[ad_1]

Definition

What’s M2 in cash provide? M2 is a metric used to gauge the amount of cash provide in the US. It contains a broader vary of economic property in comparison with the extra restricted M1 measure, which incorporates forex and cash held by the non-bank public, checkable deposits, and vacationers’ checks. The M2 measure additionally provides financial savings deposits resembling cash market deposit accounts, small-time deposits which can be beneath $100,000, and shares in retail cash market mutual funds.

Fast Take

Traders discuss % achieve in each nominal and actual phrases. Nominal doesn’t contemplate inflation, however actual phrases contemplate inflation.

Traditionally, over time, property resembling S&P, gold, home costs, and even Bitcoin have tended to go up in worth in nominal phrases.

Nonetheless, if you regulate for inflation or the cash provide, you get a really totally different return in your funding.

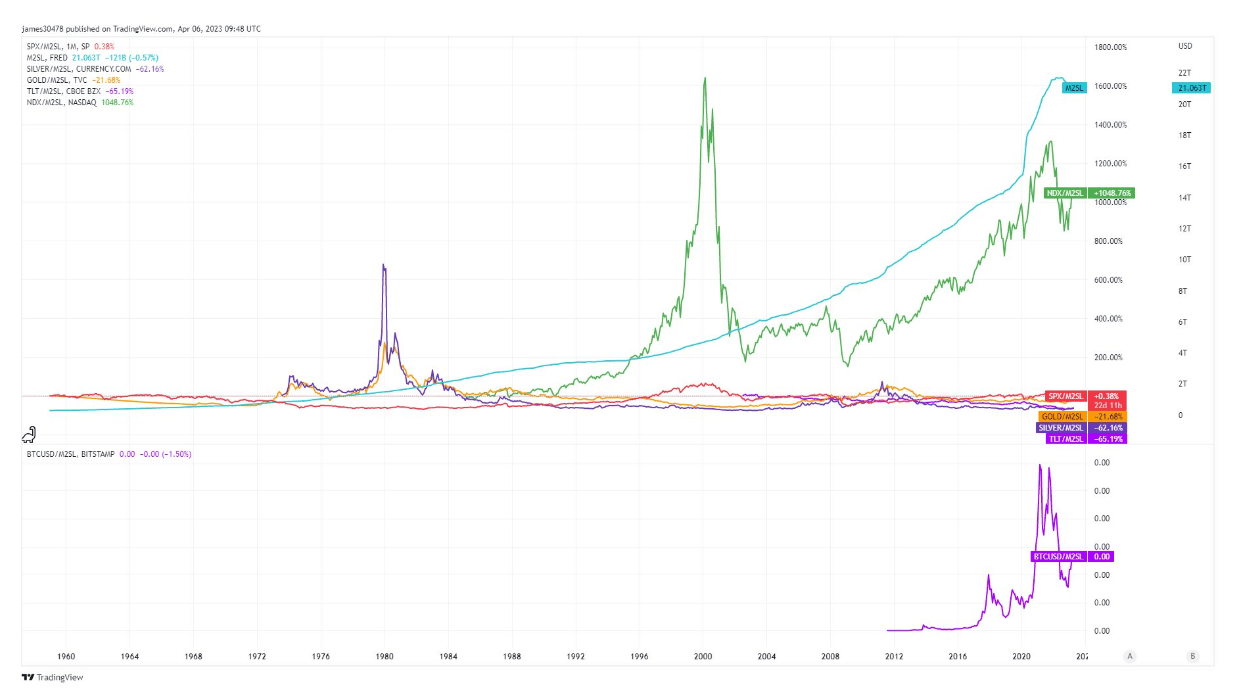

The M2 cash provide has grown quickly and has now surpassed 21 trillion. But, asset efficiency appears to be like fairly totally different if you regulate for cash provide progress.

Bitcoin is the one asset that has eclipsed its earlier all-time excessive, whereas the subsequent greatest performer is the Nasdaq. Nonetheless, that failed to interrupt its all-time excessive in 2000, and we advise no motive for it to interrupt it sooner or later.

Given Bitcoin’s provide dynamics and the upcoming halving, there may be potential for a brand new all-time excessive to be reached even after adjusting for the cash provide, which may have important impacts available on the market.

Asset Returns: (Supply: Buying and selling View)Key figures:

TLT: -65%

Silver: -62%

Gold: -22%

SPX: +0.38%

Nasdaq: 1068%

BTC-USD: 108,000%

The put up M2 cash provide evaluation reveals one clear winner in race appeared first on CryptoSlate.

[ad_2]

Source link