[ad_1]

Be part of Our Telegram channel to remain updated on breaking information protection

Legal professionals are the massive winners from a sequence of crypto business bankruptcies with a price fest price greater than $700 million, the New York Occasions (NYT) reported.

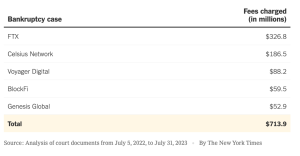

Legal professionals, accountants, consultants, cryptocurrency analysts, and different professionals have earned the charges since final 12 months, in line with an evaluation by the NYT. The tally relies on what the newspaper known as an exhaustive evaluation of greater than 5,000 pages of billing statements and court docket paperwork from the bankruptcies of FTX, Celsius Community, Voyager Digital, BlockFi, and Genesis International.

FTX stands out because the case with the best charges, totaling $326.8 million. The full charges comprise each these formally authorized by a chapter choose and a few which can be nonetheless pending approval.

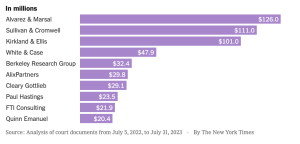

Two main legislation corporations, Sullivan & Cromwell and Kirkland & Ellis, emerge as among the many greatest beneficiaries, the story stated. Sullivan & Cromwell, managing FTX’s chapter, has billed over $110 million in authorized charges, whereas Kirkland & Ellis has charged $101 million for his or her involvement in three of the cryptocurrency bankruptcies, the NYT reported.

Some stated the charges charged as exorbitant and pointless provided that lots of the people owed cash are beginner merchants who misplaced their private financial savings, the NYT story stated

Authorized Consultants Defend Crypto Chapter Charges

Legal professionals defended the charges, saying they invoice at market charges and argue that the bankruptcies are complicated and time-intensive.

In addition they cited the dearth of clear cryptocurrency laws as an element contributing to the complexity and elevated prices of dealing with the circumstances, the story added.

Charge Examiners to Monitor Prices

In some cases, judges overseeing the chapter circumstances have reportedly chosen to herald unbiased attorneys as price examiners, to control bills and collaborating with the corporations to trim any pointless spending, the story stated.

Katherine Stadler, because the price examiner for the FTX chapter case, stated that the proceedings had been on monitor to be very costly by any measure. She stated the prices incurred to this point already amounted to a good portion of FTX’s remaining money, the story added

Associated Articles

Wall Avenue Memes – Subsequent Huge Crypto

Early Entry Presale Reside Now

Established Neighborhood of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Finest Crypto to Purchase Now In Meme Coin Sector

Group Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link