[ad_1]

The Mitsubishi UFJ Monetary Group, Datachain, and Solamitsu are engaged on making the Progmat Coin, a Yen-backed stablecoin, interoperable. Expectations are that it’s going to enhance settlement occasions and scale back related charges.

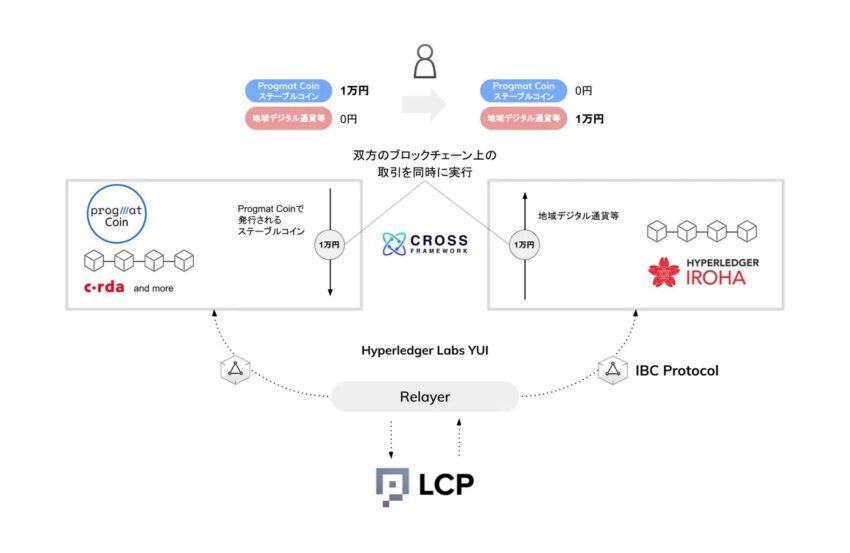

Mitsubishi UFJ Monetary Group, Japan’s largest financial institution, has began growth to make a home stablecoin interoperable. Native media shops report that the financial institution is working with Datachain and Solamitsu “to understand a clean mutual switch and trade between all kinds of desk cash to be issued domestically.”

Stablecoin Interoperability To Streamline Remittances

The stablecoin in query is named the Progmat Coin and makes use of the Hyperledger Iroha. The events state that the interoperability of this stablecoin with home monetary establishments will enhance trade. Companies intend to make use of Hyperledger Iroha, a permissioned blockchain community. The report reads,

“This can lead to all kinds of stablecoins and clean mutual transfers and exchanges between regional digital currencies that shall be issued by varied banks and different nations, and can have the ability to streamline interbank, business-to-business and private remittances.”

Sooner or later, growth efforts will shift in direction of cross-border remittances and lowering charges and can contain international central financial institution digital currencies (CBDCs). Japan expects to implement a invoice on stablecoins in 2023, which might permit banks to subject stablecoins.

Progmat Coin Might Have Intensive Use Circumstances

The Progmat Coin was first introduced in 2022 to streamline settlement processes. Nonetheless, Progmat is greater than only a settlement resolution, as it might additionally function on different networks. The truth that it should permit cross-border remittances and exchanges with different CBDCs provides to its use instances.

Progmat can be a platform, with a utility token reportedly within the works. Growth can also ultimately deal with NFTs and different crypto belongings. Contemplating Japan is attracting web3 expertise, the stablecoin may even see way more expansive use instances sooner or later.

Mitsubishi and Others Transfer Deeper Into Crypto

The Mitsubishi financial institution has been ramping up its efforts with respect to blockchain expertise and cryptocurrencies. As an illustration, the nation may quickly permit 13 registered belief banks, together with this one, to supply crypto custody providers. Whereas lawmakers are eager to make sure investor safety throughout these developments, particularly after the downfall of UST.

In newer information, China’s Alibaba introduced a web3 incubator in Japan that may see Tokyu Land Company and Skeleton Crew Studio collaborate. Later, it should introduce a blockchain node service.

Disclaimer

BeInCrypto has reached out to firm or particular person concerned within the story to get an official assertion in regards to the current developments, nevertheless it has but to listen to again.

[ad_2]

Source link