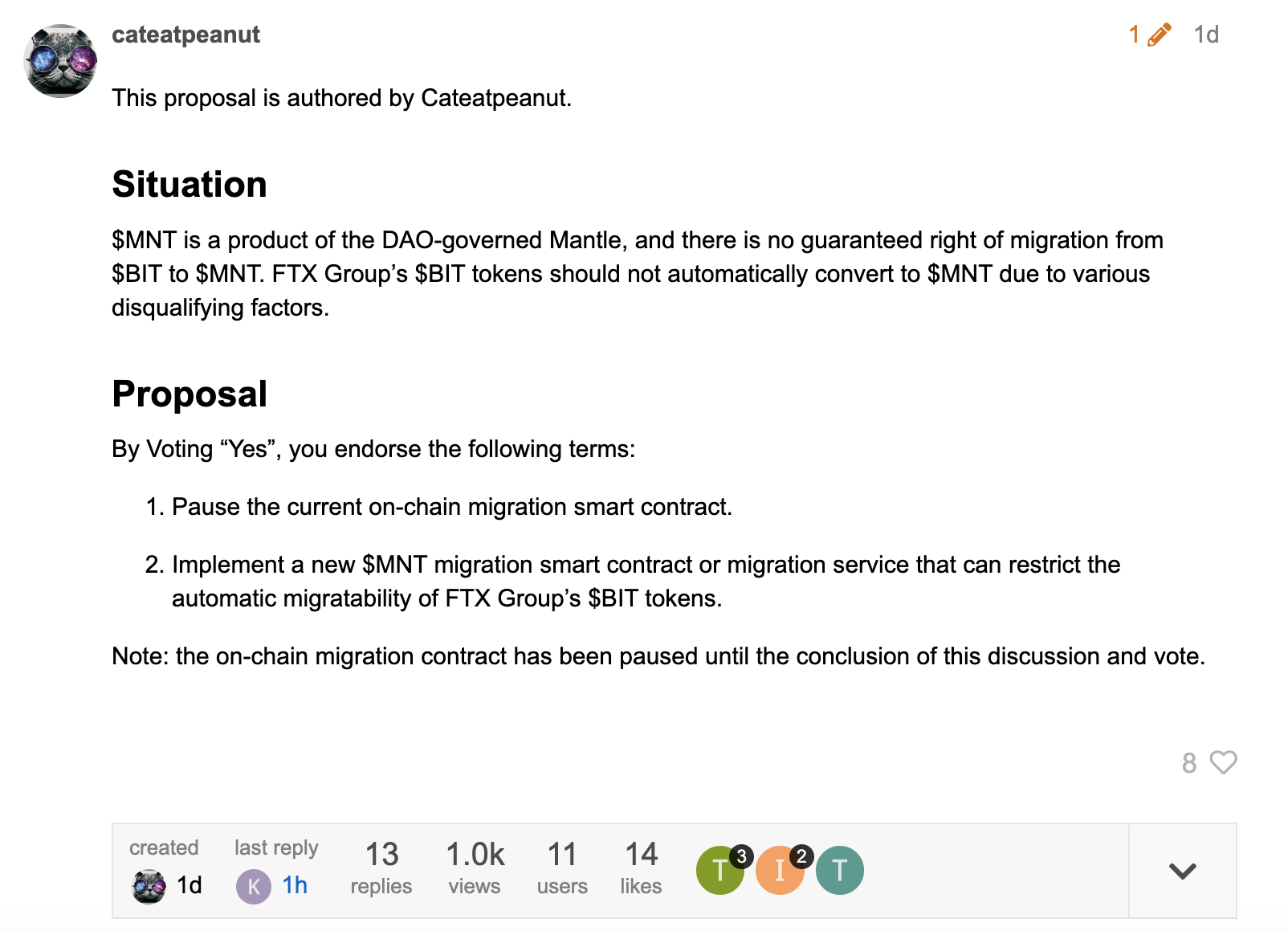

FTX trade and Alameda Analysis at present possess roughly $43 million price of BIT tokens, a results of BitDAO’s trade of 100 million BIT for over 3.3 million FTX tokens in 2021. Nonetheless, the panorama has undergone important transformation since then, with the collapse of the FTX trade. This flip of occasions prompted a BitDAO group member, who goes by the username “cateatpeanut,” to provoke a dialogue inside the Mantle decentralized autonomous group (DAO).

Cateatpeanut’s perspective contends that the BIT tokens held by the FTX group shouldn’t be included within the migration course of proposed for the newly launched MNT token. The reasoning behind this stance revolves round a number of components that disqualify these tokens from participation. Just a few months earlier, a proposal aiming to determine a “One Model, One Token” precept gained traction and was subjected to a vote on BitDAO’s Snapshot platform.

This proposal, put forth by the identical consumer, cateatpeanut, instructed a transition from the BitDAO BIT token to a recent governance token. This initiative, designated as proposal BIP-21, entails the consolidation of the BitDAO ecosystem, encompassing governance (BitDAO) and product (Mantle), below the banner of Mantle.

Whereas governance processes and treasury administration would stay unaffected, BIT holders would endure a token conversion course of to undertake the brand new Mantle token following group ratification. On Might 19, the proposal to merge Mantle and BitDAO garnered overwhelming help from the group.

The Bybit-supported L2 community Mantle group proposed that the BIT token owned by FTX/Alameda shouldn’t be transformed to new MNT token.

Alameda as soon as received 100 million BITs utilizing 362,315 FTT in 2021. Alameda at present holds 98.86 million BIT price $42 million.…

— Wu Blockchain (@WuBlockchain) August 18, 2023

Nonetheless, a current discourse amongst group members has unveiled a important facet: the tokens owned by the now-defunct crypto entity don’t possess an assured entitlement to migration within the context of those discussions. Presently, the on-chain migration contract has been paused till the conclusion of the dialogue and the vote.

What Does the BIP-21 Proposal Entail?

Following a reported vote depend of 235 million BIT in favour and 988 BIT towards, the BIT token’s transformation into the MNT token was endorsed. This MNT token presently stands because the indigenous foreign money inside the Mantle ecosystem. The deliberate conversion is anticipated to happen previous to the rollout of the Mantle L2 mainnet, a strategic transfer geared toward sparing token holders from incurring fuel charges linked to the conversion course of.

It’s price noting that the proposed modifications are projected to go away governance preparations unaffected. In response to the stipulations outlined within the BIP-21 snapshot, these alterations are strictly categorized as a “beauty rebranding.” The underlying intent of those changes is to streamline branding, mitigate potential confusion, and optimize the general BitDAO ecosystem, all in preparation for the upcoming mainnet launch.

FTX and its BIT Holdings

In November 2021, Alameda cast a take care of BitDAO, the precursor to Mantle. Each entities received right into a deal which executed a swap involving 100 million BIT tokens for barely over 3.3 million FTX tokens (FTT). This transaction held a valuation of $100 million on the time and was accompanied by a binding 3-year lock-up dedication. This meant that neither occasion might offload the opposite’s tokens till November 2024, which is greater than a 12 months away.

With a large chunk of BIT tokens being held by FTX, the now-defunct firm will be capable to purchase a substantial share of MNT’s provide upon migration. The competition arises from the assumption that FTX shouldn’t be capable of get pleasure from these advantages after falling wanting upholding its earlier lock-up association. The trade had already been suspected of dumping its BIT tokens throughout its crash a pair months in the past.

On the opposing facet of the discourse, there’s a perspective asserting that imposing programmatic restrictions on FTX’s participation might doubtlessly forged the community within the gentle of centralization and subjectivity. The decision of this matter emerges as a pivotal evaluation of early governance for the fledgling Mantle DAO, carrying weighty implications for its trajectory.

Associated Information

Wall Avenue Memes – Subsequent Massive Crypto

Early Entry Presale Stay Now

Established Group of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Greatest Crypto to Purchase Now In Meme Coin Sector

Workforce Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link