[ad_1]

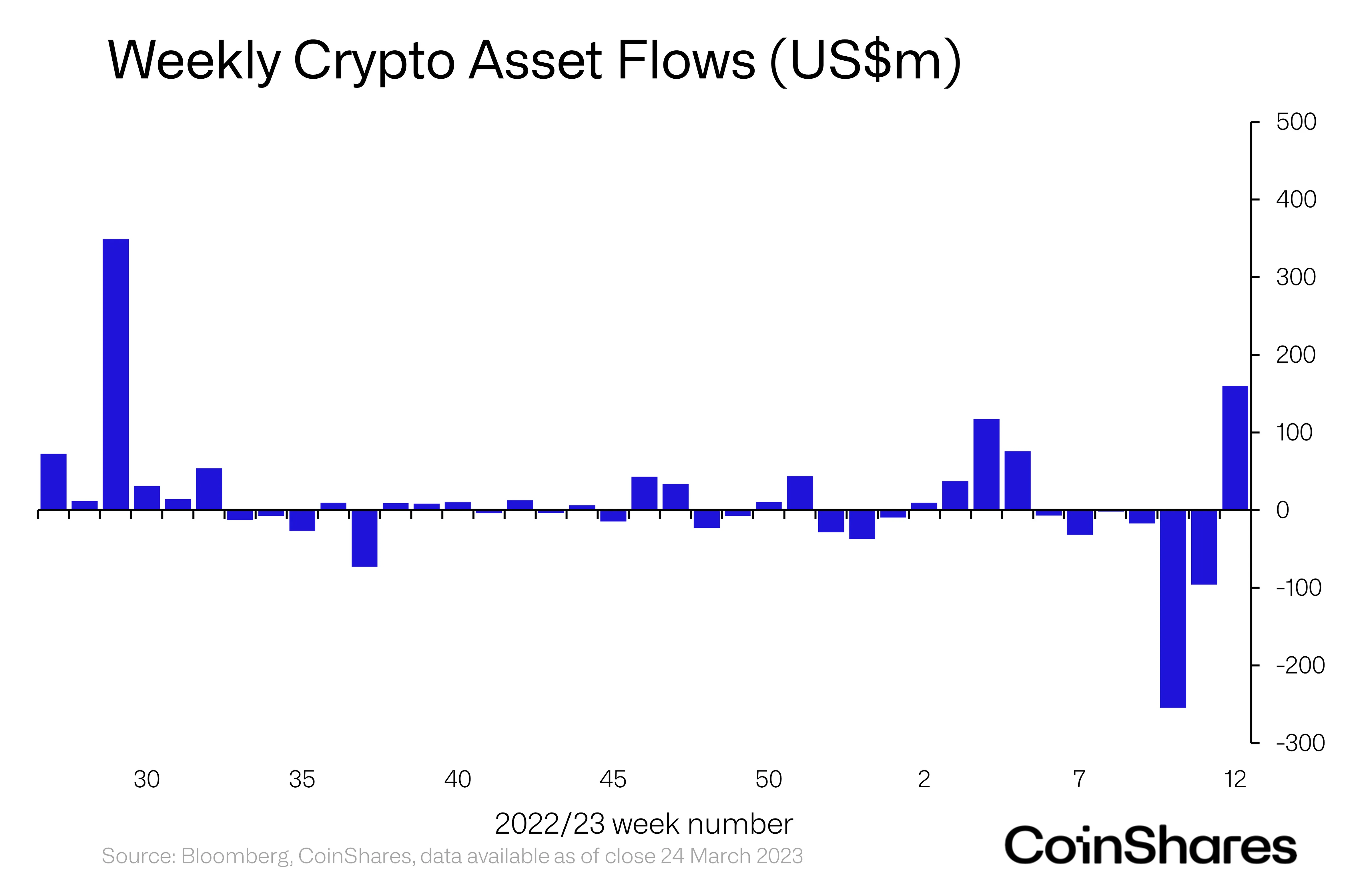

Digital belongings supervisor CoinShares says institutional crypto funding merchandise lastly ended their six consecutive weeks of outflows final week in an enormous approach.

In its newest Digital Asset Fund Flows Weekly Report, CoinShares finds that institutional crypto funding merchandise noticed the very best inflows in over eight months.

“Digital asset funding merchandise noticed inflows totaling US$160m, the biggest since July 2022. A marked turnaround following 6 weeks of outflows that totaled US$408m. Whereas the inflows got here comparatively late in comparison with the broader crypto market, we imagine it is because of growing fears amongst buyers for stability within the conventional finance sector.”

Bitcoin (BTC) merchandise loved almost $130 million of inflows final week. Nonetheless, brief BTC merchandise, which intention to revenue off of Bitcoin happening in worth, additionally took in $31 million.

“Bitcoin was the first beneficiary, seeing inflows of US $128m, and expressed not too long ago by a few of our shoppers as a secure haven for the primary time. Though not all share this view as short-bitcoin additionally noticed inflows of US $31m, remaining the funding product with probably the most inflows this yr to date, however not the most effective acting from a worth perspective.”

Ethereum (ETH) merchandise misplaced $5.2 million final week, marking ETH’s third consecutive week of outflows.

“We imagine investor jitters across the Shanghai improve (anticipated twelfth April) are the almost certainly cause.”

Solana (SOL), Polygon (MATIC) and XRP merchandise loved inflows to the tune of US$4.8m, US$1.9m and US$1.2m, respectively.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Test Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Test Newest Information Headlines

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any loses you could incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in online marketing.

Featured Picture: Shutterstock/sparkzen

[ad_2]

Source link