[ad_1]

The pockets deal with marked as Justin Solar withdraws 200 million USDT from JustLend and deposits it into Huobi. Huobi’s USDT reserves have additionally elevated from round $85 million to the present $285 million. This text delves into the specifics of this transaction, its implications, and the encircling context.

Justin Solar, founding father of TRON and a widely known persona within the cryptocurrency area, has at all times been below the highlight for his strategic investments and his opinions on market dynamics. A latest transaction from a pockets deal with marked as his has made headlines.

The Massive Transfer: From JustLend to Huobi

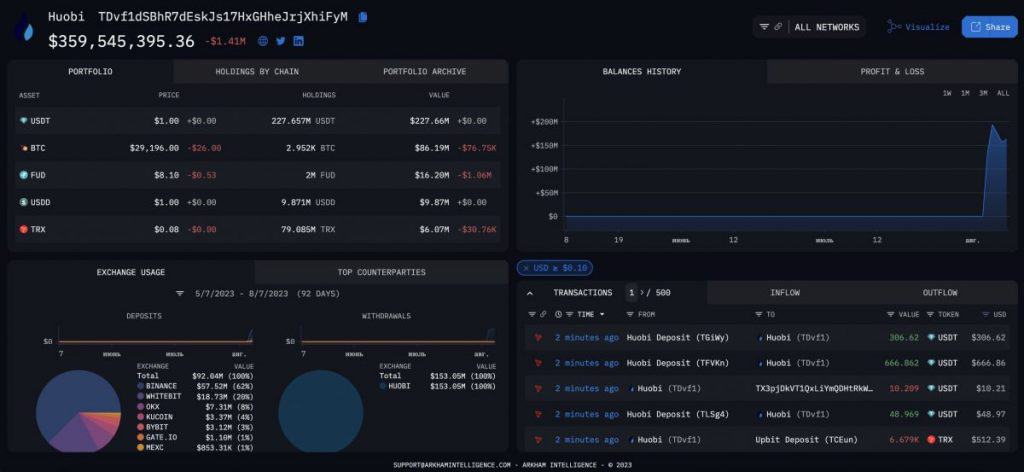

Not too long ago, somebody noticed a major transaction the place somebody withdrew 200 million USDT from JustLend, a widely known decentralized finance platform. This identical quantity then went into Huobi, a globally recognized cryptocurrency alternate. The supply of this transaction was a pockets deal with recognized as TDvf1dSBhR7dEskJs17HxGHheJrjXhiFyM, which has been labeled as belonging to Justin Solar. This has naturally sparked curiosity and speculations throughout the crypto group.

The pockets deal with marked as Justin Solar (TT2T17KZhoDu47i2E4FWxfG79zdkEWkU9N) withdraws 200 million USDT from JustLend and deposits it into Huobi. Huobi’s USDT reserves have additionally elevated from round $85 million to the present $285 million. Not too long ago, because of the investigation of…

— Wu Blockchain (@WuBlockchain) August 8, 2023

A Ripple Impact: Huobi’s Surging Reserves

Huobi’s USDT reserves have witnessed a major upsurge, from an preliminary $85 million to a staggering $285 million. This almost threefold enhance can largely be attributed to the latest deposit made by the aforementioned deal with.

It’s essential to know the broader context through which this transaction is going down. Not too long ago, sure executives of Huobi have come below police investigation. This scrutiny has led to apprehensions and uncertainty amongst its consumer base, prompting them to withdraw their funds from the platform. Amidst this backdrop, the large deposit into Huobi assumes better significance and has led many to surprise in regards to the strategic pondering behind such a transfer.

Evaluation and Implications

There are just a few potential causes and implications for this transfer:

Diversifying Property. Justin Solar, given his strategic acumen, could be trying to diversify his holdings. Shifting funds between platforms shouldn’t be unusual for high-net-worth people within the crypto area.Bolstering Confidence. Given the latest adverse publicity surrounding Huobi because of the investigations. A major deposit from a high-profile persona like Solar would possibly serve to revive some confidence within the platform.Market Technique. Solar, together with his huge expertise, might probably anticipate a market shift or alternative that many are usually not aware of. His actions usually carry weight and are carefully monitored for insights by analysts.

Within the always altering world of cryptocurrencies, such important fund actions, particularly when linked to distinguished figures like Justin Solar, inevitably create ripples. Whereas the precise motive behind this transfer stays speculative, it undoubtedly underscores the dynamic and complicated nature of cryptocurrency markets. We nonetheless have to see the opposite results this transaction will trigger within the broader context of Huobi’s operations and fame.

Learn extra:

[ad_2]

Source link