[ad_1]

The Maker token, MKR, has managed to interrupt the $1,500 stage with a pointy 15% rally as on-chain information exhibits MKR has seen excessive tackle exercise not too long ago.

Maker Has Outperformed Prime Cash With 15% Rally In Previous Week

Whereas giants like Bitcoin have struggled not too long ago, MKR has confirmed to be totally different because the coin has noticed a powerful run of bullish momentum. Following the newest leg up within the asset’s rally, it has surged previous the $1,500 stage, a feat it hasn’t replicated since Might 2022, nearly a 12 months and a half in the past now.

Associated Studying: Bitcoin Bearish Sign: Lengthy-Time period Holders Deposit To Exchanges

The beneath chart exhibits what the asset’s latest rally has seemed like:

The worth of the cryptocurrency has sharply gone up in latest days | Supply: MKRUSD on TradingView

Out of the highest 100 cryptocurrencies by market cap, solely Chainlink (LINK) and Curve (CRV) have seen higher returns than Maker’s 15% good points throughout the previous week.

Even these two property haven’t seen bullish momentum as constant as MKR prior to now month, although, as MKR’s excellent 42% earnings within the interval notably outshine theirs.

Maker Energetic Addresses Have Hit A ten-Week Excessive

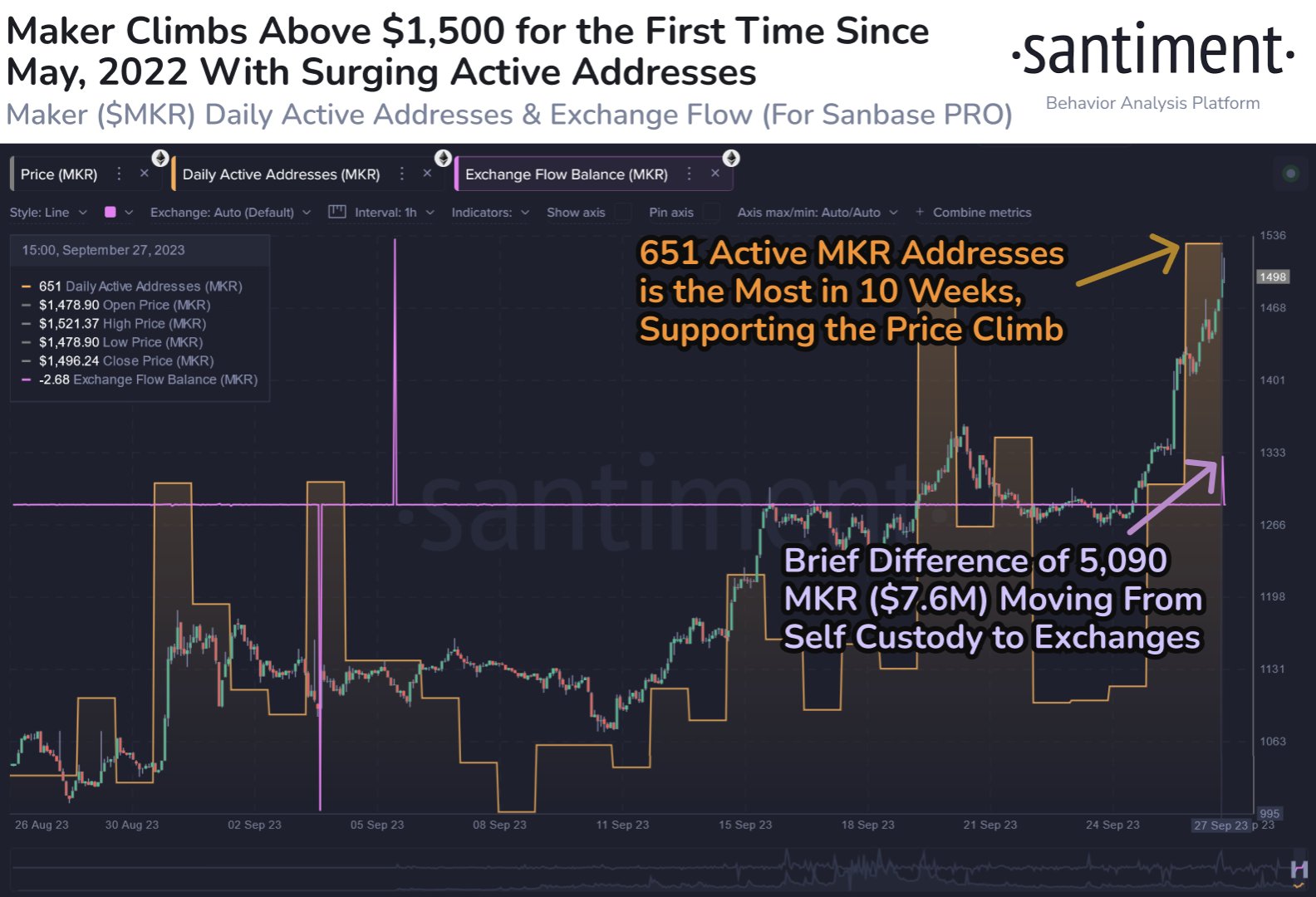

In accordance with information from the on-chain analytics agency Santiment, this sharp run in MKR has come alongside a surge within the cryptocurrency’s “energetic addresses” metric.

This indicator retains monitor of the day by day complete variety of distinctive Maker addresses which can be participating in some sort of transaction exercise on the blockchain. This metric’s worth can merely be checked out as the quantity of site visitors that the community is receiving day-after-day.

When the indicator has excessive values, it implies that numerous customers are taking part within the buying and selling exercise of the asset. Such a development implies that curiosity within the coin is excessive at present.

Now, here’s a chart that exhibits how the energetic addresses metric has modified for MKR throughout the previous month:

Appears like the worth of the indicator has shot up over the previous few days | Supply: Santiment no X

From the graph, it’s seen that the Maker energetic addresses have climbed up alongside the rally within the asset’s value. After the newest enhance within the indicator, its worth has hit 651, which is the very best noticed in round 10 weeks.

Usually, for any surge to be sustainable, it requires continued participation from a considerable amount of merchants. Rallies that aren’t accompanied by a ample rise in person exercise often run out of steam earlier than lengthy.

For the reason that newest Maker surge has seen an growing variety of addresses turning into energetic, indicators might be trying good for its sustainability. As the worth continues its run, although, some traders is likely to be tempted to reap the excessive earnings that they’ve amassed.

In the identical chart, Santiment has additionally connected the information for the alternate netflow, which exhibits that some inflows of $7.6 million simply have occurred in direction of centralized alternate platforms, implying that profit-taking might already be starting.

This can be a comparatively modest quantity, however the analytics agency warns that inflows may be one thing to be cautious about, as they might lead in direction of at the least a short lived prime within the value.

Featured picture from Shutterstock.com, charts from TradingView.com, Santiment.web

[ad_2]

Source link