[ad_1]

Since its inception, Bitcoin has (virtually) all the time been the poster little one for volatility. But, the Bitcoin value is hardly shifting in any path in the mean time. However the newest knowledge suggests a stunning twist within the story.

As per a latest report by on-chain knowledge supplier Glassnode, “Bitcoin markets are experiencing an extremely quiet patch, with a number of measures of volatility collapsing in direction of all-time lows.” This raises the query: Are we getting into a brand new period of Bitcoin value stability, or is the market misreading the indicators?

Historic Context For The Volatility Of Bitcoin

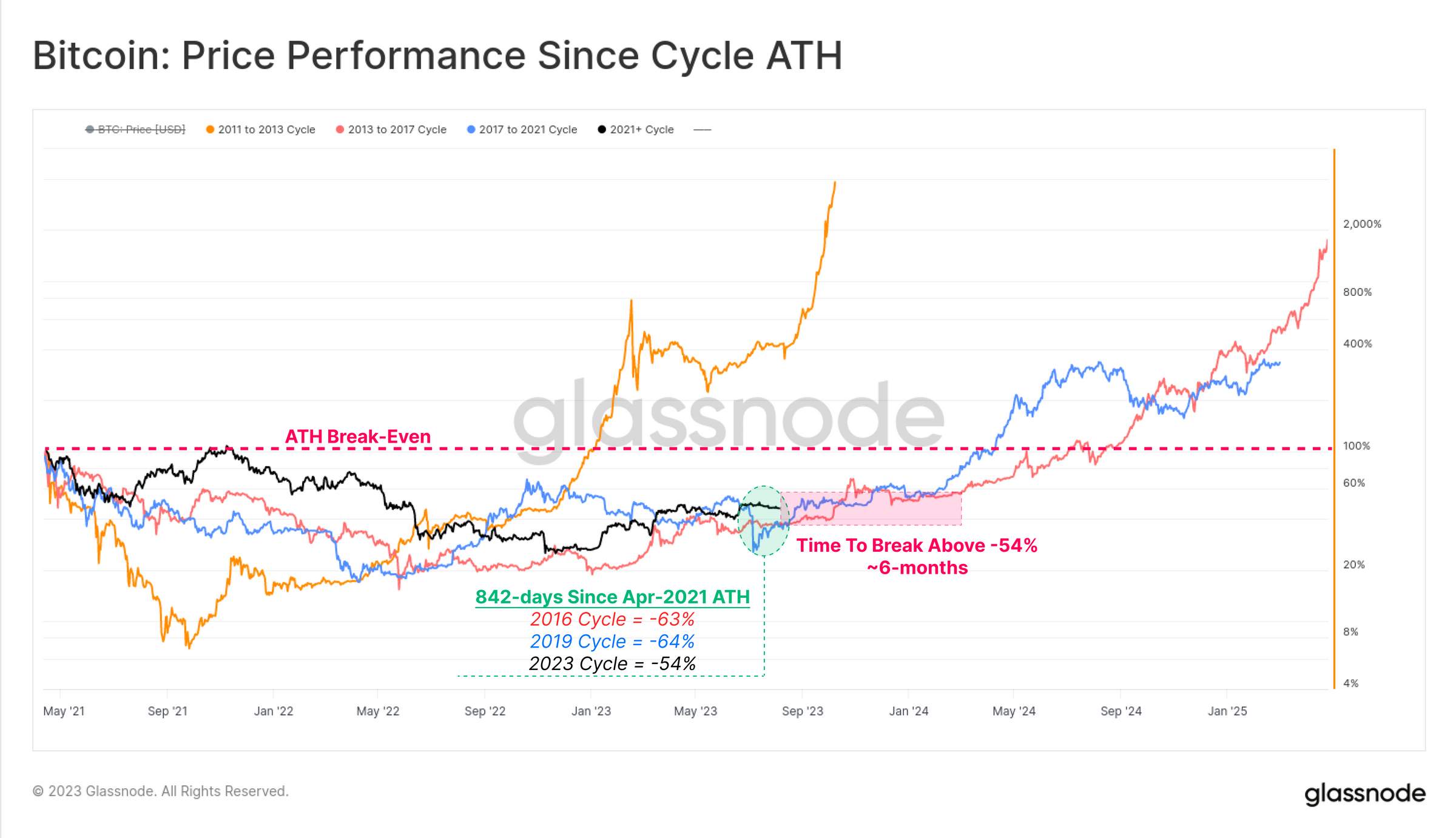

To actually perceive the present state of the market, it’s important to delve into the historic context. The Glassnode report notes, “It has been 842-days for the reason that bull market peak was set in April 2021.” Throughout this era, Bitcoin’s restoration has been extra sturdy than in earlier cycles, buying and selling at -54% under its all-time excessive (ATH), in comparison with a historic common of -64%.

Drawing parallels with previous cycles, the report highlights that each the 2015-16 and 2019-20 cycles underwent a “6-month interval of sideways boredom earlier than the market accelerated above the -54% drawdown degree.” This might be indicative of an identical “boredom” section within the present cycle.

One of the placing revelations from the Glassnode report is the intense volatility compression Bitcoin is presently present process. “Bitcoin realized volatility starting from 1-month to 1-year commentary home windows has fallen dramatically in 2023, reaching multi-year lows.” That is paying homage to 4 distinct intervals in Bitcoin’s historical past, together with the late stage of the 2015 bear market and the post-March 2020 consolidation following the outbreak of COVID-19.

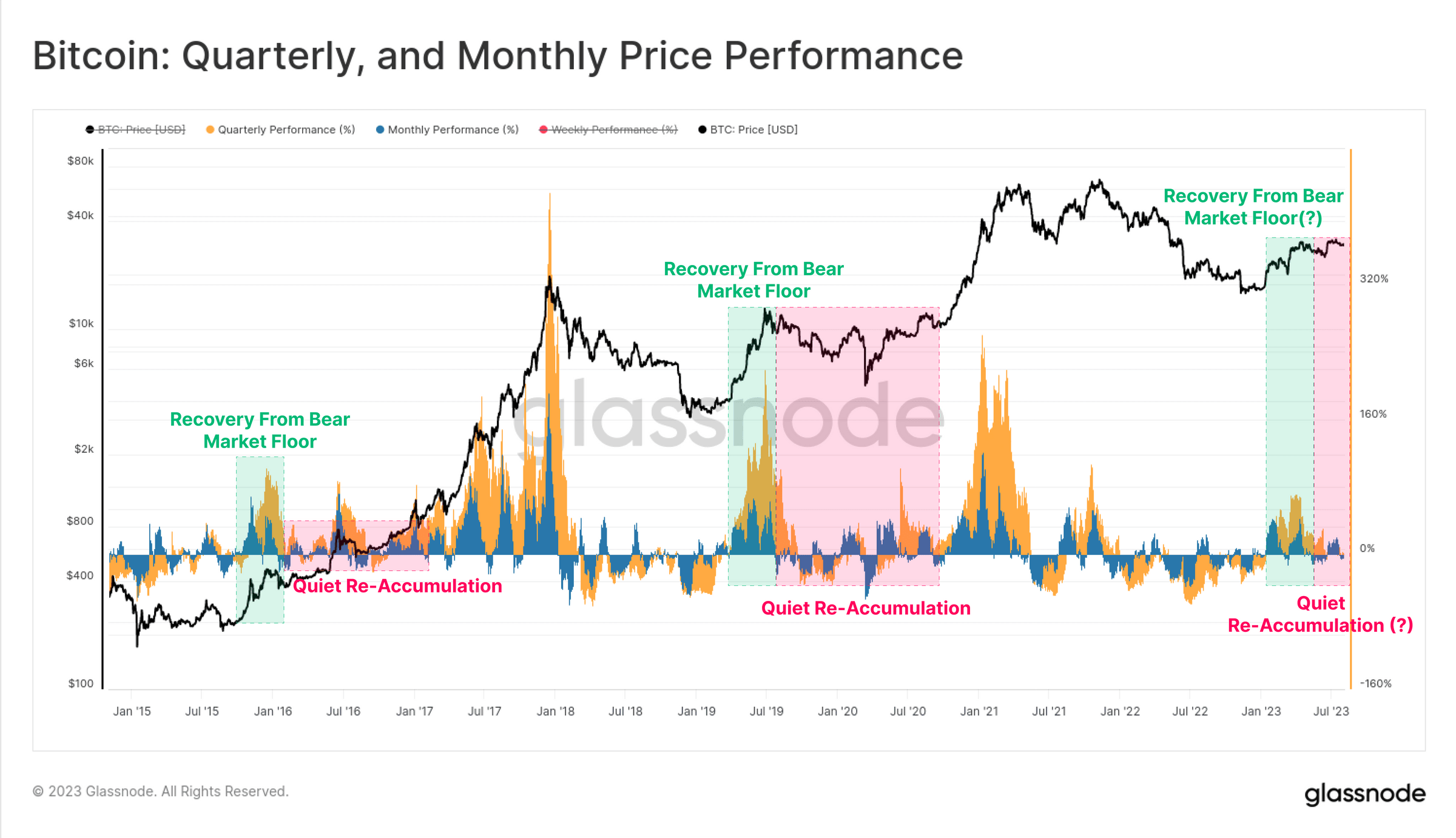

Following the livid rally firstly to 2023, the worth efficiency on each a quarterly and month-to-month foundation has moderated. This mirrors Bitcoin’s earlier cycles the place the preliminary surge from the low is strong, however then transitions into a protracted section of uneven consolidation, a section of re-accumulation.

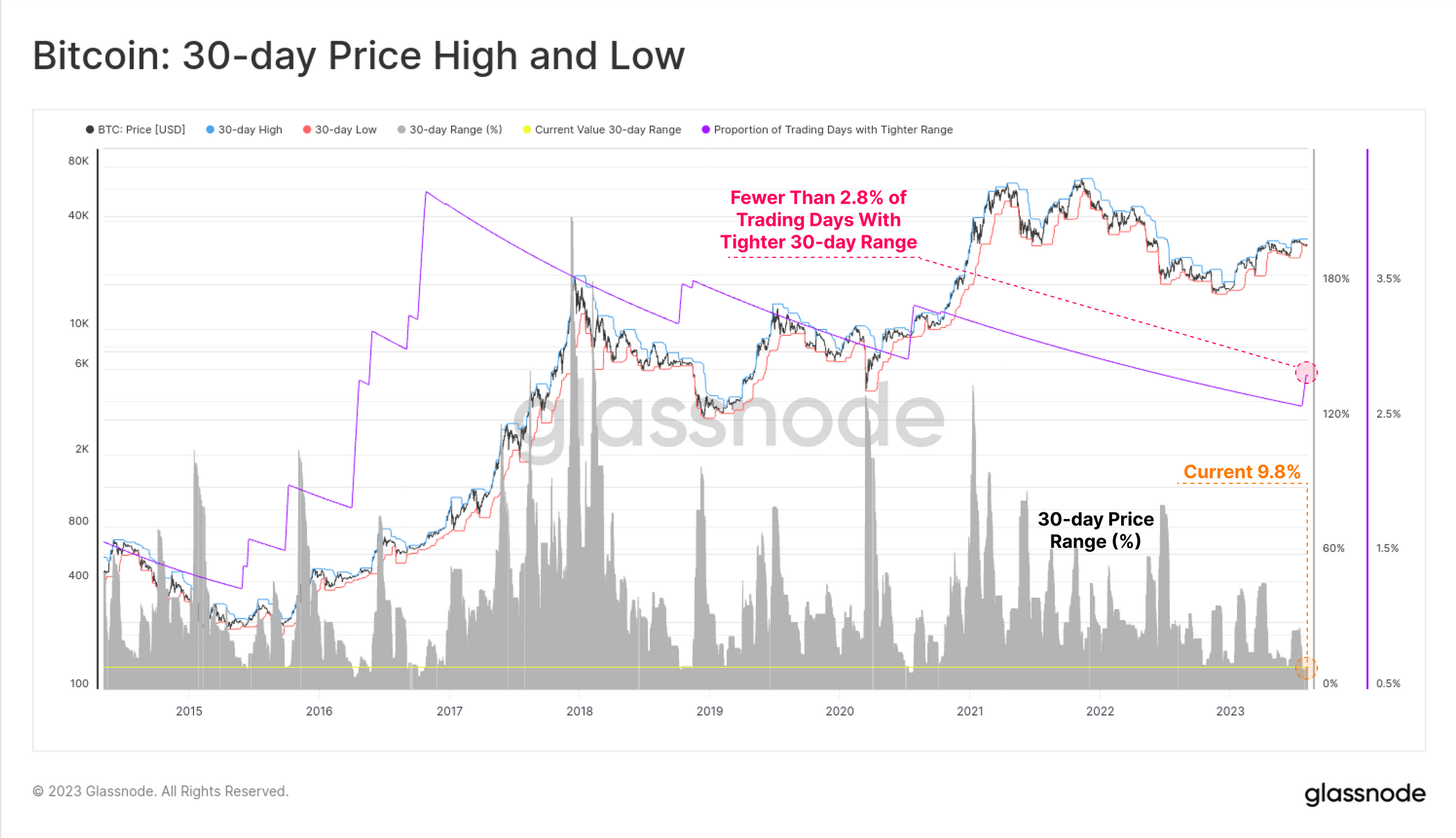

Moreover, the report states, “The worth vary which separates the 7-day excessive and low is simply 3.6%. Simply 4.8% of all buying and selling days have ever skilled a tighter weekly commerce vary.” The 30-day value vary is much more excessive, constricting value to only a 9.8%, and with solely 2.8% of all months in BTC’s historical past being tighter. Such ranges of value compression are uncommon for Bitcoin, suggesting an anomaly or a possible precursor to a big market transfer.

Derivatives Market Insights

The derivatives market, typically seen as a barometer for underlying asset sentiment, can also be echoing this quiet spell. “The mixed Futures and Choices commerce quantity for [BTC and ETH] are at, or approaching all-time-lows,” the report notes. That is additional emphasised by the truth that “BTC is presently seeing $19.0B in mixture derivatives commerce quantity, while ETH markets have simply $9.2B/day.”

Curiously, the choices market is exhibiting indicators of a big “volatility crush.” As per Glassnode, “Choices are pricing within the smallest volatility premium in historical past, with IV between 24% and 52%, lower than half of the long-term baseline.” That is additional corroborated by the traditionally low Put/Name Ratio and the 25-delta skew metric, suggesting a internet bullish sentiment available in the market.

The crux of the matter lies in deciphering these indicators. The report aptly questions, “Given the context of Bitcoin’s notorious volatility, is a brand new period of BTC value stability upon us, or is volatility mispriced?” Traditionally, intervals of low volatility in Bitcoin have typically been adopted by vital value actions. Whether or not this can be a calm earlier than a storm or a real shift in direction of a extra secure Bitcoin stays to be seen.

However as Tony “The Bull”, the chief chart technician at NewsBTC, has identified yesterday, the technical indicators are additionally pointing to a protracted interval of re-accumulation, that means that the section of low volatility is prone to proceed for a while to return.

At press time, the BTC value was at $29,277.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link