[ad_1]

Cardano has noticed some rise since hitting a low across the $0.23 stage following the FTX collapse. Nevertheless, right here’s what on-chain knowledge say about whether or not that was the underside or not.

Three Cardano Indicators Shot Up Throughout Native Backside Formation

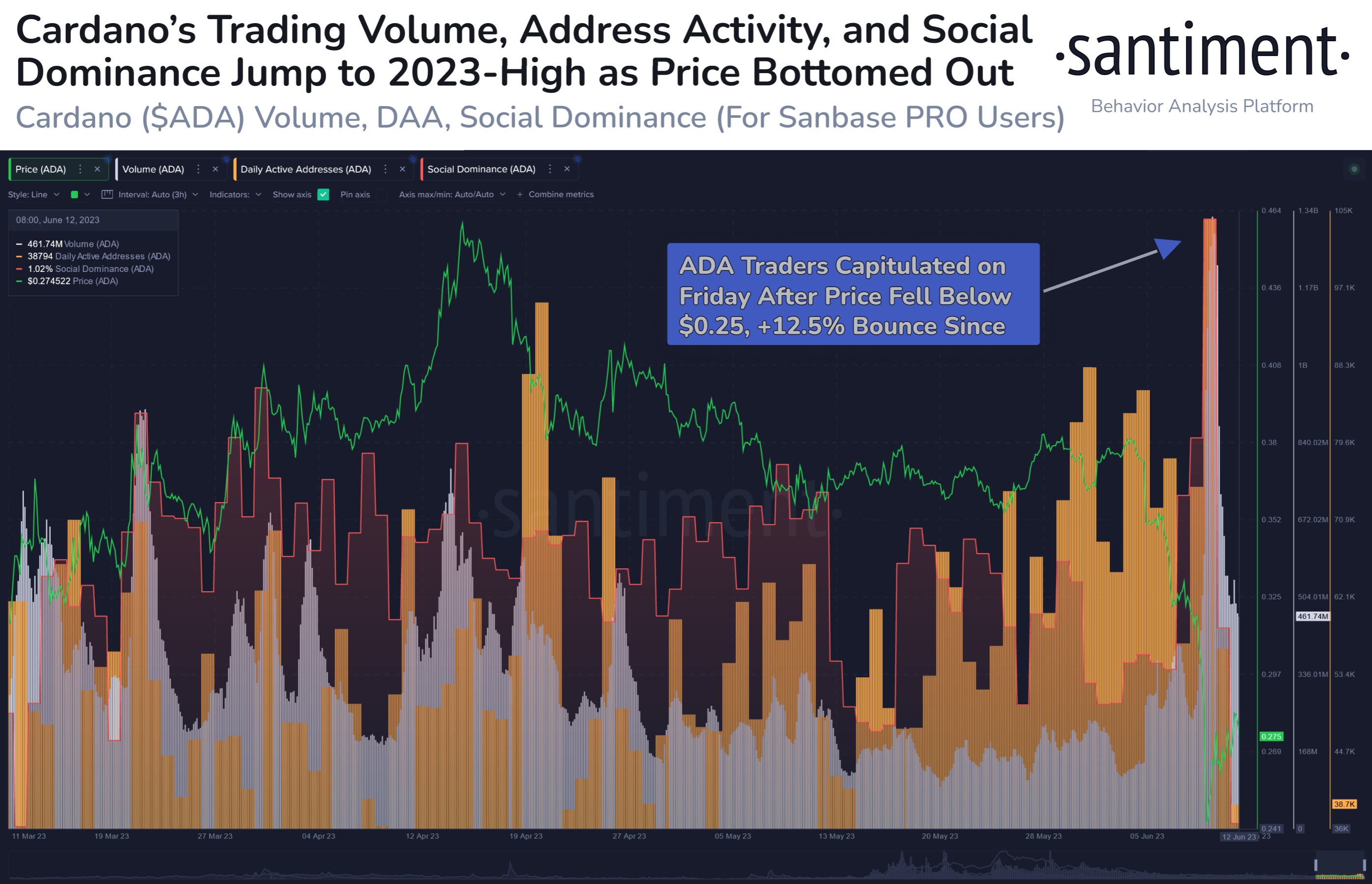

Based on knowledge from the on-chain analytics agency Santiment, three ADA metrics had surged to the very best stage for 2023 when the value hit the $0.23 low. The primary of those metrics is the “buying and selling quantity,” which measures the full quantity of Cardano that’s being moved round on the blockchain on daily basis by the customers.

When the worth of this metric goes up, it signifies that numerous tokens of the asset are being transacted on the community proper now. Such a development could be a signal that merchants are lively within the sector at present.

However, low values of the metric indicate the market is displaying low exercise for the time being. This type of development might recommend that there’s a lack of curiosity within the coin among the many common investor.

The second indicator of curiosity right here is the “day by day lively addresses,” which measures the day by day complete variety of distinctive Cardano addresses which might be participating in some transaction exercise on the blockchain.

This metric additionally gives us with hints about how lively the market is, however the important thing distinction between the day by day lively addresses and the buying and selling quantity is that the previous incorporates details about the variety of customers visiting the community, whereas the latter doesn’t.

A number of whales making giant strikes will present up as an lively market below the buying and selling quantity, whereas the lively addresses would disagree as there aren’t many customers concerned in such a state of affairs. Naturally, each these indicators collectively can present an correct image of the market.

Now, here’s a chart that reveals the development in these Cardano indicators over the previous few months:

Seems to be just like the metrics have noticed a pointy leap in current days | Supply: Santiment on Twitter

From the graph, it’s seen that each the buying and selling quantity and the day by day lively addresses spiked when the asset’s value was declining and hit a low across the $0.23 stage.

This may indicate that each when it comes to the full variety of customers and the full quantities that they had been shifting, the market had turned fairly lively throughout this value plunge.

The chart additionally consists of the info for the third related metric right here, “social dominance.” Briefly, this indicator tells us what share of discussions on social media associated to the highest 100 cryptocurrencies by market cap is coming from posts particularly about Cardano.

The ADA social dominance additionally shot up concurrently the opposite indicators, implying that the curiosity across the asset jumped on social media as the value quickly declined.

All these metrics rising collectively through the formation of this low may sign that there was real curiosity in shopping for the dip throughout the market. Naturally, if that is really the case, the underside might doubtlessly now be in for Cardano.

ADA Value

On the time of writing, Cardano is buying and selling round $0.27, down 22% within the final week.

ADA has been going up because the plunge | Supply: ADAUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Santiment.internet

[ad_2]

Source link