[ad_1]

Michael Burry, famend investor, and hedge fund supervisor, has as soon as once more made headlines together with his vital quick place within the conventional market, which may impression the nascent crypto trade if his guess is to materialize.

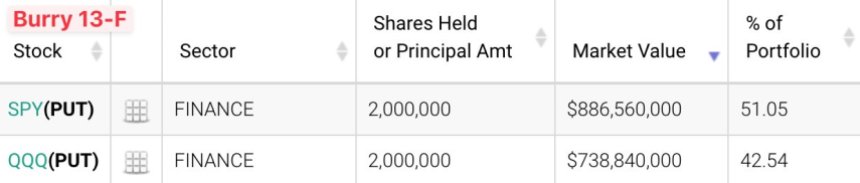

Burry, recognized for precisely predicting the subprime mortgage disaster, just lately went mega-short with over $1.6 billion in S&P 500 (SPY) and Nasdaq 100 (QQQ) places. These indexes typically report a excessive correlation with the crypto market as they appeal to comparable buyers.

Burry’s $1.6 Billion Brief Indicators Potential Implications For Crypto Market

Burry’s observe report as an astute investor lends weight to his newest guess. By predicting and taking advantage of the subprime mortgage disaster, he gained a fame as an investor able to figuring out market developments earlier than they unfold.

It is very important think about that Burry has established himself as a prognosticator who is usually forward of the curve and is keen to attend for the anticipated market modifications to come back to fruition.

On this matter, Yan Alleman, co-founder of Glassnode, has supported Burry’s strategy, suggesting that whereas the short-term results will not be instantly evident, the long-term payoff is prone to be vital.

Alleman additionally highlighted the potential impression of the US Greenback Index (DXY) on the cryptocurrency market, particularly Bitcoin.

In line with Alleman, the latest renewed energy of the DXY may exert stress on Bitcoin. The DXY measures the worth of the U.S. greenback in opposition to a basket of main currencies.

On The Verge Of A Ultimate Leg Up?

As Burry predicts, a drop within the DXY may lead to a big surge in crypto belongings, together with Bitcoin, as buyers search different shops of worth. This surge would symbolize a closing leg up earlier than a presumed deep correction throughout monetary markets.

Whereas the correlation between the DXY and Bitcoin has been topic to debate, the potential penalties of Burry’s quick place available on the market can’t be ignored.

If his prediction had been to come back true, it may set off a domino impact, resulting in a considerable downturn in conventional markets and a subsequent surge in crypto belongings.

Nonetheless, the implications for Bitcoin and the broader crypto market in such a situation are twofold. On the one hand, Bitcoin has typically been hailed as a digital retailer of worth and a hedge in opposition to conventional market downturns.

Burry’s quick place available on the market may reinforce this narrative, attracting extra buyers to Bitcoin as a secure haven asset.

Alternatively, the cryptocurrency market’s excessive volatility may amplify the potential crypto massacre if Burry’s guess materialized.

A sudden surge in promoting stress for Bitcoin and different cryptocurrencies, coupled with a widespread market correction, may lead to a pointy decline within the crypto market, inflicting substantial losses for buyers who entered the market at its peak.

Because the market unfolds within the coming weeks and months, all eyes might be on Michael Burry’s $1.6 billion quick place and its potential impression on conventional markets and crypto.

Solely time will inform if Burry’s guess proves prescient as soon as once more or if the market defies his expectations, leaving buyers to navigate the ever-changing panorama of funding alternatives.

As of the present writing, Bitcoin (BTC) is buying and selling at $29,300, indicating a marginal 0.3% decline over the previous 24 hours. The cryptocurrency has continued to be in a consolidation section for the reason that begin of August.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link