[ad_1]

Fast Take

Up to now, 2023 has been a great yr for Bitcoin and threat belongings, with Bitcoin up 71%, Nvidia up 92%, and Meta up 68%.

The S&P 500 is up 7% whereas the Nasdaq is up 20%

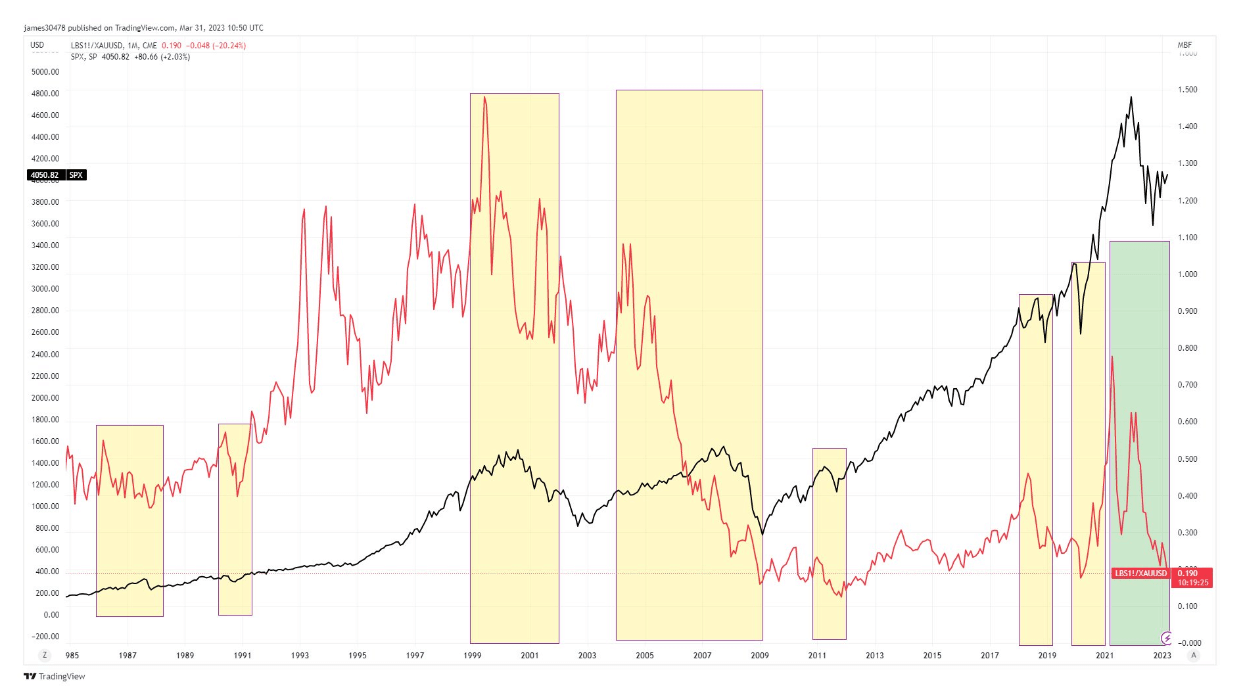

Nonetheless, the lumber-to-gold ratio signifies a risk-off surroundings, and the inventory market has at all times adopted a crash.

Highlighted are the areas the place the lumber-to-gold ratio collapsed, and subsequently, the S&P 500 went down.

1987 Crash

1990 Bear Market

2000 Tech Bubble

2008 Lehman Crash

2011 Summer time Crash

2018 4Q Correction

2020 Covid Crash

As Bitcoin is considerably correlated to the US inventory market this might imply additional headwinds for Bitcoin.

The publish Lumber to gold ratio breaks down, suggesting a risk-off surroundings appeared first on CryptoSlate.

[ad_2]

Source link